WTI Limps Lower After API Reports 10th Straight Weekly Crude Build

Oil prices ended the day to the upside with WTI topping $77 intraday (but ended Feb with its 4th straight monthly loss).

“Oil prices have fallen for the month due to an extremely warm winter in the U.S. and Europe,” Jay Hatfield, chief executive officer at Infrastructure Capital Management, told MarketWatch.

“In addition, recent mixed data on inflation and associated hawkish [Federal Reserve] commentary have been a headwind for oil as the dollar strengthened and stock prices came off of highs.”

Overhanging the market is uncertainty around the global economic outlook as the Federal Reserve and other major central banks continue to push interest rates higher in a bid to rein in inflation, and the signs from week-after-week of inventory increases remains an ominous one.

API

-

Crude +6.203mm (+350k exp)

-

Cushing +483k

-

Gasoline -1.774mm (-300k exp)

-

Distillates -341k (-700k exp)

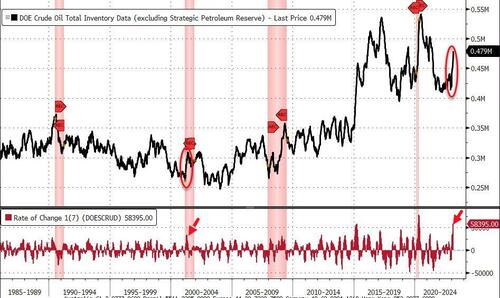

If API’s data is confirmed tomorrow, this will be the 10th straight weekly build in crude inventories and 9th straight build in stocks at Cushing. Products, on the other hand, did see a drawdown…

Source: Bloomberg

Crude has struggled to find direction in February, trading within the smallest monthly range since July 2021, hovering just below $77 ahead of the API print and limped slightly lower on the report…

Still, crude has been stuck in a trading range since December, with WTI trading between a bottom near $70 and highs just above $80 a barrel.

Notably, the last few weeks have seen one of the fastest builds in crude inventories in history…

Not exactly a bullish/no-landing signals.

Tyler Durden

Tue, 02/28/2023 – 16:37

via ZeroHedge News https://ift.tt/v78ntyu Tyler Durden