A More Complex Report Than The Headlines Suggest

Authored by Peter Tchir via Academy Securities,

The headline (Establishment) jobs numbers were great. 339k jobs added, 283k in the private sector AND 93k of upward revisions. That is in line or even better than yesterday’s ADP report. At this point I have no idea why we have the Challenger layoff report, as it doesn’t seem to reflect any of the jobs data.

But the Household report says we lost 310k jobs in the month. And for 2 months we have lost 170k jobs on a cumulative basis. The unemployment rate ticked higher to 3.7% from 3.4%. That is based on jobs lost in the Household report, since the participation rate remains unchanged (except for rounding).

So the jobs number we all look at screams HIKE, but the unemployment rate at least says hike or even pause.

Hourly earnings were revised down a touch last month, but remain above 4%. For those in the Fed who believe wage inflation is the key driver of inflation, that will tilt them slightly hawkish.

Hours worked continued to slide, from 34.6 hours in January to 34.3 hours in May, often a prelude to declining hiring needs.

I think we have to price in:

-

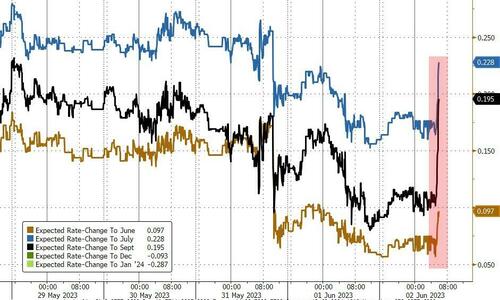

Possibility of June hike increased (higher 2 year yields)

-

The likelihood that the Fed will have to react to the strength in the report and ignore the weak parts (more inversion of 2s vs 10s).

Given ADP, I can see how we are going to run with the job market is great scenario (though the new ADP was changed to better track NFP, so I’m not sure what to make of that).

I guess we need to look at participation rates, or why the birth/death model created 231k jobs to poke holes in the report.

On the Garbage In/Garbage Out front, Household is back to such a deviation from the Establishment (I think, even accounting for the wide margin of error on Establishment and the even larger margin of error on the Household report, they are not telling the same story).

So, the Fed will treat this as hawkish, the bulls will cheer this as soft or no landing and the bears will find enough to say the potential for a recession is still real.

Risk assets could power through this data, which would be a positive event and I would like to see “good news” being “good news” even if it increases the probability of a hike!

Tyler Durden

Fri, 06/02/2023 – 09:05

via ZeroHedge News https://ift.tt/nhJjcL8 Tyler Durden