UMich Inflation Expectations Soared In April, Sentiment Inched Higher

A busy end to the week for macro appears to be settling the narrative that we are facing stagflationary pressures as growth slows but inflation signals remain far stickier than expected.

This morning’s final UMich report confirms the flash inflation expectations have jumped dramatically with longer-term inflation expectations actually increasing inter-month to +3.0%…

Source: Bloomberg

The Headline sentiment ticked higher MoM…

Source: Bloomberg

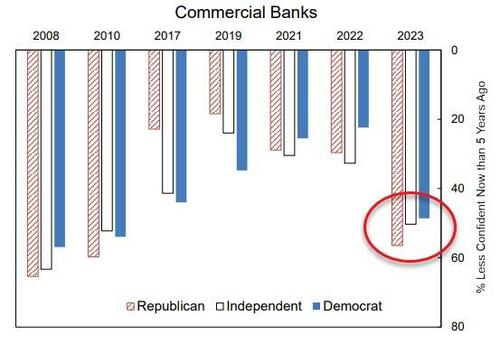

Net change in confidence in commercial banks, unsurprisingly, plummeted since last fall, a consequence of the recent well-publicized failures of SVB and other banks. Note, though, that the survey grouped all commercial banks together and did not distinguish between large and medium-sized or regional institutions.

In fact, it’s one thing that brings all political cohorts together…

UMich notes that despite the increasingly negative news on business conditions heard by consumers, their short and long-run economic outlook improved modestly from last month.

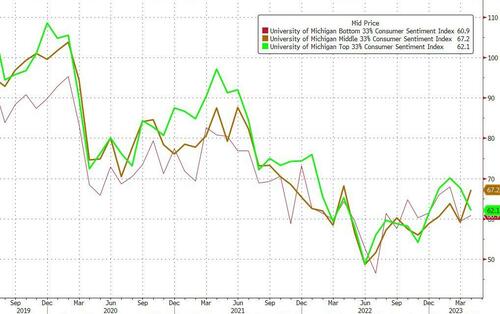

Notably, sentiment declined most for the richest respondents…

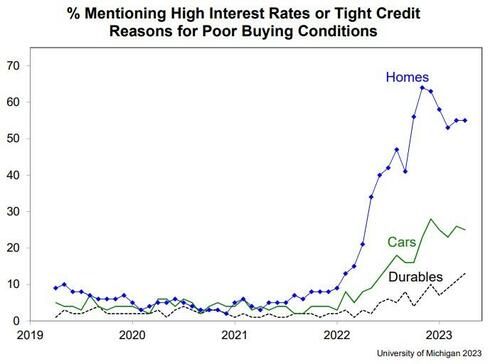

However, these improvements were balanced by worsening assessments of personal finances due to higher expenses, reflecting the ongoing pain stemming from continued high prices.

Finally, we note that the market is now fully pricing in the 25bps hike next week by The Fed and the blackout window means no FedSpeak to push back against exuberant narratives, but bear in mind the clarity that Jay Powell offered ‘fake’ Zelensky in the revealed clip yesterday – while dated, it would appear his views are far more hawkish than the market expects going forward.

Tyler Durden

Fri, 04/28/2023 – 10:09

via ZeroHedge News https://ift.tt/rMGB2cX Tyler Durden