Why Hasn’t The GOP Yet Walked The Walk On Its Mayorkas Impeachment Talk?

Authored by James Varney via RealClear Wire,

It’s almost an understatement to say that Republican candidates campaigned hawkishly on border control in the runup to the 2022 midterms: As they decried the flow of illegal immigrants and drugs from Mexico, many vowed to impeach the man they largely blamed for the mess, Homeland Security Secretary Alejandro Mayorkas.

Republicans have continued hammering Mayorkas since taking control of the House. Judiciary Committee Chairman Jim Jordan, who called the flooding of more than 5 million illegal immigrants across the southern border since President Biden took office an “intentional” policy, has made several visits to the U.S.-Mexico border with other Republicans, and the House has held multiple hearings on immigration.

But as winter has turned to spring, the GOP has taken little action to remove Mayorkas. Republicans Andy Biggs of Arizona and Pat Fallon of Texas have each filed bills, but the House Judiciary Committee, from which any impeachment move must come, has not taken up either resolution.

Conservative groups focused on the southern border told RealClearInvestigations that impeachment did not come up during recent meetings in Washington.

“I just came from the Hill and a bunch of meetings with staffers and they’re reporting the same thing; one said the conference is split, with a lot of GOP ‘George W. Bush types’ who love the cheap labor for American industry and agriculture,” said Todd Bensman of the conservative Center for Immigration Studies and author of “Overrun: How Joe Biden Unleashed the Greatest Border Crisis in U.S. History.”

Bensman calls it an “old story,” but cheap labor is only part of it. Republicans aren’t united on this issue because some fear that following through on impeachment talk will alienate the moderate swing voters that the GOP needs to remain in control of the House.

Even Republicans who have publicly attacked Mayorkas are now reticent about discussing impeachment. RCI reached out to 16 GOP House members for comment. Neither Biggs nor Fallon responded. Virginia Rep. Bob Good, a member of the Freedom Caucus who is co-sponsor of both resolutions, declined to comment on the record. Other outspoken administration critics such as Dan Crenshaw of Texas, Tom McClintock of California, and Matt Gaetz of Florida did not respond.

Only two of the 16 Republican House members agreed to speak on the record.

“I have repeatedly called for his impeachment and am confident that Chairman Jordan will hold true to his word of impeaching Mayorkas for overseeing an unprecedented surge of illegal activity at our southern border,” Rep. Paul Gosar of Arizona said.

Rep. Scott Perry of Pennsylvania said Biden administration officials have lied about what they have done at the border but was more circumspect on impeachment, suggesting a wait-and-see attitude may be behind the aggressive rhetoric.

“I’m not on the Judiciary Committee and it would have to come from there,” he said. “My hope is that at least some information will come from hearings because some members legitimately have some questions.”

Perry and others said they would like to see the Judiciary Committee make the case for impeachment, a process Jordan appears to be favoring. For the moment, however, the only concrete step Republicans have taken is a symbolic gesture by Rep. Chip Roy of Texas to try to cut Mayorkas’ salary from the DHS budget.

The bills filed by Reps. Biggs and Fallon contend that Mayorkas’s conduct meets the constitutional threshold for impeachment, “high crimes and misdemeanors.” Fallon’s bill, H. Res. 8, alleges that the secretary has violated the oath all cabinet members take to “faithfully uphold” the laws of the United States by failing to enforce:

-

The Secure the Fence Act of 2006 that requires the DHS secretary to “maintain operational control over the entire international land and maritime borders of the United States.”

-

The Immigration and Nationality Act that requires the DHS secretary to “detain inadmissible aliens arriving in the United States or aliens who are present in the United States without inspection until processed.” Instead, it claims, Mayorkas’ “catch and release” approach has allowed more than “1,000,000 illegal aliens” into the country.

While referencing those two laws, the Biggs resolution, H. Res. 582, also accuses Mayorkas of violating the Public Health Services Act by failing to protect U.S. citizens from “risk and exposure to and contracting Covid-19 by refusing to take necessary steps to prevent contagious illegal aliens from entering the United States.”

In sum, the Biggs resolution concludes Mayorkas should be impeached because “his actions have subverted the will of Congress and the core tenets of the Constitution.”

RCI reached out repeatedly to a dozen Democratic members of the House Judiciary Committee seeking comment on a possible impeachment of Mayorkas and their reaction. None of them responded.

Mayorkas has stated repeatedly he has no intention of resigning, a suggestion Republican Sen. Ted Cruz of Texas made again Tuesday when Mayorkas appeared at a Senate committee hearing. “If you had any integrity you would resign,” Cruz said.

The volley came after the two got into a verbal spat over how truthful the administration has been about the border. Cruz cited comments by White House Press Secretary Karine Jean-Pierre that people are “not walking across the border” along with photographs of people doing just that. “You claim you care, Mr. Secretary –– that is a lie,” Cruz said.

Cruz again accused Mayorkas of dissembling after the DHS chief would not answer a question about whether Jean-Pierre lied. Mayorkas called Cruz’s accusation “revolting.”

Nevertheless, the department is bracing for a possible impeachment and taking steps for Mayorkas’ defense. A government contract was signed with the law firm Debevoise & Plimpton to provide legal assistance to the secretary; that contract would kick in only if the Judiciary Committee moved an impeachment motion to the House floor.

Debevoise & Plimpton did not respond to a request for comment about the arrangement. Biden administration officials familiar with it said it was necessary because the impeachment of a cabinet secretary is so rare none of its legal staff has any relevant experience.

The terms of the contract were not disclosed, although officials pointed to examples in the past where House Republicans hired outside legal counsel to assist it on legislation that proved legally fraught.

A DHS spokesperson said the contract was necessary to “ensure the Department’s vital mission is not interrupted by the unprecedented, unjustified and partisan impeachment efforts of some members of Congress, who have already taken steps to initiate proceedings.”

History shows the House can move swiftly on impeachment if members choose to. The Democratic majority, along with a handful of Republicans, voted to impeach departing President Trump just one week after the post-election riot at the Capitol on Jan. 6, 2021.

Defenders of the government’s current border policies say that the conservatives’ argument is flawed. The Biden administration’s approach is basically a relaxation of the Trump administration’s more stringent strategy. As such, they amount to policy differences between the two major political parties and fall far short of any “crimes and misdemeanors” that would justify impeachment.

But, as RCI has previously reported, President Biden’s policies have marked a sharp break from his predecessor’s, since Biden’s first day in office, when he signed seven executive orders on immigration that, among other things,  suspended deportations.

Hans von Spakovsky, a senior fellow at the conservative Heritage Foundation who co-authored the February report, “The Case for Impeachment of Alejandro Nicholas Mayorkas Secretary of Homeland Security,” defended the impeachment argument from liberals who deride it as purely political.

“It inaccurately and incorrectly asserts that we are confusing the requirements of the Immigration and Naturalization Act with the Trump administration policies,” he said. “Our analysis is based not on disagreeing with the policies implemented by Mayorkas, but with his violation of federal immigration law.”

“I think we have laid out in our paper what we think the basis is for impeachment,” von Spakovsky told RCI. They include the claims that Mayorkas:

-

“deliberately defied and contravened the laws he is charged with faithfully executing.”

-

“repeatedly abused the authority of his office, including by, among other conduct, enticing a flood of aliens to cross the U.S. southern border with his policies and Statements.”

-

“betrayed the trust of the people by lying to Congress and withholding information and misleading the public in an effort to hide and suppress the nature and consequence of his abominable policies.”

Von Spakovsky added that “the misguided priorities of Mayorkas have resulted in a huge backlog in the adjudication system that unfairly hurts the many thousands of U.S. citizens and lawful applicants whose immigration matters are delayed many months.”

Although von Spakovsky and others argue impeachment is warranted “consistent with U.S. history and constitutional traditions,” it would also be a highly unusual move. Only one cabinet member has ever been impeached, President Ulysses S. Grant’s War Secretary William Belknap in 1876, but he resigned the same day the House voted unanimously against him.

Attorney General Harry Daugherty in 1922 and Treasury Secretary Andrew Mellon in 1932 also faced possible impeachment proceedings by the House, but the former resigned in 1924 and the latter left the cabinet and became U.S. ambassador to England.

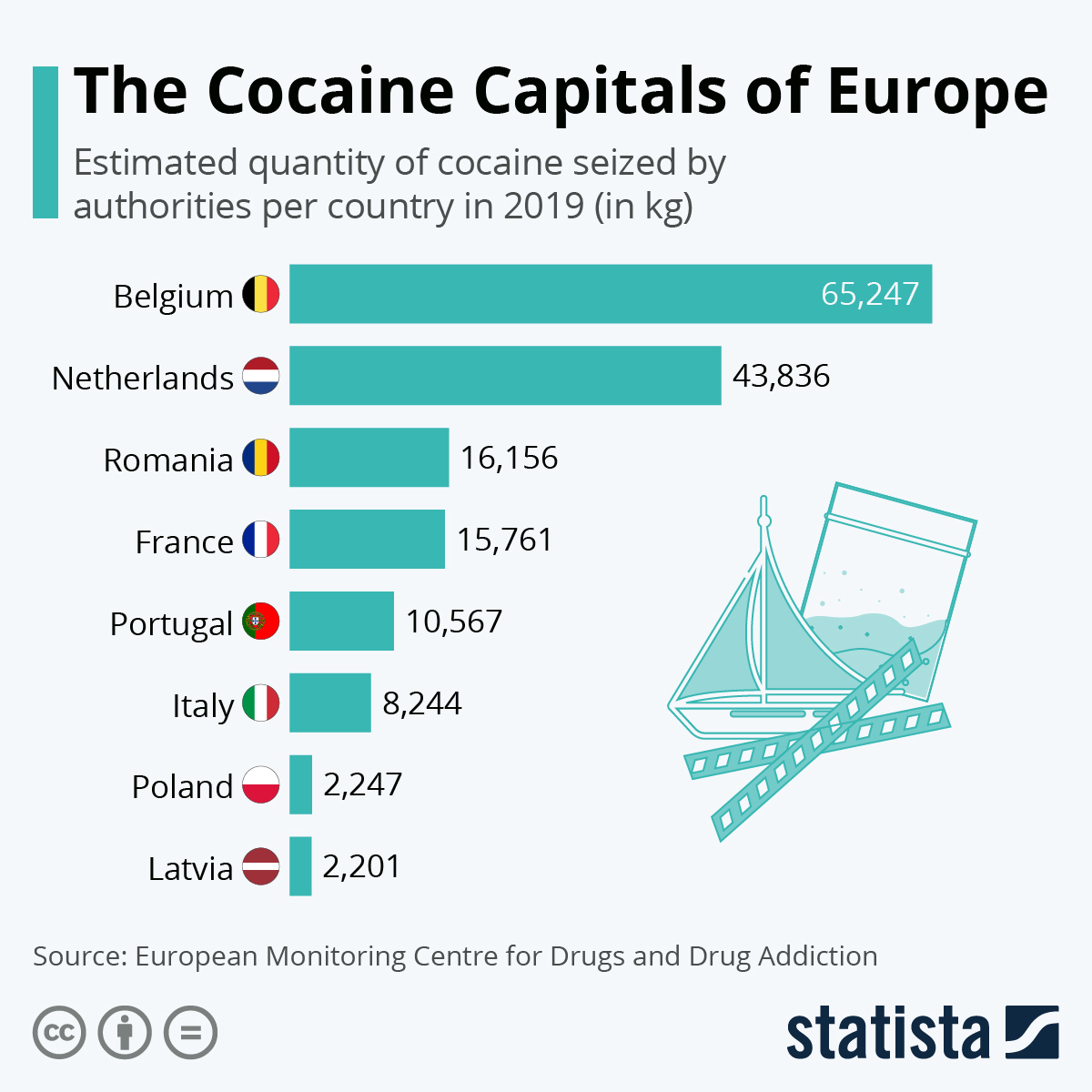

Impeachment supporters also point to the dangers the Biden administration’s porous border have created. In addition to the humanitarian issues of hundreds of thousands of people migrating through Mexico to the U.S., and the money they have paid to Mexican cartels to facilitate their passage, the southern border has become the main conduit for deadly illicit fentanyl.

Scott Perry said his constituents would like to see the Republicans do more than simply talk about the border crisis, though he noted that Mayorkas is the agent who carries out policies set by President Biden.

“It’s chaos down there with the fentanyl and the cartels making millions of dollars,” he said.

“Most of our constituents are distraught about that and want it fixed, and many would like accountability for how it occurred. Ultimately, the president is responsible so why not impeach him?”

But as to what might actually happen with Mayorkas, Perry acknowledged he wasn’t sure.

“My sense is that with the Judicial Committee holding hearings we are working toward those kind of things,” he said. “That will go to the fact-finding we need to have to convince some of our skeptical members.”

Tyler Durden

Sat, 04/01/2023 – 12:30

via ZeroHedge News https://ift.tt/Qlyh8Re Tyler Durden