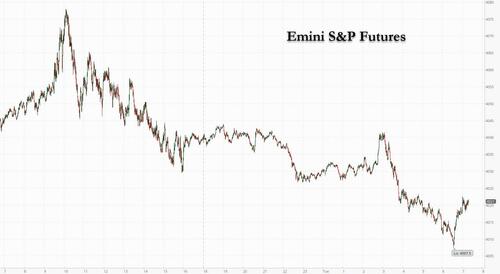

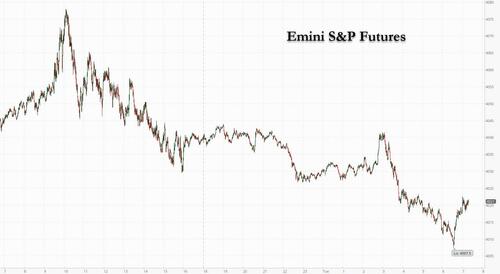

US equity futures showed no sign of rebounding on Tuesday from the Nasdaq’s worst single-day drubbing in over a month, with investors growing nervous ahead of this week’s barrage of central bank meetings which include the BOE and ECB Thursday and start tomorrow, when the Fed is expected to hike rates by 25bps; a barrage of earnings reports from some of the world’s biggest companies is also keeping investors busy.

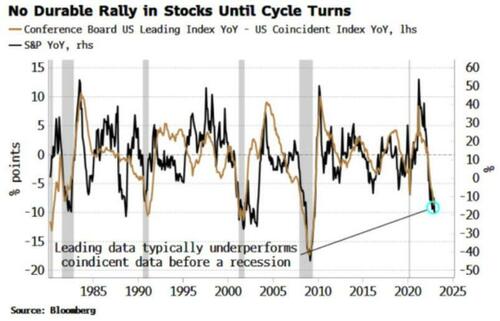

Futures for the Nasdaq 100 and the S&P 500 indexes slipped 0.6% and 0.3%, recovering from even bigger losses earlier in the session as doubts continue to grow about the sustainability of a four-month old rally, which has accelerated further since the start of the year. The Nasdaq benchmark tumbled more than 2% on Monday, its largest decline since Dec. 22 . Despite the pre-Fed jitters, however, both the S&P 500 and the Nasdaq 100 are poised for their best start to a year since 2019 as optimism over slowing inflation and resilient economic growth fueled appetite for risk. However, the start of the earnings season with corporate warnings and reiteration of the Fed’s resolve to raise rates have put a damper on the recovery. Treasury yields dipped, the dollar edged higher and oil extended its recent losses.

In premarket trading, chipmaker stocks slumped with NXP Semiconductors NV dropping more than 4% after a disappointing first-quarter forecast. Exxon Mobil surpassed profit expectations for the ninth time in 10 quarters, but shares are down premarket as the company signaled investors won’t see any additional rewards. McDonald’s also fell as much as 1.8% after its operating margin for the fourth quarter misses the consensus estimate. Its 2023 forecast for the measure also trailed. Moderna and BioNTech are also dropping in US premarket trading after Pfizer’s 2023 outlook included softer revenue estimates for its Covid vaccine and pill than analysts expected (MRNA dips 2.4% and BNTX, which is partner on PFE’s shot, falls 2%). On the plus side, General Motors jumped more than 5% after posting forecasts that beat analysts’ estimates; its results lifted shares of automakers Ford and Stellantis. Here are some other notable premarket movers:

- Shares in NXP Semiconductors drop 4% in US premarket trading after the chipmaker gave a forecast for first-quarter revenue that missed estimates. The company saw weak demand in its mobile, industrial and smart home businesses, while its autos segment remained resilient.

- Shares of semiconductor companies are falling in US premarket trading on Tuesday, after Samsung Electronics said it expects the smartphone market to contract in 2023 and NXP Semiconductors (NXPI US) reported a sales decline in its mobile business.

- Micron leads chip stocks lower in US premarket trading after Samsung Electronics said it expects the smartphone market to contract in 2023 and NXP Semiconductors reported a sales decline in its mobile business.

- Comstock Resources (CRK US) shares rise as much as 6% in US premarket trading, ahead of the oil and gas company’s inclusion in the S&P SmallCap 600 index.

- Health insurance stocks and managed-care providers could come under pressure in the short term, analysts said, after a Medicare audit rule was finalized under which the agency will seek around $4.7 billion over 10 years in clawback payments. Shares in insurers including Humana (HUM US) and UnitedHealth (UNH US) declined in US postmarket trading on Monday.

- FibroGen Inc. (FGEN US) gained in postmarket trading Monday after William Blair raised the recommendation to outperform from market perform, joining at least two other analysts who have lifted their ratings this month.

- Integer Holdings Corp. (ITGR US) declined postmarket Monday after the medical device outsource manufacturer announced the launch of a $375m convertible senior notes offering.

- Harmonic (HLIT US) dropped in postmarket trading Monday after forecasting adjusted earnings per share for 2023 that missed the average analyst estimate.

“Markets are tense,” said Raphael Thuin, head of Capital Markets Strategies at Tikehau Capital. “They haven’t made up their minds about the ongoing earnings season,” he said, noting visibility also remains low on the outlook for inflation and how policy makers intend to keep price growth in check. He warned that a surprisingly hawkish tone from the Fed could trigger a backlash across markets. The US central bank will conclude its meeting on Wednesday and is widely expected to raise rates by 25 basis points.

Signs of earnings pressure are complicating the picture for investors hopeful that the Fed will ease off on its aggressive rate-hike cycle: According to data compiled by Bloomberg, earnings per share estimates for the S&P 500 have fallen since peaking in June 2022, while revenue projections have flatlined. Margins are coming under pressure as slowing inflation erodes pricing power.

“The prospect of a stabilization of interest rates at 5% after March is shifting the focus from the rate side to the growth side,” said Willem Sels, chief investment officer at HSBC Private Bank. “Mixed earnings will probably continue to lead to some volatility in coming weeks, so we are neutral on developed-market equities for now.”

European stocks extended a decline after data suggested the euro area will avoid a recession after unexpectedly expanding at the end of 2022, prompting traders to ramp up bets on monetary tightening by the ECB. The Stoxx 600 was down 0.7% with miners, financial services and energy the worst performing sectors. Gross domestic product edged up by 0.1% in the final quarter, Eurostat said Tuesday, defying economist estimates for a contraction of 0.1%. While German and Italian output shrank, France and Spain recorded expansion. There was also stronger-than-anticipated data on Monday from Ireland. Among individual stock movers in Europe on Tuesday, Swiss lender UBS Group AG dropped more than 3% after reporting a slump in revenue at its key wealth management business. Unicredit SpA surged after the Italian lender reported better-than-expected profit. Here are some of the biggest European movers on Tuesday:

- UniCredit shares rise as much as 9.6% after the Italian lender beat expectations across the board, including delivering what KBW says is a “monster” capital return

- Swedbank jumps as much as 5% after the lender’s 4Q net interest income (NII) fueled a strong profit beat. Analysts say they expect positive revisions to earnings estimates for 2023-2024

- Diageo gains as much as 2.1% after Investec upgraded the drinks giant to buy from hold, saying the shares are “a rare bargain” after their post-earnings decline

- SEB rises as much as 9.2%, their biggest jump since October 2021, after the French household-appliances maker reported 4Q sales that beat the average analyst estimate.

- UBS shares fall as much as 4.1% in early trading with analysts saying the Swiss banking and wealth management group’s results look mixed when delving into the details

- Tele2 shares fall as much as 5% after the telecom operator forecast low-single-digit growth in Ebitda after-leases for 2023, which analysts say was “soft” compared to consensus

- Rheinmetall shares fall as much as 7.2% after the defense company said it plans to offer of two series of unsubordinated, unsecured convertible bonds with an aggregate principal amount of €1 billion

- Wartsila shares fall as much as 5.8%. The power plant services company posted a “heavy” 50% miss on its fourth-quarter EPS, driven by legacy pricing and one-time items, RBC says

- AMS-Osram shares fall as much as 4.9% after the Swiss semiconductor company announced a CEO change, a move Vontobel described as “unexpected” and adding uncertainty

- Darktrace drops as much as 7.6% to a record low after Quintessential Capital Management issued a 70-page report explaining why it’s short the shares of the cybersecurity firm

- Trelleborg shares drop as much as 4.6%, retreating from yesterday’s record close, as Citi writes in note that it appears too early for a re-rating in the industrial firm’s stock

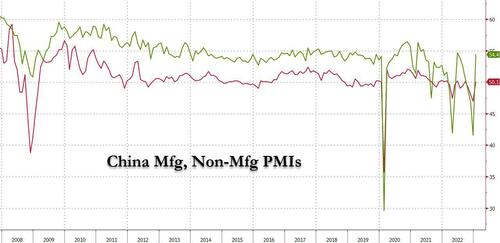

Asian stocks fell for a second day as mainland Chinese shares pulled back after Monday’s advance, with traders awaiting key decisions from major central banks this week. The MSCI Asia Pacific Index declined as much as 1.2%, dragged lower by technology shares after Samsung Electronics posted weaker-than-expected fourth-quarter results. Equity markets in Hong Kong, South Korea and Taiwan retreated. China’s CSI 300 Index fell even after the latest economic data showed manufacturing and services expanded for the first time in four months as the nation exited from Covid Zero.

The benchmark gauge shied away from a bull market after a recent rally fueled by the return of foreign investors took a breather. “Stocks generally have had a very good run recently despite concerns of a US recession and Fed hawkishness,” said Chetan Seth, an Asia Pacific equity strategist at Nomura. “So there is naturally a huge focus on US payrolls data this Friday and what Chair Powell has to say this coming Thursday early morning in Asia.” Interest-rate decisions are scheduled this week for the Federal Reserve, the European Central Bank and the Bank of England. The Fed is widely expected to raise rates by a quarter percentage point, with investors on the lookout for any changes in the future tightening path. The MSCI’s Asian benchmark was poised for a monthly gain of around 8%, its best January performance since 1994. The gauge has rallied 23% since Oct. 31 on China’s rebound, beating the S&P 500 by 19 percentage points

Japanese equities erased earlier gains, ending the day lower ahead of major central-bank decisions this week. The Topix Index fell 0.4% to 1,975.27 as of the market close in Tokyo, while the Nikkei declined 0.4% to 27,327.11. Daiichi Sankyo Co. contributed the most to the Topix’s decline, decreasing 4.9%. Out of 2,165 stocks in the index, after its 3Q results. 1,382 rose and 696 fell, while 87 were unchanged. “This week we have the US jobs report and the FOMC meeting,” said Hideyuki Suzuki, general manager at SBI Securities. “We’ll have to monitor the Fed meeting.” Interest-rate decisions are scheduled this week for the Federal Reserve, the European Central Bank and the Bank of England.

Australian stocks also dipped, with the S&P/ASX 200 index edging 0.1% lower to close at 7,476.70, dragged by losses in mining and real estate shares. Australian retail sales declined for the first time in 2022 in December, suggesting consumers are beginning to rein in spending in response to rapid inflation and rising interest rates. In New Zealand, the S&P/NZX 50 index fell 0.6% to 11,967.72.

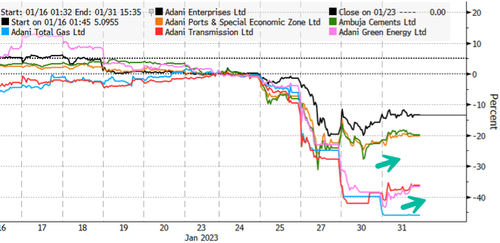

Indian stocks closed little changed amid a volatile session ahead of the federal budget’s presentation on Wednesday. HDFC Bank and software makers were key drags on benchmark index. Adani Group stocks were mostly higher as the conglomerate’s flagship firm successfully concluded its $2.5 billion follow-on share sale, helped by demand from institutional investors. Seven out of 10 companies controlled by Adani Group advanced while the decliners were led by Adani Total Gas, which plunged 10%. The S&P BSE Sensex rose slightly less than 0.1 percent to 59,549.90 in Mumbai, while the NSE Nifty 50 Index moved by a similar amount. Fifteen of the 20 sector sub-gauges compiled by BSE Ltd. advanced, led by services-sector companies, while energy firms were the worst performers. Stocks in Asia and Europe were mostly lower as investors await key decisions from major central banks this week. Cigarette and FMCG-products maker ITC contributed the most to the Sensex’s gain, increasing 2.2%. Half the 30 shares in the Sensex index rose and half fell.

In FX, the Bloomberg Dollar Spot Index rose 0.2% to its highest level since Jan. 24, as broader market sentiment turned cautious with the Federal Reserve set to kick off its two-day meeting, while the European Central Bank and the Bank of England both issue policy decisions on Thursday. The Norwegian krone and Australian dollar are the weakest among the G-10’s while the Japanese yen outperforms. “The price action suggests market participants are nervous over a hawkish policy surprise from central banks including the Fed this week, and/or a lot of good news has already been priced into markets now in anticipation of China’s economy reopening more fully,” MUFG analysts wrote in a note

- The euro falls as much as 0.5% versus the dollar before clawing back some losses; the Euro Stoxx 50 index slips 0.7%, taking a hit on the back of mixed corporate earnings as investors focus on growing pressures on banks, tech, other sectors

- The pound slipped 0.3% vs the dollar, weighed down by month-end selling. Ahead of Thursday’s BOE rate decision, a survey of economists suggests a half-point hike is most likely with a three-way vote split

- The Norwegian krone stumbles to its weakest against the euro in more than two years, after the country’s central bank said it would raise its FX purchases next month. Its wealth fund reported its biggest loss since the 2008 global financial crisis.

- The yen edged up, while the yield on 10-year JGBs rises toward the Bank of Japan’s 0.5% policy ceiling as solid demand for central bank loans fails to quell speculation that another policy change is in store

In rates, treasuries edge up, pushing the 10-year yield 2bps lower to 3.51%, with gilts underperforming by ~1bp in the sector, helping unwind some Treasury gains seen in Asia session. Gilts lag, and markets trade with a broad risk-off tone with S&P 500 futures lower, adding to Monday’s slide. The two-year yield slips 0.2bps to 4.23%, keeping the inverted two-year/10-year yield curve little changed. Bunds gain, led by a 2.5 basis point slide in the five- year yield to 2.33%. German 10-year yields are lower by 2bps while the UK equivalent is unchanged. US economic slate includes employment cost index and consumer confidence.

In commodities, crude futures decline, with WTI down 1.7% to trade near $76.60. Spot gold falls roughly $18 to trade near $1,905

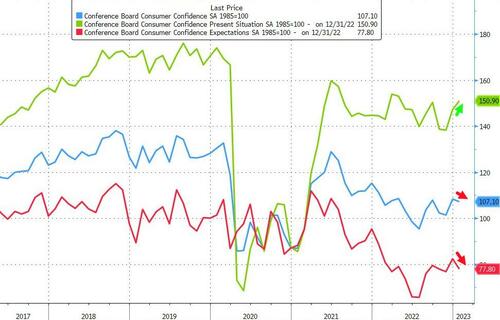

Looking to the day ahead now, and data releases include the first look at Q4 GDP for the Euro Area. Alongside that, we’ll get the French CPI release for January, as well as German unemployment for January and UK mortgage approvals for December. In the US, there’s then the Conference Board’s consumer confidence for January, the ECI, the MNI Chicago PMI for January, and the FHFA house price index for November. Finally, earnings releases include ExxonMobil, Pfizer, McDonald’s, UPS, and Caterpillar.

Market Snapshot

- S&P 500 futures down 0.3% to 4,019.75

- MXAP down 1.1% to 167.63

- MXAPJ down 1.4% to 548.11

- Nikkei down 0.4% to 27,327.11

- Topix down 0.4% to 1,975.27

- Hang Seng Index down 1.0% to 21,842.33

- Shanghai Composite down 0.4% to 3,255.67

- Sensex down 0.1% to 59,437.41

- Australia S&P/ASX 200 little changed at 7,476.66

- Kospi down 1.0% to 2,425.08

- STOXX Europe 600 down 0.7% to 451.36

- German 10Y yield little changed at 2.29%

- Euro down 0.3% to $1.0822

- Brent Futures down 1.1% to $83.95/bbl

- Gold spot down 0.9% to $1,905.51

- U.S. Dollar Index up 0.20% to 102.49

Top Overnight News

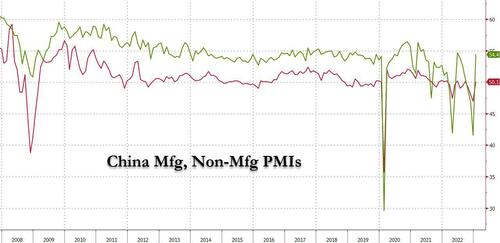

- China’s NBS PMIs rebound in January, w/manufacturing at 50.1 (up from 47 in Dec and inline w/the St’s 50.1 forecast) and non-manufacturing 54.4 (up from 41.6 in Dec and ahead of the St’s 52 forecast). RTRSThe Biden administration has stopped providing US companies with licences to export to Huawei as it moves towards imposing a total ban on the sale of American technology to the Chinese telecom equipment giant. FT

- US President Biden is to end COVID-19 emergency declarations on May 11th, according to the White House.

- US President Biden announces funding for major transportation projects funded by the bipartisan infrastructure law; USD 1.2bln across nine projects.

- The Biden administration plans to release the president’s budget on March 9th, according to Punchbowl sources.

- The euro area is on course to avoid a recession after euro zone Q4 GDP edged up by 0.1% in the final quarter, despite double- digit inflation and Russia’s invasion of Ukraine. While German and Italian output shrank, France and Spain recorded expansion

- France’s CPI for Jan rose vs. Dec, but was relatively inline w/ St expectations (+7% vs. +6.7% in Dec). Germany’s CPI for Jan was due out this morning but will be delayed a few days because of technical issues. RTRS

- France has signalled openness to sending fighter jets to Ukraine as western countries weigh the next steps in military assistance to help Kyiv resist Russian attacks. FT

- IMF issues a bullish update on the global economy, increasing its 2023 GDP growth forecast from +2.7% to +2.9%. IMF

- German retail sales unexpectedly fell in December as a Christmas shopping period weighed down by high inflation and the energy crisis revived fears of a more marked slowdown in Europe’s largest economy. Retail sales decreased by 5.3% in December compared with the previous month, the federal statistics office said on Tuesday. Analysts polled by Reuters had forecast a 0.2% rise in price-adjusted terms. RTRS

- Biden will herald a $300MM grant for the Gateway Program, which aims to build a new rail tunnel beneath the Hudson River, during an appearance in NYC on Tuesday. Politico

- Gautam Adani did it. The $2.5 billion equity sale by his flagship company was fully subscribed, a reprieve after Hindenburg’s attack on his empire. Today’s the final day of bidding in the follow-on offering by Adani Enterprises, which climbed 2.8%. Adani Total plunged by the 10% daily limit to lead losses in most of the group’s stocks. BBG

- Asian stocks fell for a second day as mainland Chinese shares pulled back after Monday’s advance, with traders awaiting key decisions from major central banks this week

- The International Monetary Fund raised its global economic growth outlook for the first time in a year, with resilient US spending and China’s reopening buttressing demand against a litany of risks

- The US Treasury is set to keep the size of its quarterly sale of longer-term securities unchanged in an announcement this week, with bond dealers seeing little scope for changes to issuance strategy amid a partisan battle over expanding the government’s borrowing authority

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined following the weak lead from global counterparts added to the cautiousness heading into the upcoming risk events, while a rebound in Chinese PMI data failed to inspire a rally as the region also digested a slew of earnings updates. ASX 200 was subdued as the outperformance in defensives was offset by losses in tech and with Retail Sales at a larger-than-expected contraction. Nikkei 225 softened amid a deluge of earnings releases which impacted several of the largest movers in the index, although losses were contained by better-than-expected data releases. KOSPI suffered amid losses in its largest constituent Samsung Electronics which posted its lowest quarterly operating profit in 8 years and flagged macroeconomic uncertainties will persist this year. Hang Seng and Shanghai Comp. were pressured despite the strong Chinese PMI data which topped forecasts and returned to expansion territory, while attention was also on preliminary earnings and reports that US President Biden’s team is weighing fully cutting off Huawei from US suppliers.

Top Asian News

- US Commerce Department notified companies it would no longer grant them licences to export to Huawei as the White House mulls fully cutting off Huawei from US suppliers, according to FT and Bloomberg.

- US is pushing for military sites in the Philippines to counter China, according to WSJ.

- Indian Gov’t Economic Survey: 2023/24 GDP Growth 6.0-6.8%, baseline GDP growth pegged at 11% nominal and 6.5% in real terms.

- Chinese Premier Li says will keep economic operations within a reasonable range, according to state media; maintaining financial stability and fending off risks still long-term and arduous tasks, will keep the Yuan exchange rate basically stable.

European bourses are lower across the board, Euro Stoxx 50 -0.6%, as the upside after France’s CPI fizzled out and reverted back to APAC performance. Sectors are mostly in the red with Banking names outperforming post-earnings while Basic Resources lag given the risk tone and USD. Stateside, futures are similarly pressured and have been in-fitting with European peers throughout the session ahead of key Employment Cost data, ES -0.5%.

Top European News

- IMF raised its 2023 global GDP growth forecast to 2.9% from 2.7% citing resilience in advanced economies and China reopening but cut its 2024 global GDP growth forecast to 3.1% from 3.2% due to steeper monetary policy tightening. Click here for more detail.

- French and German Economy Ministers are to head to the US on February 6th-7th, to attempt to “iron out” the disagreement sparked by the US’ Inflation Reduction Act, via Politico citing sources.

- UK PM Sunak has been warned by two former negotiators, including Lord Frost not to trade off the power to overrule the EU in Northern Ireland in order to make a deal with Brussels, according to The Telegraph.

- Riksbank Governor Thedeen says high inflation and increasing interest rates are testing the resilience of the Swedish financial system.

- UK Dec. Mortgage Approvals Fall to 31-Month Low of 35.6k

- UK to Be Only G-7 Economy in Recession This Year, IMF Says

- Norway’s Wealth Fund Loses 14% as Inflation, War Hit Markets

- Tesco in Talks to Buy Paperchase Brand, Other IP Assets: Sky

- UniCredit CEO Says Current Valuations Don’t Allow M&A

FX

- The USD is on the front-foot as the DXY benefits from the downturn in risk sentiment and as such continues to extend above 102.00 to a 102.61 peak, though the 102.50 mark is proving sticky ahead of data.

- EUR/USD tested 1.08 to the downside following below/in-line with consensus French inflation while the subsequent Flash/Prelim. GDP print for Q4, which was unexpectedly positive, failed to spur any sustained EUR upside.

- Antipodeans are the current laggards with soft Australian retail sales hampering the AUD and more-than-offsetting any positivity from China’s PMIs; AUD/USD down to 0.6999 and NZD/USD to 0.6421 troughs vs 0.7065 and 0.6479 peaks.

- JPY is little changed overall with comparably softer USD yields and the risk tone offsetting the USD’s dominance, USD/JPY in a narrow 130.05-130.53 range.

- PBoC set USD/CNY mid-point at 6.7604 vs exp. 6.7607 (prev. 6.7626)

Fixed Income

- EGBs are currently mixed/flat, despite pronounced action throughout the session in the wake of French and EZ data points, Bunds are currently towards the lower-end of 136.54-137.30 parameters.

- The complex experienced an initial bid on the in-line/slightly cooler than consensus French inflation metrics before slipping following unexpectedly positive EZ Q4 QQ GDP, as the more resilient economy provides the ECB with the necessary cover to continue tightening.

- Amidst this, Gilts and USTs have been directionally in-fitting but with magnitudes more contained ahead of Thursday’s BoE and today’s key US data ahead of the FOMC; currently, US yields are a touch softer with action slightly more pronounced at the short-end of the curve.

Commodities

- Crude benchmarks have been moving lower throughout the session as sentiment sours somewhat as we move closer to the week’s key risk events.

- Thus far, WTI March has dipped under USD 77/bbl (from a USD 78.14/bbl high) while its Brent April counterpart fell under USD 83.50/bbl (from a USD 84.80/bbl high).

- Russia banned domestic oil exporters from adhering to Western price caps and called on the energy ministry to devise an approach for monitoring prices of Russian oil exports by March 1st.

- Spot gold has tested USD 1900/oz to the downside, though the figure at 21-DMA at USD 1901/oz is seemingly providing support with the yellow metal yet to move below the figure; LME Copper is downbeat given the above risk tone and firmer USD.

Geopolitics

- Russia and Belarus began joint military staff training, according to the Belarusian Defence Ministry.

- US President Biden said the US will not send Ukraine F-16 jets, according to CBS News.

- S. Korean and US Defence Chiefs pledge to expand the level and scale of joint military drills.

- NATO Secretary General Stoltenberg said to Japan that the war in Ukraine demonstrates that their security is closely interconnected and he appreciates the support Japan provides including cargo capabilities, while he added that they will continue to strengthen the partnership between Japan and NATO, according to Reuters.

US Event Calendar

- 08:30: 4Q Employment Cost Index, est. 1.1%, prior 1.2%

- 09:00: Nov. S&P CS Composite-20 YoY, est. 6.70%, prior 8.64%

- S&P/CS 20 City MoM SA, est. -0.65%, prior -0.52%

- S&P/Case-Shiller US HPI YoY, prior 9.24%

- 09:00: Nov. FHFA House Price Index MoM, est. -0.5%, prior 0%

- 09:45: Jan. MNI Chicago PMI, est. 45.0, prior 44.9, revised 45.1

- 10:00: Jan. Conf. Board Consumer Confidence, est. 109.0, prior 108.3

- Present Situation, prior 147.2

- Expectations, prior 82.4

- 10:30: Jan. Dallas Fed Services Activity

DB’s Jim Reid concludes the overnight wrap

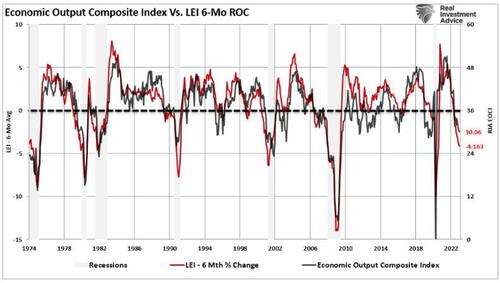

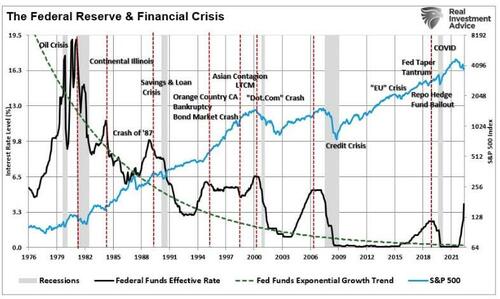

After putting in a very strong start to 2023, markets lost a fair bit of ground yesterday as investors grew a little concerned about the sustainability of the current rally. There were several factors driving that, but an important one was the stronger-than-expected Spanish inflation print for January, which added to fears that inflation could prove more persistent than feared, meaning that central banks would need to keep up their hawkish stance for some time yet. That led equities and bonds to sell off over the last 24 hours, with the S&P 500 (-1.30%) putting in its worst start to a week so far this year, and second worst day of the year, just as 10yr Treasury yields rose +3.3bps as well. Clearly there’s still plenty to navigate over the course of the week, but with US financial conditions having eased to their most accommodative in months, there’s an awareness that the Fed could seek to reassert their hawkish credentials through tomorrow’s decision.

In terms of the specific moves, risk assets struggled for the most part, with big tech leading the declines as fears about higher rates ramped up again. That saw the NASDAQ shed -1.96% on the day (worst day since December 22nd), whilst the FANG+ index of megacap tech stocks saw an even larger decline of -3.41% (also the worst day since December 22nd). While megacap tech stocks led the declines, 80% of S&P 500 constituents lost ground yesterday with the worst single sector actually being energy (-2.29%) on lower oil prices, as Brent crude was down -2.03%. In fact, the only major sector to just finish positive on the day was the defensive consumer staples (+0.07%) group. On this side of the continent, the STOXX 600 (-0.17%) saw more modest declines and finished near the highs of the day before the last part of the US sell-off

As mentioned at the top, the day got off to a rough start after the Spanish inflation print for January came in significantly higher than expected. The release saw CPI come in at 5.8% on the EU-harmonised measure, which was an increase from the previous month’s 5.5% and a full point above the expected decline to 4.8%. In addition, core inflation (using the national definition) moved up to another multi-decade high of 7.5%, having been at 7.0% in December. So that’s bad news for hopes that we were now firmly trending downwards, and the acceleration of core inflation will raise concerns about how persistent its still proving. Next up is French inflation today with German consumer prices, slated for today, now being postponed to next week, seemingly due to technicalities over new base effects. Very intriguing! Staying with inflation, the US employment cost index (ECI) is a very important release today, especially ahead of the FOMC.

Even before the Spanish numbers, investors were already expecting that the ECB would be the most hawkish central bank this week, but that print served to ratchet that up further. For instance, investors are now fully anticipating a 50bps hike on Thursday, but pricing further out now points to 147bps of further hikes by July, which was up +8.9bps on the day. In turn, that led European sovereigns to underperform their counterparts elsewhere, with yields on 10yr bunds (+7.9bps), OATs (+8.3bps), Spanish bonds (+9.1bps) and BTPs (+10.2bps) all rising on the day.

Back to Germany, and we got a further piece of bearish news yesterday after data showed their Q4 GDP growth came in at a contractionary -0.2%, which was beneath expectations for an unchanged reading. That’s a bit of a knock since it goes against the more positive narrative recently that high gas storage and falling prices would aid the economy. It also means that if there’s another contraction in Q1, then the technical definition of a recession would be met.

In other news, it was widely reported yesterday that the EU are set to respond to the US’ Inflation Reduction Act by loosening the rules on tax credits. The proposals are set to be published tomorrow, but according to a Bloomberg who’d seen a draft it included a Net-Zero Industry Act to simplify regulations, among others. European Commission President von der Leyen is giving a speech on the issue tomorrow, and ahead of that, our European economists put out a report (link here) where they assess the technical details behind various policy options along with their pros and cons.

Back in the US, Treasuries might not have struggled as much as their European counterparts, but it was still a tough day as investors positioned ahead of tomorrow’s Fed decision. That meant yields on 10yr Treasuries were up +3.3bps, and the more policy-sensitive 2yr yield was up +3.5bps at 4.234%. As with the ECB, those moves were in part because investors ramped up their hawkish expectations of the Fed, with terminal rate pricing for June up +2.0bps on the day to a nearly 3-week high of 4.931%.

Late in the US session, there was news that the Biden administration was weighing fully cutting off Chinese technology company Huawei from American suppliers, including US chipmakers such as AMD, Intel, and Qualcomm. President Trump’s administration had initially named Huawei a national security concern, which meant that US companies were required to receive approval from the government before transacting with Huawei. According to Bloomberg, Huawei sales make up less than 1% of revenue for AMD, Intel, and Qualcomm. However, investors should keep an eye on possible knock-on effects if the US does ban sales to the Chinese company.

This morning in Asia equity markets across the region are trading in negative territory, taking their cue from Wall Street declines overnight. Those negative moves have come despite fresh economic data out of China showing a bounce in activity (more on this below). As I type, the Hang Seng (-1.27%) is the largest underperformer with the CSI (-0.79%) and the Shanghai Composite also drifting lower. Elsewhere, the KOSPI (-0.72%) is also losing ground as index heavy-weight Samsung Electronics’ (-2.74%) operating profit plunged in 4Q of last year amid the global chip downturn. Meanwhile, the Nikkei (-0.21%) is also edging lower. US stock futures are indicating a muted start with those on the S&P 500 (-0.01%) just below flat while contracts tied to the NASDAQ 100 (-0.22%) are seeing slightly deeper losses.

Coming back to China, the official manufacturing PMI swung back to expansion in January after reporting a reading of 50.1 (in-line with consensus), up from a 34-month low of 47.0 in December as the nation ended strict Covid curbs. At the same time, sentiment among service-led businesses improved dramatically as the non-manufacturing PMI came in at an upbeat 54.4 figure (v/s 52.0 expected), marking the healthiest expansion since June 2022. Meanwhile in Japan, the unemployment rate remained unchanged at 2.5% in December with the job-to-applicant ratio staying at 1.35 (v/s 1.36 expected). Separately, retail sales rebounded +1.1% m/m in December, beating the market forecast for a +0.7% rise and against an upwardly revised -1.3% decline in the prior month. Industrial Production also beat a -1.0% consensus with a -0.1% m/m figure for December and compared to a +0.2% increase in November.

Elsewhere, the International Monetary Fund (IMF) upgraded its 2023 global growth estimates while stating that the EM growth slowdown may have bottomed out in 2022. They forecast that global GDP will likely expand 2.9% in 2023, an improvement of +0.2 percentage from its October prediction, mainly due to resilient demand in the US and Europe coupled with China’s reopening. Additionally, for 2024 it expects global growth to accelerate to 3.1%.

In terms of yesterday’s other data, it was generally on the more positive side. For instance, the European Commission’s economic sentiment indicator for the Euro Area in January moved up for a third consecutive month to 99.9 (vs. 97.0 expected), which is its highest level since June. Meanwhile in the US, the Dallas Fed’s manufacturing index rose to its highest since May at -8.4 (vs. -15.0 expected)

To the day ahead now, and data releases include the first look at Q4 GDP for the Euro Area. Alongside that, we’ll get the French CPI release for January, as well as German unemployment for January and UK mortgage approvals for December. In the US, there’s then the Conference Board’s consumer confidence for January, the ECI, the MNI Chicago PMI for January, and the FHFA house price index for November. Finally, earnings releases include ExxonMobil, Pfizer, McDonald’s, UPS, and Caterpillar.