Stalling China Recovery Deals A Blow To European Stocks

By Michael Msika, Bloomberg markets live reporter and strategist

With alarm bells sounding in various corners of China’s economy, European stocks with high exposure to its markets are counting on further policy support from Beijing to reinvigorate their gains. Trouble is, the prospects of major stimulus appear poor.

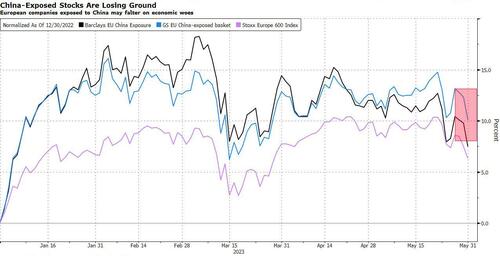

The rally in China-facing stocks has fizzled. Since the Lunar New Year holidays in late January, baskets of European shares with sizable income from the country have lagged behind the benchmark Stoxx 600. That gap widened on Wednesday after a surprisingly weak reading of manufacturing activity in the world’s second-largest economy. Today’s Caixin positive reading offered some modest relief, but suggests recovery remains uncertain and more evidence is needed to gauge the outlook.

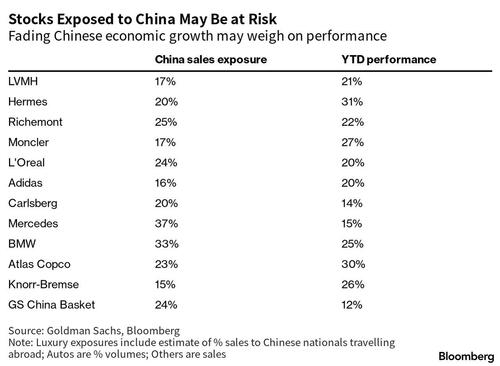

This is a big deal for European large caps. The Euro Stoxx 50 generates one fourth of its revenue in Asia, according to Goldman Sachs strategists. For the broader Stoxx 600, the figure is 21%. To certain sectors, China is a vital source of demand — some miners and tech companies rely on it for as much as half their revenue. Among industrial, auto and luxury stocks the share is 15% to 30%.

Almost all the latest data points indicate that China’s economic comeback is sputtering. Industrial output, retail sales and fixed investment grew much slower than expected in April, housing market sales are regressing again, and demand for raw materials from copper to glass has been weak. The services sector has been a bright spot so far, but record-high youth unemployment begs the question of how sustainable that strength will be.

Tepid metals demand from China has helped entrench miners as the worst equity performers this year. But the malaise is spreading, with appliance maker SEB, insurer Prudential, elevator manufacturer Kone, industrial technology company OC Oerlikon, and luxury giants like LVMH and Burberry all taking a hit. Another wave of Covid infections has added to the selling momentum.

“We believe that China exposure baskets might keep disappointing,” say JPMorgan strategists led Mislav Matejka, citing the faltering recovery there as a key reason to downgrade euro-area stocks weeks ago. That message was echoed by Barclays strategist Emmanuel Cau, who recommends clients selectively reduce exposure to China.

Bets that luxury brands, airports and airlines will benefit from a return of Chinese customers come with risks. The number of outbound flights from China has stagnated at around 40% of pre-pandemic levels, with capacity to countries like Spain and France still low, according to Nomura economists led by Ting Lu. International travel is just too expensive for ordinary households, they say.

Hopes for a return of China-inspired equity gains now hinge on a sweeping stimulus package from Beijing. But most strategists say that won’t come easily at a moment when the government is watchful about rising debt loads and stretched fiscal positions. For its part, China’s central bank has vowed to avoid major monetary easing in the wake of the turmoil in US regional banks crisis.

“We fear that the bar for fiscal support is relatively high,” says JPMorgan’s Matejka. Citigroup strategists led by Dirk Willer say China does need additional stimulus measures to prop up growth, and they may eventually come, but they are “far from imminent.”

Some are willing to look through the near-term hurdles. Morgan Stanley analysts say job gains will drive the next stage of a rebound in Chinese consumption. While the retail sales recovery has been bumpy, it should accelerate by the end of this year. Within the luxury sector, they prefer owners of brands with an ultra-premium position in China, such as LVMH and Richemont. They see spirits maker Pernod Ricard as another beneficiary.

China-exposed baskets also appeal to investors nervous about raising their direct bets on the country’s stocks when geopolitical tensions are high. “Some investors consider investing in China through European stocks as a lower risk way of doing that,” HSBC strategist Edward Stanford says in an interview. “One of the beauties of investing in China through Europe is you’ve got the reassurance of a European corporate infrastructure, disclosure and regulatory environment for listed investments.”

Tyler Durden

Thu, 06/01/2023 – 10:15

via ZeroHedge News https://ift.tt/rmUSd8v Tyler Durden