Vultures Circling: Bearish Bets Against REITs Soar As CRE Meltdown Risks Mount

As storm clouds gather over the commercial real estate market, it faces ever-darker prospects by the week. Short-seller vultures are circling above CRE REITs, targeting these investment vehicles with significant exposures to office, retail, and hotel with massive bearish bets on the hope “more borrowers will default on office debt as interest costs increase and property values fall,” as reported by Bloomberg.

New data compiled by S&P Global Market Intelligence shows short interest in some of the largest REITs with exposure to commercial properties, Blackstone Mortgage Trust Inc. and Starwood Property Trust Inc., have soared in recent weeks.

Hedge funds are making bearish bets in the credit derivatives and equities spaces on the premise remote and hybrid work will continue to paralyze demand for tier 2 and 3 properties and crush landlords. Data from broker Cushman & Wakefield indicates office vacancy rates are rising at alarming rates.

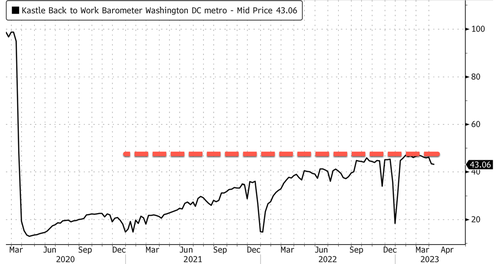

The gold-standard measure of office occupancy trends is the card-swipe data provided by Kastle Systems. The average office occupancy nationwide is around 46%, still well off the highs from pre-pandemic levels.

The problem now is borrowers lack new tenants, which means default risk increases and negatively impacts REITs. These investment vehicles generate revenue from the spread between their capital costs and the interest rates charged to borrowers for loans.

Gavriel Kahane, the co-founder of real estate investment firm Arkhouse, warned there’s mounting concern among top investors about “ballooning defaults on held loans” due partly to higher refinancing costs. He noted:

“Mortgage REITs in general do better when the Fed funds rate stays constant, and in this hyper-turbulent environment distress bubbles up.”

The surge in bearish bets is an ominous sign market participants recognize the CRE space is headed for severe pain. The Mortgage Bankers Association reported a delinquency rate on office loans across all lenders climbed to 2.7% at the end of 2022, up from 1.6% in the previous quarter. We suspect that the rate will continue to rise throughout this year.

Bloomberg noted, “Office loans are a minority of the portfolios for the mortgage REITs that are being shorted.”

Recall last month, we pointed out that regional banking turmoil would have spillover effects in the CRE space — especially the office sector (Read: New “Big Short” Hits Record Low As Focus Turns To $400 Billion CRE Debt Maturity Wall). And since then, JPM, Morgan Stanley, and Goldman Sachs have all joined the CRE gloom parade.

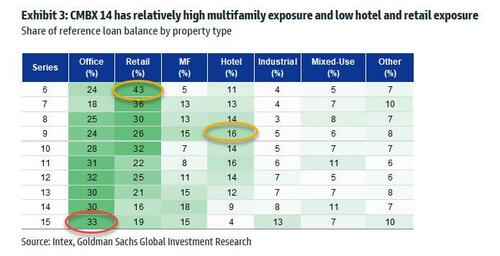

We highlighted the next big short: BBB- tranches of CMBX Series 15, due to its outsized exposure to office commercial real estate…

BBB- tranches of CMBX Series 15 is sliding again.

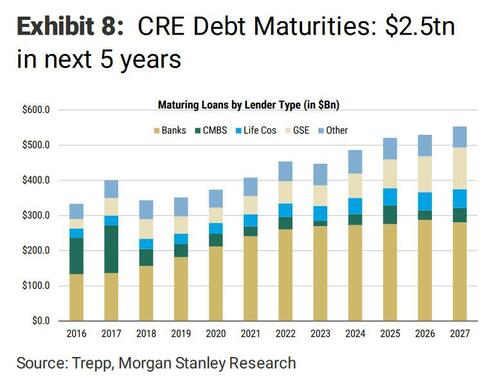

We also cautioned about a large maturity wall in the CRE sector, with $400 billion of debt due this year. Morgan Stanley data shows $2.5 trillion in CRE debt comes due over the next five years.

Perhaps last week’s Vornado Realty Trust announcement about delaying its dividend is a harbinger of what’s to come. The REIT just hit a 27-year low.

Read this:

“We expect private equity and commercial real estate to suffer as regional banks were disproportionate funders of these sectors and the crisis has shut leveraged lending primary markets for the time being,” fund managers James Hanbury and Jamie Grimston of Brook Asset Management wrote in a letter to investors seen by Bloomberg.

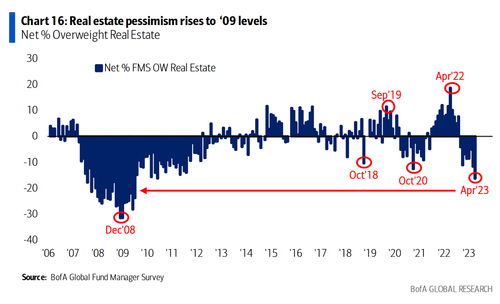

The latest BofA Fund Managers Survey (available to pro subs in the usual place) shows institutional players are most bearish on real estate since 2009.

Meanwhile, CRE Billionaire Sam Zell recently told New York University graduate students that remote work is a “bunch of bullshit” and that they should dismiss the idea of working from home. It might be hard for Zell to persuade folks to return to the office. These work trends seem permanent and will exert pressure on the CRE space, with mounting risks of a default wave. The dominos appear to be already falling.

Tyler Durden

Sun, 04/30/2023 – 14:00

via ZeroHedge News https://ift.tt/7Zu6FJN Tyler Durden