What If The Whole Shebang Unravels?

Authored by Charles Hugh SMith via OfTwoMinds blog,

Nobody seems to be wondering what happens should the real world no longer respond to the Perpetual Motion Finance Machine.

Scrape away the hand-wringing about interest rates and we find a bedrock of complacency. Nobody seems to doubt that the status quo can grind on for another 30 years doing the same stuff it’s done for the past 30 years.

Japan’s Perpetual Motion Finance Machine can apparently run for another 300 years without a hitch. Here’s how the Perpetual Motion Finance Machine works: the government spends huge sums it doesn’t have by selling bonds to the central bank, which creates the money to buy the bonds out of thin air. Perpetual Motion–perfect!

Japan’s immense success with its Perpetual Motion Finance Machine offers other governments a rock-solid template for permanent funding of all the goodies everyone wants and needs. It’s perpetual motion, nothing can stop it.

This then drives another surefire financial gimmick, the Yen Carry Trade: borrow in yen at near-zero rates and then use the free money to buy US Treasuries yielding 3% or 4%. Free money! This is also assumed to be so ironclad it’s good to go for another 30 years, heck, make it 300 years.

the assumption here is nothing can bring down a system that can create as much money as it needs to solve any spot of bother and we have the past 30 years of history to prove it.

Nobody seems to think there are any constraints on the Perpetual Motion Finance Machine or the alternatives being proposed: crypto, gold-backed currencies, and so on. That these alternatives might fail to solve the underlying problem–there’s no way to keep the Waste Is Growth-Landfill Economy running with solely financial means–that’s impossible. Finance fixes everything.

Until finance in all its flavors is the problem, not the solution. Few seem to ponder the possibility that the whole freaking shebang of debt and leverage might give way and tumble over the cliff regardless of what reforms (gold-backed currencies, etc.) and other financial modifications are instituted.

In other words, few seem willing to entertain the possibility that the system is now beyond the point that a return to stability is possible. In systems terms, the whole shebang (the global financial system and the global economy it enables) has veered so far out of equilibrium that incremental policy tweaks can no longer restore equilibrium.

The dominant dynamic will be wild swings within a widening gyre of instability until the whole shebang unravels. Then there’s the real world, which–and I know this is shocking–can actually trump financial gimmicks.

Imagine the scene on the Titanic when the engineer explains to the captain the ship is doomed because too many watertight compartments have been compromised by the collision with the iceberg, and the captain reassures him: “No worries, we have a printing press on board and we’ll print as much money as we need to repair the ship.” Uh, right.

Yesterday I went to the local outlet of a major national grocery chain to pick up a couple of sale items. I walked around the cavernous store but didn’t spot any hand-baskets, so I asked a clerk, “Did you get rid of the hand-baskets?” She replied, “No, we just don’t have any.”

I submit this as the perfect summary of how the whole shebang unravels. No, we didn’t dispense with X, we just don’t have any.

In other words, we’d be going to Heck in a hand-basket except we’re out of hand-baskets.

This is not an isolated incident. Here are a few more.

1. Tried to reach an office in the healthcare system. Left four polite messages last week, no response. Called the doctor’s office, the staffer said that office is understaffed. Gee, lucky nobody actually needs any prompt response.

2. Submitted a form via their “secure online system” regarding my IRA at a major US bank. No response for several weeks, so I called the number provided and was eventually connected (after many minutes of jarring music) to a support person who wanted to help but did not know what form I was referring to. In other words, every avenue of communication is a dead-end.

3. Another call to Corporate America connected to a support staffer whose English was so poor I couldn’t make out what she was saying, but beyond that, she clearly had not been trained to do the basic functions of her job. So what to do? You know, of course: hang up, spin the roulette wheel and hope for a more competent staffer.

OK, I get it: I’m cursed. The rest of you are getting excellent service from every company, from the DMV, and so on, and there are stacks of hand-baskets waiting to increase your shopping pleasure.

Yes, these are all inconsequential developed-world annoyances. The point isn’t that they’re life-changing, the point is that these systems used to function reliably and now they don’t. This can be written off with various excuses, but what if it’s evidence that the real-world systems we rely on are all sliding toward the cliff edge of systemic dysfunction or breakdown?

One more anecdote. The guy ahead of me in the grocery store line ponied up $255 for a couple bags of groceries and another $22 for some Coors beer. He didn’t look like his household was bringing in $250,000 a year, and yet he didn’t seem troubled by dropping almost $300 for a couple bags of groceries and a few beers. He was clearly price insensitive, i.e. we don’t need no stinking discounts, we pay full pop for whatever we want.

Personally, I would be having a cardiac arrest if all I got for $277 was a couple bags of groceries and a few beers. But again, I guess I’m cursed with frugality and nobody else even cares how much things cost now. A $60,000 pickup truck? No problem, give me two!

Nobody seems to be wondering what happens should the real world no longer respond to the Perpetual Motion Finance Machine. Meanwhile, I’m cursed with the gut feeling that the printing press on board the Titanic isn’t going to keep the whole shebang glued together as long as everyone else seems to think, and that substituting new financial gimmicks won’t restore the system, either.

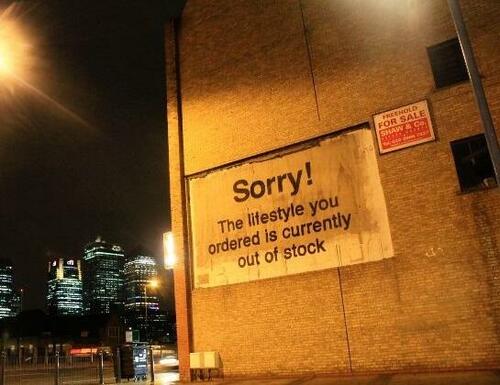

The lifestyle you ordered is out of stock and we have no idea when the back-order will be filled. But no worries, we’ve got 30 years of history to prove that all we need to do to enjoy 30 more years of Waste Is Growth is play around with various versions of “money,” debt, speculative bubbles and phantom capital.

But really, everything’s FINE (Fragile, Insecure, Nonsensical, Expensive) and it’s all rock-solid for another 30 years. But hey, why be so darned cautious, make that 300 years, we’ve got Perpetual Motion.

New Podcast: Its a Waterfall – Risk, Collateral & Productivity (48 min)

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Tyler Durden

Fri, 04/28/2023 – 07:20

via ZeroHedge News https://ift.tt/iHEf0cm Tyler Durden