ISM Manufacturing Screams Stagflation, Still Contracting With “Reigniting Inflationary Pressures”

Following S&P Global’s manufacturing survey’s surprise jump in the flash data, the 50.4 print has dropped intra-month to 50.2 (still back in expansion)

-

S&P Global US Manufacturing final April print of 50.2, down from 50.4 flash, up from 49.2 in March – highest since Oct 2022

-

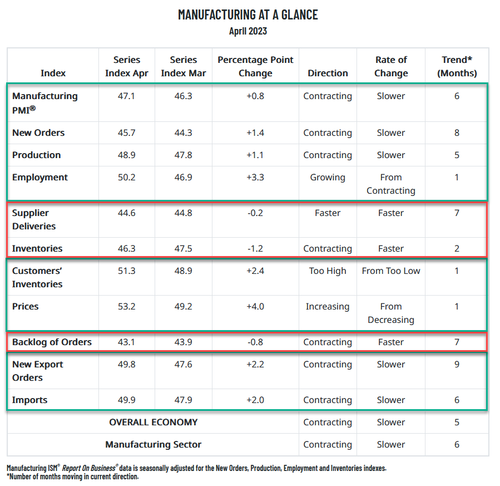

ISM US Manufacturing April print of 47.1, up from 46.3 prior (and betyer than the expected 46.8) – but still in contraction (sub-50).

Given the notable slide in the US macro surprise index

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“US manufacturing output has regained some encouraging momentum at the start of the second quarter, having stabilised in March after four months of decline.

“While the upturn is in part linked to greatly improved supply chains, helping reduce backlogs of orders, April also saw a welcome upturn in new order inflows for the first time since last September.

“Although only modest, the rise in new orders hints at a tentative revival of demand, notably from consumers but there are also signs that fewer customers are deliberately winding down their inventory levels.

“The brightening demand picture was accompanied by a lifting of business confidence about the outlook and increased hiring. The downside was a reigniting of inflationary pressures, with a stronger order book encouraging more firms to pass through higher costs to customers.”

Economic activity in the manufacturing sector contracted in April for the sixth consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM Report.

“Of the six biggest manufacturing industries, two – Petroleum & Coal Products; and Transportation Equipment – registered growth in April.”

“New order rates remain sluggish as panelists remain concerned about when manufacturing growth will resume. Panelists’ comments registered a 1-to-1 ratio regarding optimism for future growth and continuing near-term demand declines. Supply chains are prepared and eager for growth, as panelists’ comments support reduced lead times for their more important purchases. Price instability remains and future demand is uncertain as companies continue to work down overdue deliveries and backlogs. Seventy-three percent of manufacturing gross domestic product (GDP) is contracting, up from 70 percent in March.

However, fewer industries contracted strongly; the proportion of manufacturing GDP with a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 12 percent in April, compared to 25 percent in March,” says Fiore.

Prices Paid back above 50…

Source: Bloomberg

So ISM screams stagflation – no growth and higher prices.

Tyler Durden

Mon, 05/01/2023 – 10:05

via ZeroHedge News https://ift.tt/cn5m1fH Tyler Durden