Capital One Expects Recession By Year-End, Hammered By Bad Debt Provisions

So much for the “strength” of the consumer.

Capital One CEO Richard Fairbank just pulled the plug on the narrative that America’s aggregate spending strength is anything but a mirage of extreme wealth thriving while a vast majority of Americans are struggling through amid core inflation pain.

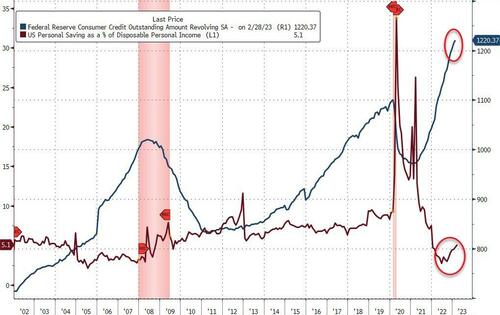

We already know that Americans have been leaning on their credit cards to make ends meet...

But now, Capital One’s CEO has pointed out the delinquency rate for customers at least 30 days late on payment rose 134 basis points from one year earlier to 3.66% – reaching the highest level since March 2019.

And it’s going to get worse, as charge-offs – the rate at which banks take on losses for debt they no longer believe will be paid off – haven’t yet caught up to delinquencies.

Fairbank acknowledged it’s likely they will also return to 2019 levels around the middle of the year – lagging a quarter or two behind the industry, as happened during the pandemic and global financial crisis.

Specifically, the write-off rate in the firm’s US credit-card portfolio soared to 4.04% in this year’s first three months ($1.7 billion), almost double the rate a year earlier, and the Virginia-based lender said provision for credit losses soared to $2.8 billion in the quarter ended March, up from $677 million a year ago.

The driver for that expected loss is simple – reality!

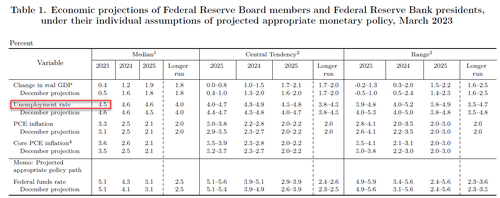

“We are assuming a material worsening of labor markets with the unemployment rate rising from today’s very low levels to above 5% by the end of 2023,” the CEO told analysts on a conference call.

“We are also assuming adverse effects from inflation and some further worsening of consumer profiles from the flip side of their extraordinary outperformance in the earlier period during the pandemic.”

Put another way – Fairbank expects an imminent recession as The Fed itself forecasts a 4.5% unemployment rate by year-end and calls that a “shallow recession”…

None of this should be a surprise (to anyone who is simply not buying every word coming out of The White House).

“There are nascent signs of trouble brewing” in credit delinquencies, Glenmede’s Jason Pride and Michael Reynolds warned in a research note this month, adding:

“An ever-larger share of credit balances have transitioned to early stages of delinquency, consistent with past periods of recession.”

It appears the economic “pain” that Powell warned about is starting to strike the ‘average joe’.

Last August, Powell said that “while higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

With the banking crisis re-escalating (cough FRC cough), the question is just how significant will this credit tightening be and how sustained will it be before The Fed is forced to fold?

Tyler Durden

Fri, 04/28/2023 – 13:45

via ZeroHedge News https://ift.tt/YTEHvur Tyler Durden