Nomura Is First Bank To Call For 50bps Rate Hike In March

In the past year, Japanese bank Nomura has had a penchant for making several headline-grabbing outlier predictions about the Fed: in June, Nomura was the first bank to call for a 75bps rate hike (a view that quickly became consensus after the infamous Hilsenrath weekend report that blew up the Fed’s forward guidance), followed one month later by an even more show-stopping forecast for a 100bps rate hike in July. Verdict: it got one out of two right (the former, not the latter), yet still not a bad track record when the bank takes the bold step to break away from the echo chamber herd.

This week, the bank has done it again, because with the Fed seemingly torn between keeping its 25bps rate hike cadence or expanding it to 50bps to give the tightening campaign a little extra “oomph” after the latest FOMC minutes found that a higher than expected “few” favoed a 0.5% rate hike, Nomura’s strategist Aichi Amemiya writes that he now expects a 50bp hike in March followed by 25bp hikes in May and June “as persistent inflation drives the Fed to a more hawkish stance.”

Here’s his reasoning, excerpted from the note (available to pro subs in the usual place):

Resurging inflation leads to our revised forecast of a 50bp rate hike in March and a higher terminal rate

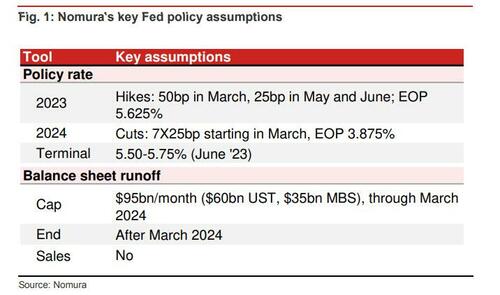

Incoming inflation data suggest the underlying inflation trend may have stopped moderating in recent months. Although the Fed downshifted to a slower pace of rate hikes in 25bp increments in February, the recent persistence of inflation, in addition to strong labor markets and easy financial conditions suggests: 1) the Fed is unlikely to rely on goods-led disinflation, as it could be short-lived; 2) the underlying trend inflation may be re-accelerating, thus raising the risk of under-tightening and 3) aggressive policy action might be needed to tighten financial conditions. Against this backdrop, we revise our near-term Fed call as follows (Fig. 1):

- A 50bp rate hike in March.

- Two 25bp rate hikes in May and June to a terminal rate of 5.50-5.75%. Previously, we had expected one more 25bp rate hike in March to a terminal rate of 4.75-5.00%.

- Our expectation for the first cut is unchanged at March 2024.

- We maintain our view that balance sheet reduction will continue until March 2024.

The 50bp rate hike in March may sound aggressive. That said, we think the Fed is further from a pause on rate hikes than we had originally believed and it is possible more front-loaded rate hikes will be needed to tighten financial conditions and control inflation.

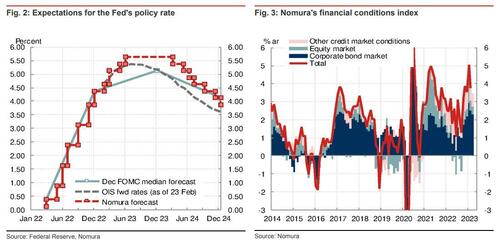

Furthermore, in light of the continued recent easing in financial conditions (chart below, right), Nomura suggests that the Fed may also be motivated to hit a higher terminal rate.

Amemiya followed up on his forecast today, after Minneapolis Fed President Kashkari spoke at a moderated discussion, and Atlanta Fed President Bostic released an essay on “Striking a Delicate Balance” between reducing inflation and inflicting too much economic pain: Kashkari responded to the question about the size of rate hikes, indicating he is open-minded to either 25bp or 50bp, which lends support to Nomura’s call for a 50bp rate hike in March. However, he stressed that he is focused on the “dots,” referring to the FOMC participants’ projections for the federal funds rate. He said the March dots are much more important than how much the Fed will raise at the March meeting. He also said January data are concerning, and that he is leaning towards pushing up his policy path. That suggests he may revise up his 2023 dot to 5.625% from 5.375% in December.

According to Nomura, “while we expect a 50bp rate hike at the March meeting, alternatively, the Fed could raise the median 2023 dot to 5.625% which may have a similar market impact. However, our key point is that we will likely see renewed hawkishness at the March meeting, either in the form of a 50bp rate increase or higher-than-expected dots.”

Meanwhile, Bostic’s essay came across hawkish, in our view, however his terminal rate expectation remained at 5.00-5.25%. It’s also interesting that he mentioned “a narrative has gained momentum among some commentators that the Fed should consider reversing its course of raising the federal funds rate.” This comment is somewhat out of line with our perspective that recent market developments have tended towards expecting and pricing in a higher terminal rate.

And while other banks are becoming increasingly hawkish, not one is willing to stake its credibility on predicting that the Fed will once again backtrack on its hiking strategy, and boost rates by 50bps this month after raising 25bps in February as that would be a tacit admission of yet another serious error, the third in a row (after “transitory inflation” and the 50bps to 75bps June rate hike switcheroo).

For what it’s worth, after pricing in just one 25bps rate hike in March for much of February, the odds of a 50bps are now at 25bps and rising.

More in the full note available here for pro subs.

Tyler Durden

Wed, 03/01/2023 – 22:40

via ZeroHedge News https://ift.tt/mDZtYL6 Tyler Durden