Bostic Batters Stock Bears But Bond Yields Soar After Record Inflation

Strong US labor data (claims dropped and unit labor costs rose) combined with record high core European inflation (not expected) lifted rates on both sides of the pond and punished US stocks early on.

While the Dow was holding up overnight thanks to Salesforce’s gains, the S&P and Nasdaq both opened below their 200DMAs and so the machines went to work to lift above that at the cash open.

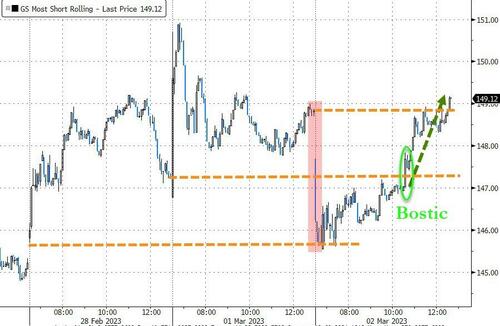

Markets then drifted sideways until, at 1330ET, Fed’s Bostic sparked a buying frenzy with this Bloomberg headline…

- BOSTIC: FED COULD BE IN POSITION TO PAUSE BY MID TO LATE SUMMER

Which is idiotic because, that’s not a ‘pivot’ and is already priced in, and also because this is what Bostic actually said:

-

Bostic: Fed Has ‘Ways to Go’ in Raising Interest Rates

-

Bostic: Higher Rate Endpoint Could Be Needed if Economy Shows More Strength

And, as a reminder, he is a non-voter!

The STIRs market didn’t budge on Bostic with a 25% chance of 50bps hike in March, May a lock for 25bps and June 70% odds of another 25bps…

Source: Bloomberg

Stocks took off with The Dow leading (thanks to CRM) along with Nasdaq and S&P. Small Caps lagged…

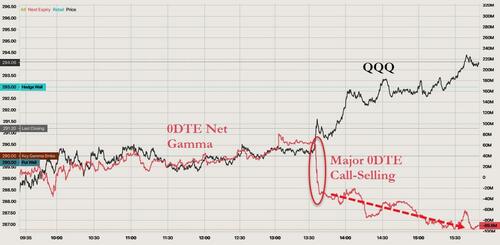

The post-Bostic buying spree was ignited by 0DTE players yet again with put-selling dominating the positive-gamma push (though there was call-buying too)…

The 0DTE ignition sparked a more traditional short-squeeze in stocks too…

Source: Bloomberg

0DTE behavior in QQQ was very different with a massive call-selling jolt as Bostic spoke (we can only imagine some offsetting position against this)…

The Nasdaq ran back above its 200DMA…

And the S&P ramped back above its 200DMA, with the machines pushing it all the way back above its 50DMA…

The Dow rallied back up to its 100DMA…

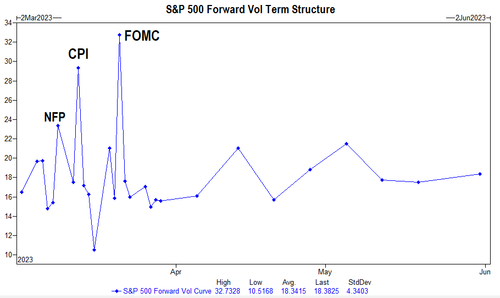

VIX broke back below 20 today, but the decoupling may be driven by the volume dominance of short-dated options (which don’t hit the VIX calc)…

Source: Bloomberg

Skew has also collapsed this week…

Source: Bloomberg

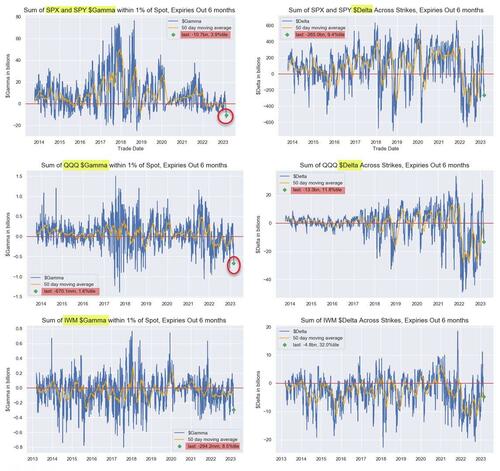

But as Nomura’s Charlie McElligott noted this morning, ignoring the bounced this afternoon, stocks are increasingly near a pocket of “accelerant flow” risk to the downside, from both 1) longer-dated Dealer Options positioning as we slip into “Short Gamma / Short Delta” location, as well as 2) potential for further CTA Trend selling-out of what had turned meaningfully “$Long” Global Equities exposure in recent months…

Source: Nomura

At the same time, the market’s expectation for The Fed’s terminal rate hit 5.50% today for the first time… and no rate-cuts at all are priced in now for 2023 (before fading after Bostic’s comments)…

Source: Bloomberg

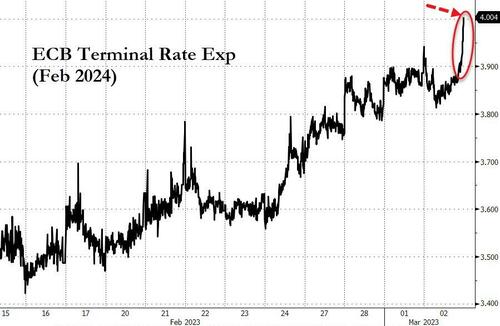

Expectations for ECB’s terminal rate were lifted today on the hot CPI print, topping 4.00% for the first time…

Source: Bloomberg

Treasury yields were higher across the curve today after the strong EU inflation data. On the week, the belly is underperforming with the long-end and 2Y yields up the least

Source: Bloomberg

30Y Yields topped 4.00% for the first time since November…

Source: Bloomberg

Even more problematically for the housing market’s nascent recovery… it’s over mate! 30Y Mortgage rate are back above 7.00%!

Source: Bloomberg

Before we leave bond-land, consider that 6mo T-Bills have not been this cheap to stocks since the peak of the dotcom bubble…

Source: Bloomberg

And given that the 3 largest ETF inflows this past week are all in short-term T-Bills, it seems more than a few are thinking the same…

Source: Bloomberg

The dollar rallied today – ignoring the dovishness that stocks apparently heard from Bostic…

Source: Bloomberg

Bitcoin ended modestly lower, bouncing back with stocks after early weakness…

Source: Bloomberg

Oil prices ended higher with WTI above $78…

Gold limped lower in a narrow range…

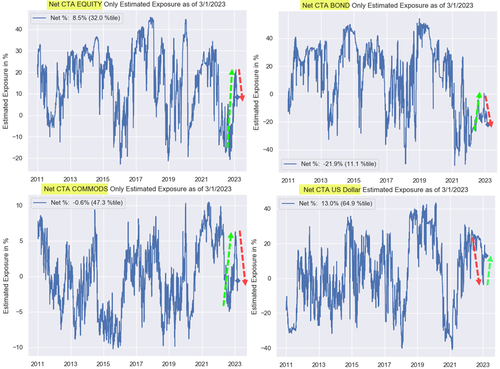

Finally, we note that CTA exposures have all reversed in recent days across asset-classes after the pivot-panic-positioning in January…

Source: Nomura

Will January’s “everything rally” and “anti-USD” trade come back soon? The next 3 weeks have Payrolls, CPI, and FOMC landmines for any positioning…

And, as we noted earlier, traders are betting on the market becoming more homogenous within the next month, shrugging off the idiosyncracies of earnings and themes.

Tyler Durden

Thu, 03/02/2023 – 16:01

via ZeroHedge News https://ift.tt/Jrge5Oj Tyler Durden