Futures Flat On First Republic Failure Day

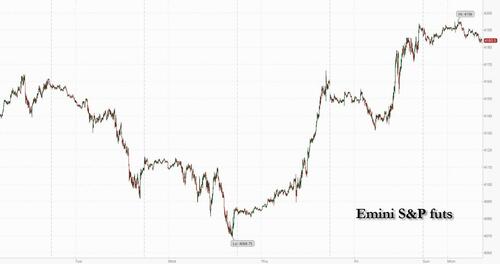

US stock futures were flat to start the busy new week in subdued trading with much of the world close for May 1 celebrations, as investors assessed the government-backstopped intervention which saw JPMorgan Chase acquire First Republic Bank ahead of this week’s Federal Reserve rates decision. Contracts on the S&P 500 were unchanged at 4,187 after the underlying benchmark gained sharply on Friday, rising 0.8% on the back of another painful gamma squeeze. The dollar dropped, alongside Treasuries which edged lower after a muted session in Asia. There was no trading in much of Europe to observe the May 1 holiday, with markets also shut in Asian centers like Hong Kong, Singapore and mainland China.

In premarket trading, First Republic tumbled 39% while JPMorgan advanced 2.9% as the already largest US bank became even bigger courtesy of billions in taxpayer funding. JPMorgan will take over First Republic’s assets, including about $173 billion of loans and $30 billion of securities, as well as $92 billion in deposits. JPMorgan and the Federal Deposit Insurance Corp., which orchestrated the sale, agreed to share the burden of losses, as well as any recoveries, on the firm’s single-family and commercial loans. But really the losses, which will be funded by US taxpayers leaving JPM with the best assets which it bought for pennies on the dollar and is why JPM stock is up 3% premarket. Here are the other notable premarket movers:

- Alignment Healthcare Inc. shares are up 4.8%, as Raymond James upgrades the health care software company to outperform from market perform.

- Carvana shares rise as much as 18% after Bloomberg reported late Friday that the online auto retailer’s creditors, who hold about 90% of CVNA’s bonds, have been pitching to the company ways to pare down debt and improve liquidity, including a proposal for a debt-for-equity swap.

- Top Financial Group Ltd. pulls back after rallying 1,510% over the last two trading sessions.

- Iveric Bio Inc. jumps 18% after Japan’s Astellas Pharma Inc. agrees to buy it for about $5.9 billion.

- General Motors shares rise as much as 2.9% Monday after the carmaker was upgraded to overweight from equal-weight at Morgan Stanley which says the stock looks oversold.

- Manchester United Plc slides 5.2% Monday, amid a looming decision by the Glazer family over the sale of the football club.

- Teradata advances 3.3% after Guggenheim Securities raised the database-management company to buy from neutral, saying channel checks signal that it may be at a positive inflection point with customer retention and revenue expansion through its cloud strategy.

Meanwhile, investors are anticipating the Fed to hike interest rates for a 10th consecutive – and final – time on Wednesday as it combats still-stubborn inflation. The benchmark S&P 500 has climbed in the past two months even amid banking sector turmoil and recession concerns, as investors take comfort in better-than-feared earnings and expect any slowdown to be mild. However, “if the message delivered at this meeting is more hawkish, it could provide a near-term negative surprise for equities,” Morgan Stanley’s permabear Michael Wilson wrote in a note, really scraping the bottom of the barrel on this one.

Shares in First Republic bank were halted after tumbling 46% in premarket trading. Regulators had worked into the evening on Sunday in Washington before announcing JPMorgan won the bidding to acquire the lender in an emergency government-led intervention. The collapse of First Republic was the second-biggest bank failure in US history. Private rescue efforts had failed to undo the damage from wrong-way investments and depositor runs that have roiled regional lenders.

As described earlier, JPMorgan acquired about $173 billion of First Republic’s loans, $30 billion of securities and $92 billion in deposits. JPMorgan and the FDIC which orchestrated the sale, agreed to share the burden of losses, as well as any recoveries, on the firm’s single-family and commercial loans, the agency said early Monday in a statement. JPMorgan shares rose 3.9% in premarket trade.

There was no trading in most of Europe to observe the May 1 holiday, with markets also shut in Asian centers like Hong Kong, Singapore and mainland China. What Asian markets were open saw stocks rise: benchmarks in Japan and Australia climbed, lifting the MSCI Asia Pacific Index 0.2% higher, with Japanese technology names NEC and Keyence among the top contributors to gains.

NEC surged 14% on strong results, helping boost the benchmark Topix to its highest since September 2021 even as Sony fell following disappointing guidance. Australia’s key gauge rose amid expectations the central bank will keep interest rates on hold when it meets Tuesday. The regional benchmark capped a 1.1% loss in April as geopolitical tensions and an uneven economic recovery spurred losses in Chinese equities. However, stocks in Japan capped a fourth-straight month of gains amid renewed investor interest, optimism over earnings and the central bank’s decision to maintain loose policy.

“The yen is trending somewhat toward depreciation, and we expect a somewhat positive impact on Japanese stocks, with scope for buying of bank stocks that were sold” recently, JPMorgan equity strategists led by Rie Nishihara wrote in a note Monday. Chinese stocks listed in Hong Kong will be in focus when trading resumes Tuesday, after data showing consumer spending surged while the housing market continued to rebound. Still, an unexpected contraction in manufacturing activity in April confirmed that the broader economic recovery remains uneven. Onshore markets will be shut through Wednesday

In FX, the Bloomberg dollar index dipped even as the slide in the yen continued following last week’s dovish BOJ announcement.

- USD/JPY advanced as much as 0.5% to 136.98, the highest since March 10, before paring gains to trade around 136.81. The BOJ indicated it has more confidence in wage increases for this fiscal year, according to its full quarterly economic report released Monday

- EUR/USD fell as much as 0.3% to 1.0992, a third day of declines

- This week’s interest-rate decision by the European Central Bank is going down to the wire as officials await two key economic reports arriving just one day before they convene.

- GBP/USD dropped 0.4% to 1.2517, paring last week’s advance

- The extra bank holiday for King Charles III’s coronation on May 8 could help tip the economy into a minor contraction in the second quarter, economists say

Treasuries fell after a Friday rally. A sudden drop for Bitcoin dragged the cryptocurrency further below $30,000 after a stellar run this year.

Looking at the week ahead, interest rate decisions will be in focus this week. The Federal Reserve is expected to increase borrowing costs by 25 basis points to a range of 5% to 5.25%, a level not seen since 2007. The European Central Bank is also forecast to raise its key lending rates by 25 basis points. The Reserve Bank of Australia will likely keep interest rates on hold when it meets Tuesday.

Apple Inc. headlines another busy week of earnings that includes Advanced Micro Devices Inc. and Ford Motor Co. In Asia, banks including HSBC Holdings Plc and Macquarie Group Ltd. will deliver their profit reports. In Europe, Volkswagen AG and energy giants BP Plc and Shell Plc are on the docket.

Top Overnight News

- JPMorgan Chase & Co. won the bidding to acquire First Republic Bank in an emergency government-led intervention after private rescue efforts failed to fill a hole on the troubled lender’s balance sheet and customers yanked their deposits.

- China’s NBS PMIs for April fall short of expectations, with manufacturing falling back into contraction territory for the first time since Dec (49.2, down from 51.9 in Mar and below the Street’s 51.4 forecast) while services cool (56.4, down from 58.2 in Mar and below the Street’s 57 forecast). BBG

- China’s consumer spending and travel activity surge during the opening days of the May Day holiday period. Some 19.7 million railway trips were made across the country on Saturday, the highest on record for a single day. Shoppers were out in force on Saturday too, with major retail and catering companies seeing sales jump 21% from a year ago. BBG

- China is clamping down on allowing critical data about the economy to leave the country as Xi focuses on national security amid growing concerns in the gov’t that the US poses an existential threat to the Communist Party. WSJ

- The recovery in Macau’s casino sector gained traction in April, with gaming revenue climbing 449.9% to hit a three-year high as Chinese tourists continue to flock to the gambling hub. Gross gaming revenue reached 14.7 billion patacas ($1.8 billion). The result was better than the median analyst estimate of a 393% year-on-year increase, and is the highest monthly taking since January 2020. It was still more than a third below the 2019 level. BBG

- The debt ceiling situation in Washington is even worse than many appreciate as substantive negotiations still aren’t even taking place (the next major event will be the new “X date” estimate from the Treasury). WaPo

- JPMorgan won the bidding to acquire First Republic Bank in an emergency government-led intervention. It will take over First Republic’s assets, but agreed to share the burden of losses, as well as any recoveries, on the firm’s single-family and commercial loans with the FDIC. JPMorgan said it expects to recognize an upfront, one-time, post-tax gain of about $2.6 billion as a result of the deal. Its stock rose premarket while First Republic’s plunged. BBG

- Deutsche Bank is planning a hiring spree and significant expansion of its investment bank advisory team, as the German lender positions itself for a dealmaking rebound and to take advantage of market dislocation after the collapse of rival Credit Suisse. FT

- The central challenge for the Fed is that the economic outlook is souring at the same time that progress on reining in inflation is stalling out. Economic growth in the first quarter decelerated more than expected, data out this past week showed, while the Fed’s preferred inflation gauge is down less than a full percentage point from its peak and still more than double the bank’s 2% inflation target. The risk of a misstep is growing, and the consequences of over- or undershooting would be severe. Barron’s

- PFE (Pfizer)/BNTX (BioNTech) are in talks w/the EU to sell the region ~70M COVID vaccine doses annually until 2026, a deal that would block other firms (MRNA, NVAX, and Sanofi) from the market. FT

- On GS’s US Prime book, Health Care was net bought for the 2nd straight week and has now been net bought in 8 of the past 10 weeks. Nearly all subsectors were net bought, led by Pharmaceuticals, Life Sciences Tools & Services, and Biotech. The US Health Care L/S ratio now stands at 2.40, still near 1-year lows in the 3rd percentile, and in the 37th percentile vs. the past five years.

Market Snapshot

- S&P 500 futures little changed at 4,185.75

- MXAP up 0.2% to 160.70

- MXAPJ little changed at 514.96

- Nikkei up 0.9% to 29,123.18

- Topix up 1.0% to 2,078.06

- Hang Seng Index up 0.3% to 19,894.57

- Shanghai Composite up 1.1% to 3,323.28

- Sensex up 0.8% to 61,112.44

- Australia S&P/ASX 200 up 0.3% to 7,334.56

- Kospi up 0.2% to 2,501.53

- STOXX Europe 600 little changed at 466.89

- German 10Y yield little changed at 2.31%

- Euro down 0.2% to $1.0994

- Brent Futures down 2.0% to $78.76/bbl

- Gold spot down 0.6% to $1,978.17

- U.S. Dollar Index up 0.24% to 101.90

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were positive in a holiday-quietened start to the risk-packed week with most indices in the region

closed for the Labour Day holidays, while weekend news flow was very light although the latest Chinese PMI data

showed the nation’s factory activity unexpectedly contracted last month. ASX 200 (+0.6%) traded higher with energy leading the gains although further advances were capped after weak manufacturing PMI data from Australia and its largest trading partner, China, while the Albanese government is set to conduct a review whereby hundreds of the prior Coalition government’s infrastructure projects could be scrapped. Nikkei 225 (+0.7%) climbed above the 29,000 level for the first time since August last year after Friday’s dovish reaction to BoJ Governor Ueda’s first policy meeting and as participants digested more earnings results, with SoftBank shares also among the notable gainers amid reports the Co.’s Arm unit filed confidentially for a US IPO on the Nasdaq. Elsewhere, US equity futures were steady and took a breather following their recent rally into month-end, with price action contained amid the mass holiday closures on Monday and ahead of this week’s key events including the RBA, FOMC and ECB rate decisions, Apple earnings and the latest NFP jobs data

Top Asian News

- US President Biden and Philippines President Marcos are expected to reach agreements on issues including business engagement and military enhancements at the summit on Monday. Philippines President Marcos will have discussions at the Pentagon about joint maritime patrols and the Philippines is increasingly concerned about provocative diplomacy by China and seeking stronger ties with allies and partners. Furthermore, the US State Department called on Beijing to stop its harassment and intimidation of Philippine vessels in the South China Sea and US Commerce Secretary Raimondo will lead a presidential business delegation to the Philippines to enhance commercial and business ties, according to a senior US official cited by Reuters.

- Japanese PM Kishida said nothing concrete is decided yet when asked about reports of a summit in May with South Korean President Yoon, according to Reuters

European markets closed for Labour Day.

Top European News

- EU’s tech regulation chief Vestager said that they will have a political agreement on the EU’s Artificial Intelligence Act this year, according to Reuters.

- Fitch downgraded France from AA to AA-; Outlook Stable and Moody’s affirmed Belgium at AA3; Outlook Stable.

- UK employers are pushing to suspend scheduled pension contributions totalling tens of millions of pounds after

- many retirement schemed reached unexpected surpluses, according to FT.

- UK Citi/YouGov Inflation Expectations: 12-months: 5.2% (prev. 5.4%); 5-10yrs 3.6% (prev. 3.7%).

- NBP’s Maslowska says CPI could hit single digits at end-May, maybel early autumn., via PAP.

Geopolitics

- Russia’s Defence Ministry said its forces took four blocks in western Bahkmut, according to RIA. In relevant news, Twitter sources on Sunday reported that over a dozen of Russian Tu-95Ms bombers took off on Sunday.

- Russian Defence Ministry said there forces struck Ukrainian military facilities overnight, all designated targets hit.

- Wagner group’s Prigozhin said, in a letter to Russian Defence Ministry Shoigu broadcast on Telegram, that they are immediately requesting ammunition and if this isn’t provided immediately they will complain to President Putin. Adding, this issue alongside increasing casualties could result in them withdrawing from Bakhmut.

- Ukrainian military intelligence official said over 10 tanks of oil products with capacity of around 40k tonnes were destroyed in an explosion in Sevastopol on Saturday, while the fuel was intended for use by Russia’s Black Sea fleet and is ‘God’s punishment’ for the Russian air strike on the Ukrainian city of Uman on Friday, according to Reuters.

- Pope Francis said the Vatican is involved in a peace mission in Ukraine with the details to be released in due course, while they are willing to do everything that has to be done to bring peace to Ukraine and he discussed Ukraine peace with Hungarian PM Orban and the Russian Orthodox Church representative in Budapest, according to Reuters.

- Twitter source noted that air raid sirens are sounding in Ukraine’s capital Kyiv and that sirens are beginning to spread across Ukraine amid Russian missile launches; subsequently, Twitter source notes explosions in the Dniproletrovsk Oblast and Kyiv Oblast with air defence activity reported.

- North Korean leader Kim’s sister said agreement from the South Korea-US summit will make insecurity worse and North Korea must further perfect the nuclear deterrent, according to KCNA. Iranian President Raisi is to visit the Syrian capital of Damascus, according to IRNA

US Event Calendar

- 09:45: April S&P Global US Manufacturing PM, est. 50.4, prior 50.4

- 10:00: March Construction Spending MoM, est. 0.1%, prior -0.1%

- 10:00: April ISM Employment, prior 46.9

- 10:00: April ISM Prices Paid, est. 49.0, prior 49.2

- 10:00: April ISM New Orders, prior 44.3

- 10:00: April ISM Manufacturing, est. 46.8, prior 46.3

Tyler Durden

Mon, 05/01/2023 – 09:03

via ZeroHedge News https://ift.tt/nZqAH9t Tyler Durden