TD Doubles Down On 10Y Treasury Long In Anticipation Of Hard Landing

At a time when the 10Y yield is once again surging (rising to 4.08% from the mid-3% one month ago) and rate bulls are watching the chart below in stunned disbelief as their January gains melt away…

… one bank is sticking to its Treasury long guns. In a note from TD’s Priya Misra, the rates strategist says that she is doubling down on her Treasury Long call.

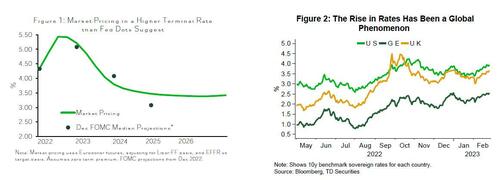

Reminding readers that she recently initiated a long 10y Treasury as she “thought that Fed pricing was appropriate at 5.25% and bond fund inflows were supportive”, since then both inflation and growth data has been very strong and the market is now pricing a Fed effective terminal rate of 5.5% (target FF rate of 5.7%) and the pricing of rate cuts has also declined” Misra writes. As a result of the recent powerful hawkish repricing, markets are now penciling in the first 25bp rate cut by Mar 2024 and a total of 170bp of cuts are priced in the 2y years after hikes end (down from 220bp in mid-Jan). In addition, global rates have risen, putting upward pressure on term premium.

So why double down now?

As she explains, “we initiated only half the risk in our trade since we were worried about strong incoming data, and we double down on the position.”

The thesis is simple: the hawkish Fed is likely to take policy even more restrictive, “increasing the odds of a hard landing”, and thus a recession which sends yields across the curve sharply lower. Needless to say, strong data remains the biggest risk for the trade since a higher terminal rate will drag the 10y rate higher as well.

“Monetary policy works with a lag and once the savings buffer has been eliminated we think that consumption will slow” Misra predicts, adding that the long TSY thesis is boosted by “bond fund inflows which have continued.”

Tyler Durden

Thu, 03/02/2023 – 15:00

via ZeroHedge News https://ift.tt/F7srLGj Tyler Durden