Ugly Data & Oil Shock: Stagflation Threat Sparks Bond & Gold Gains; Banks & The Buck Dumped

OPEC+ pissed in Powell’s victory-lap-over-inflation punchbowl overnight, jolting stocks lower. Ugly Manufacturing ISM data early on sparked the ubiquitous ‘bbrrrrrr’ trade with gold and stocks bid, dollar and bond yields tumbling. The St.Louis Fed’s Jim Bullard raised the specter of OPEC+’s production cut making The Fed’s job harder (i.e. forcing them to be more hawkish than they would like to be) which then reversed some of the equity gains (especially in big-tech and small caps – finance-heavy). Finally, the Atlanta Fed GDPNow model estimate for Q1 2023 real GDP growth is 1.7% on April 3, down from 2.5% on March 31.

Oil prices shot 6-7% higher on the OPEC+ news, with WTI back above $80, its highest since Jan 27th (breaking above its 50- and 100-DMA). This was WTI’s best day since 4/12/22…

Source: Bloomberg

OPEC+’s timing could not have been better (as we warned last week)…

CTAs are $30BN short and are about to start chasing https://t.co/Th55TKBgoN

— zerohedge (@zerohedge) March 29, 2023

The Dow dramatically outperformed Nasdaq (by the most since Oct 27th at its peak before the late melt-up), with mega-cap tech red and Small Caps ramped into the green late on. S&P stumbled around unch for most of the day before the late-day buying panic…

Early in the day, 0DTE traders faded the opening ramp, took some profits then led the charge higher with huge positive delta flow…

Energy stocks massively outperformed on the day. Financials were flat-ish, while Discretionary was worst…

Source: Bloomberg

Regional Banks were hit again, back below the 3/24 close (before the ‘all clear’ ramp)…

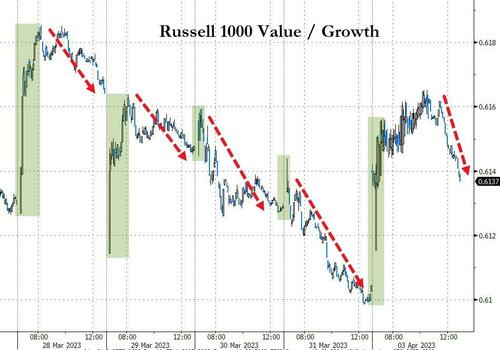

After 3 straight days of relative weakness, value stocks outperformed growth stocks to start Q2 (but we note a similar pump and dump pattern)…

Source: Bloomberg

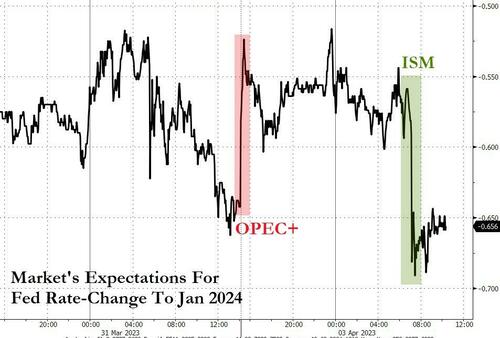

Weaker growth (ISM) and stronger inflation (OPEC) = stagflation… and that’s not at all what Powell and his pals want to see, as May rate-hike odds rose to 65%…

Source: Bloomberg

Interestingly, further out the curve you can see the impact of OPEC (hawkish) and ISM (dovish) on the market’s expectations for Fed actions…

Source: Bloomberg

Inflation expectations jumped to 5-week highs…

Source: Bloomberg

Treasury yields were all lower on the day – after quite a rollercoaster higher (OPEC+ inflation) then plunge lower (ISM weakness) – with the short-end outperforming…

Source: Bloomberg

The Dollar saw a similar velocity – ramping higher to open last night (OPEC+ hawkish) then plunging from the moment Europe opened, and accelerating after ISM weakness…

Source: Bloomberg

Cryptos were higher on the day, helped by Musk changing Twitter’s icon to DogeCoin…

Source: Bloomberg

Front-month gold futures surged back above $2,000…

Source: Bloomberg

Finally, Oil’s surge has lifted Bloomberg’s broad Commodity Index above is 6-month downtrend line, and above its 50DMA…

Source: Bloomberg

Commodities are up 6 of the last 7 days… not what Mr.Powell and Mr.Biden want to see.

Tyler Durden

Mon, 04/03/2023 – 16:00

via ZeroHedge News https://ift.tt/MqP2cuS Tyler Durden