World’s Top Buyer Of LNG Warns Of Another Price Spike

The northern hemisphere experienced higher-than-average temperatures this past winter, which helped alleviate energy crunches and sent liquefied natural gas prices tumbling from record-high levels. Now the world’s largest gas buyer expects another price spike this year.

In an interview with Bloomberg, Yukio Kani, the chairman and CEO of Jera Co., expressed his concerns about another potential surge in LNG prices, attributing this to the increasing import capacity in Europe and China, along with potential severe weather risks.

Here’s part of the interview:

This winter, with import capacity in Europe rising and China potentially increasing demand after it ended pandemic restrictions, prices could spike again if severe weather strikes, he said. There’s no opportunity for buyers to “let their guards down,” Kani said.

Jera, a venture between Tokyo Electric Power Co. Holdings Inc. and Chubu Electric Power Co., announced on Friday that it agreed to a 20-year deal to buy LNG from Venture Global LNG Inc.’s proposed terminal in Louisiana. While the company expects Japanese LNG demand to decline over the next decade, it could surprise by staying flat as more data centers and semiconductor factories are built, Kani said.

“Those two facilities guzzle electricity, making it hard to read the demand outlook,” he said.

Jera is also working to support Japan’s plans to use ammonia and hydrogen to decarbonize existing thermal power plants. The strategy has gotten pushback from other countries, most recently at the Group of Seven energy and environment ministers meeting. –Bloomberg

Kani’s comments come as Asian spot LNG futures are down 83.5% from last September’s high, touching lows not seen summer of 2021.

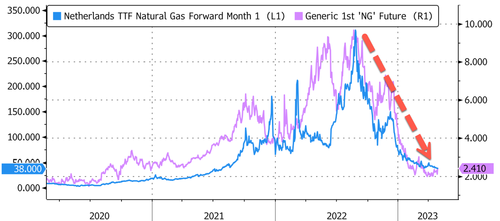

On the other side of the world, US NatGas and European NatGas futures are hovering at multi-year lows.

Kani’s prediction of severe weather could be linked to the likely return of the El Nino climate phenomenon this year, which may contribute to higher global temperatures and a subsequent rise in cooling demand, resulting in an increased need for gas. Additionally, as Europe rejiggers its energy supply chain away from Russia and relies more on US LNG shipments, supplies may face further tightening. Moreover, an uptick in China’s economic recovery could also boost LNG demand.

Tyler Durden

Sun, 04/30/2023 – 20:00

via ZeroHedge News https://ift.tt/z42rmCv Tyler Durden