Bonds & VIX Dumped, Bitcoin & Stocks Pumped As Stagflation Signals Soar

Ugly growth (GDP), uglier inflation (Core PCE), ugliest housing data (pending home sales), and ugliest-er manufacturing sentiment (KC Fed)… but hey, META beat so BTFD in Mega-Cap Tech…

META is up 15% because their earnings dropped 20% but they mentioned AI 57 times.

That helped Nasdaq extend its outperformance (best day since Feb 2nd). The S&P managed a 2% gain before limped lower into the close and Small Caps were the solid runners up in the squeeze race today… The Dow, S&P, and Nasdaq all just took off as soon as cash trading opened…

Today’s rampage saw S&P and Dow get back to even on the week while Small Caps lag as Nasdaq soars. Notably, S&P and Dow stalled perfectly at unch and held it, unable to push higher…

Nasdaq is back at recent highs…

There was a notable divergence between 0DTE VIX and ‘Old’ VIX (the latter offered as the former was bid)…

Source: Bloomberg

Under the hood, this had the smell of 0DTE call-buying and longer-dated put-covering (both implicitly positive delta and supporting the rally). Notably, later in the day, 0DTE saw major put-covering also as call-buying faded…

This was also notable, given the rise in 0DTE today. Ultra-short-dated options vol has been an early warning system for ‘event risk’ over the last year….

VIX1D Post! The CBOE has generously back-filled the data for a year. And in the process, they’ve made it easy to illustrate a theme we followed closely over this time period, namely that “event risk” was priced into ultra-short dated SPX vol as a function of FOMC and CPI day pic.twitter.com/yRwHpm3BaK

— Alpha_Ex_LLC (@Alpha_Ex_LLC) April 26, 2023

Treasuries were clubbed like a baby seal today with the short-end underperforming. 30Y yield is almost back to unchanged on the week (while the short-end remains notably lower)…

Source: Bloomberg

2Y back above 4.00%…

Source: Bloomberg

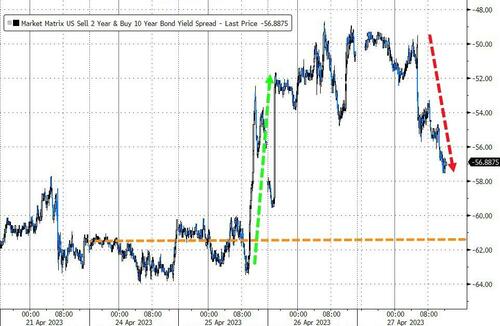

And the yield curve (2s10s) flattened significantly…

Source: Bloomberg

The dollar slipped modestly lower today, back to unchanged on the week…

Source: Bloomberg

Bitcoin rebounded from last night’s Mt.Gox fake news FUD crash

Source: Bloomberg

Oil prices managed small gains today but in context to the clubbing of the last few days, meh…

Spot Gold rallied back above $2000 overnight, only to be sold back below it as US GDP hit…

Source: Bloomberg

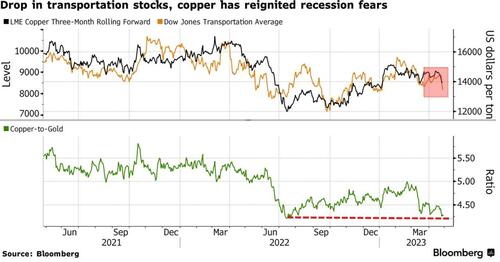

Finally, as Bloomberg notes, the concurrent breakdown in copper and the Dow Jones Transportation Average is a telling sign that expectations for an economic hard landing have some merit.

Additionally, the copper-to-gold ratio which is nearing its 2022 lows, pointing to a brewing economic storm if the path of least resistance remains down.

Hard-landing and inflation incoming!

Tyler Durden

Thu, 04/27/2023 – 16:01

via ZeroHedge News https://ift.tt/3oxpTkj Tyler Durden