“There Are Simply Too Many People Who Have College Degrees And Too Few Jobs That Require Them”

By Howard Wang of Convoy Investments

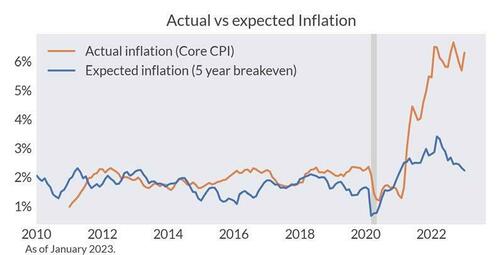

I anticipate that inflation will gradually decrease over the next year and a half to an equilibrium rate of approximately 3%. This path will be bumpy, with month-to-month fluctuations. We believe that the markets continue to expect inflation to decrease more quickly than it will. Below I show the actual inflation rate vs the market’s expectation of future inflation over the next 5 years. This mispricing of inflation expectations mean that inflation-linked bond remains an attractive asset class for us.

The primary driver of inflation is money supply. After the 2020/21 printing spree, during which the Fed was calling for transitory inflation despite all signs pointing to inflation, we saw a delayed effect of approximately a year or so. I believe there is now a similarly delayed but inevitable disinflationary process as most inflationary factors are eliminated. We are now facing high-interest rates, falling stock markets, low savings rates, slowing housing markets, decreasing money supply, lower fiscal spending.

Commodity inflation is now significantly lower than service inflation. So the primary question this year is what happens to the labor market.

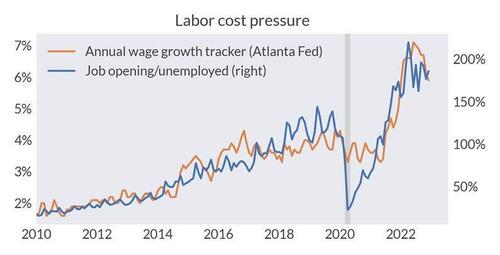

I believe services inflation is partly caused by a misallocation of labor in our society, which has been building up for many years due to an education bubble. This effect was amplified by Covid. There are simply too many people who have college degrees and too few jobs that require them. As a result, we are seeing layoffs in certain sectors like tech and finance while other blue-collar service sectors are still struggling to find enough workers. This issue will take some time and some pain to resolve as the money supply falls and the overall economy slows down. For now, the labor market continues to be tight. Below, I show our labor cost pressure gauge, which indicates some progress, but there is still a long way to go.

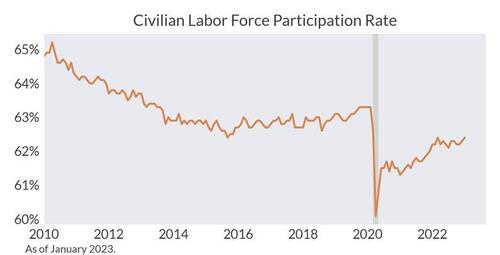

While many people think high payroll numbers are inflationary, I believe they are a sign of disinflation because it means that more people are returning to the labor pool. Below I show the civilian participation rate in the US, which is steadily rising but still substantially below Covid levels.

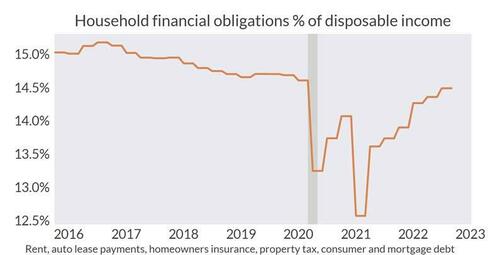

In terms of consumer financial health, we are getting close to pre-Covid levels. Below, I show the household financial obligations as a percentage of income. This metric dropped significantly during Covid and has been rising fairly rapidly since then, as high inflation and high finance costs are pressuring consumers from all sides.

The shortage of manual labor will create a crop of companies that can use AI/tech or clever labor management/ outsourcing to provide cheaper labor. These are opportunities that we will keep an eye on.

In 2023, we can expect volatility with ups and downs on a month-to-month basis, but the market will remain relatively range-bound. The Fed needs to make a real effort to contain inflation, as uncontrolled inflation in a country with $31T in debt is a recipe for disaster. At the same time, they need to ensure that the markets and the economy do not crash too hard, and they need to make sure that inflation does not tank too much, which would make debt servicing even more challenging. As I mentioned in my last letter, the Fed has to walk a tight rope, and the markets will follow.

Therefore, I expect the markets to be volatile but sideways, with long rates remaining high and sideways, offering attractive yields if you can stand the volatility from the duration. Cash/Treasury bills will continue to be a strong performer as they offer excellent returns and safety.

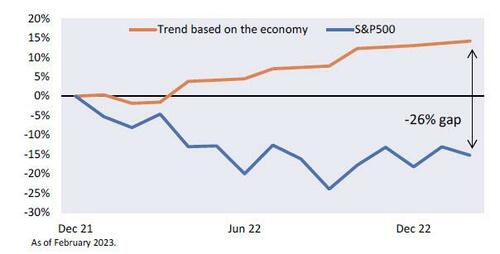

The longer the markets remain sideways while inflation is high, the more time inflation has to eat away at its real valuation. Over time, I expect the stock market to grow at a rate of something like real GDP + inflation + 3-4%, which currently translates to about 10% nominal returns a year. For example, below is a chart showing the S&P 500 nominal price versus where the S&P500 should be based on the economy. While the price is -16% below its peak, on a growth/inflation-adjusted basis, it has already seen a -26% adjustment. If inflation remains high and markets remain sideways, we may not need to see a drastic drop in prices for the valuation adjustment to happen.

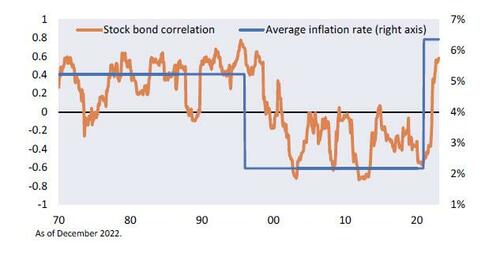

The traditional 60/40 stock-bond portfolio will continue to face challenges. The 60/40 portfolio is based on the idea that stocks generate returns while bonds provide protection during recessions, so they are negatively correlated and diversify each other. While this thesis worked in the two decades before 2022, it does not hold true if the recession is caused by inflation, as in those scenarios, both bonds and stocks drop. Looking back to the 70s and 80s, we find that stocks and bonds were positively correlated. Below, I show a loose relationship between how stocks and bonds correlate with each other over time and the inflationary environment. While bonds now provide relatively attractive long-term yields, it will struggle to diversify against short-term drops in the stock market. Investors may need to have an explicit allocation to real assets as an inflation hedge.

Tyler Durden

Wed, 03/01/2023 – 21:00

via ZeroHedge News https://ift.tt/4fuljr6 Tyler Durden