Bonds, Bitcoin, & Bullion Battered After Bank Bailout, Stagflation Scare

Weak macro data, re-accelerating inflation (prices paid), no progress on the debt-ceiling, and a bank bailout that literally does nothing to calm fears of more bank runs (or superwalks).

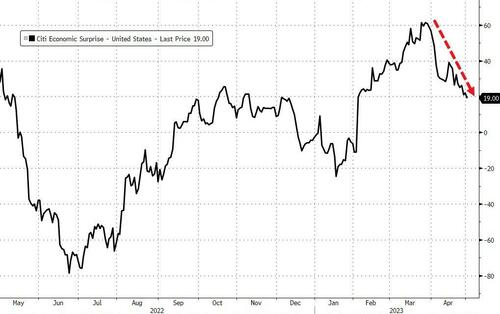

Macro data disappointment continues…

Source: Bloomberg

ISM Manufacturing signaled stagflation with prices paid rising but activity and new orders still in contraction…

Source: Bloomberg

“Stagflation is looming,” said Bruce Liegel, a former macro fund manager at Millennium Partners LP who’s been working in financial markets since the early 1980s. He advised buying short-duration Treasuries, such as the 2-year note. Rates are high now and will remain high at maturity — so investors can pick up new debt at that time at even higher rates. He also expects value stocks to outperform growth during this time as well.

“We are set to have higher rates, and higher inflation for at least three to five years,” said Liegel, who writes a monthly global macro report.

“The growth we had seen in the past was based on low interest rates and leverage. And now we are unwinding all that, which is going to be a headwind for growth for years.”

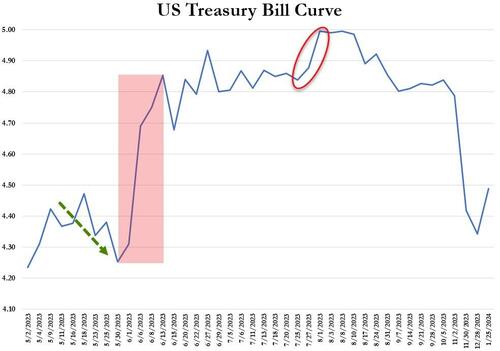

The debt-ceiling “game” in Washington remains stagnant and the T-Bill curve’s kink is becoming more and more cliff-like…

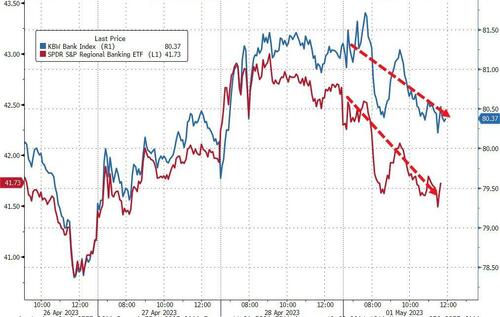

If everything’s so awesome, why are big- and small-bank stocks down today…

Source: Bloomberg

JPM, of course, outperformed as its now even too-biggest-to-fail, but BofA, Goldman, and MS were all red on the day…

Source: Bloomberg

Interestingly, with banks “fixed” and stagflation scares ascendant, we saw rate-hike expectations lift modestly hawkishly today with the terminal rate in June (but very marginally above this Wednesday – hence the 25% odds of a June hike). NOTE (off the chart because of scaling) that December is expected to be 25bps below current levels!

Source: Bloomberg

So what did all that mean for stocks? Well BTFD of course – durr, as 0DTE vol plunged at the open once again. But, they could not hold it and stocks faded late on into the red as major negative delta flow from 0DTE hit the market starting around 1200ET…

On the day the pump was met with a dump leaving the majors basically unchanged (Small Caps spiked into the green in the last few mins)…

Another day, another VIX compression (VIX his 15.60 lows intraday) and VIX1D dump and pump…

Source: Bloomberg

Treasury yields soared, despite equity’s general malaise as a holiday-thinned session was dominated by heavy corporate supply (META $8.5 billion for example). The entire curve was basically up 13-15bps…

Source: Bloomberg

Also bear in mind that Europe was largely closed today for Labor Day.

We wouldn’t be betting too hard on today’s yield surge holding as the corporate calendar easing up and rate-locks lifted…

Source: Bloomberg

The dollar was higher, reversing overnight weakness, pushing back up to Friday’s highs…

Source: Bloomberg

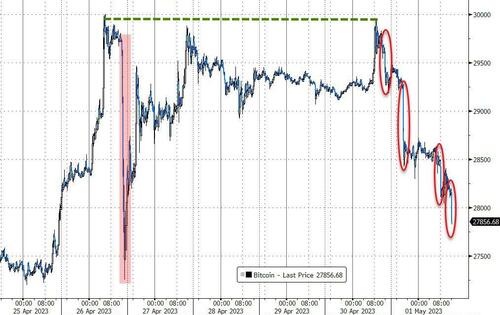

Crypto was clubbed like a baby seal for no good reason again. Bitcoin tried to tag $30k again but was punished, puking back to the Mt.Gox ‘fake news’ spike lows…

Source: Bloomberg

Gold was crazy today – with Futs spiking up to $2105 intraday on the JPM rescue then puking it all back because we can’t have the barabrous relic hinting that systemic shit is bad…

Oil was down on the day but WTI seemed to find support at $75…

Finally, well done Jim Cramer…

Source: Bloomberg

That “CNBC Pro” sub was well worth the money.

Tyler Durden

Mon, 05/01/2023 – 16:01

via ZeroHedge News https://ift.tt/zN9Ky4S Tyler Durden