Bank Turmoil Was Absent From Strategist Outlooks

By Sagarika Jaisinghani, Bloomberg Markets live reporter and strategist

Of all the top Wall Street strategists who predicted a rocky first half for equity markets back in December, many warned about mounting economic and profit risks from higher interest rates, but no one saw the turmoil in the banking sector coming.

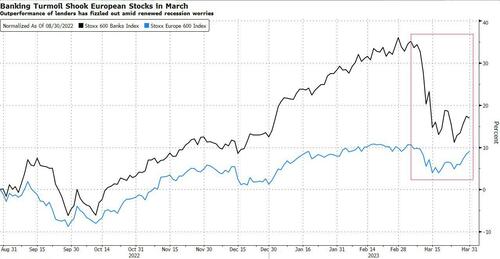

Shares in European banks just posted their deepest monthly drop since the start of the pandemic as the sudden collapse of a number of US regional lenders including Silicon Valley Bank and the meltdown in Credit Suisse stock caught leading prognosticators by surprise. Forecasters had primarily focused on the fallout from recession risks, rising rates and inflation’s erosion of corporate earnings.

Bank of America strategist Michael Hartnett said in December the next shoe to drop would be a “credit event” caused by the impact of policy tightening by the Federal Reserve, although he wasn’t expecting it to come from small banks.

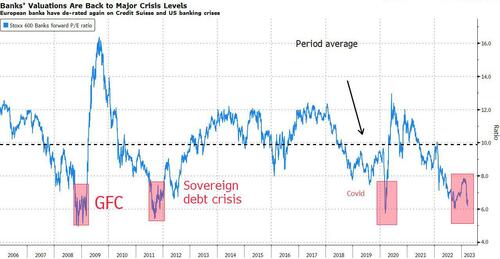

Even bearish strategists were confident about betting on banking stocks at the start of the year. And some, such as Max Kettner at HSBC, went so far as to turn optimistic about the broader market, saying the pessimism on the rest of Wall Street would likely fuel a contrarian rally. “There is no sugar coating this — our constructive view has proved pretty wrong lately,” Kettner acknowledged in a note.

The banking tumult dragged the regional benchmark Stoxx 600 to its worst March since 2020 and ended its record streak of outperformance against its US peer. It’s also sparked a rotation into defensive and growth stocks.

Part of the challenge in forecasting such a crisis is timing. The team at Goldman Sachs was among those warning that stocks would face a tough recovery in 2023, given projections of higher rates. Even so, strategist Sharon Bell says they were “surprised at the specifics” of how the weakness has played out in relation to the banking sector.

“We felt that with rates rising so fast, the US market was vulnerable,” Bell says. “But it’s one thing to say vulnerable and another to actually pinpoint the problems that can occur and that’s very, very difficult.”

In Europe, Barclays strategist Emmanuel Cau was among those recommending lenders. He downgraded his view after the banking drama, saying he now sees higher regulatory scrutiny weighing on lenders.

HSBC’s Kettner, on the other hand, remains constructive both on banks as well as broader equities. “This is not a liquidity crisis or a capital crisis, it’s about confidence,” he says. “We could easily look back in a couple of months and view this as a hiccup rather than something more sinister.”

But as recession worries take hold, Citigroup’s Beata Manthey is returning to her neutral rating on European stocks excluding the UK, less than three months after she upgraded her call to overweight because of attractive valuations.

Tyler Durden

Mon, 04/03/2023 – 13:05

via ZeroHedge News https://ift.tt/byscVuG Tyler Durden