Do The Biggest Stocks Still Have Room To Run?

Authored by Simon White, Bloomberg macro strategist,

The largest-market-cap stocks and the Nasdaq do not yet look historically overbought, meaning they may have more upside potential.

With stocks like Nvidia reaching for the moon, it might seem plain as day that mega-cap stocks are overbought. While that is true using RSIs, stochastics, etc., it is not the case when you compare their behavior to previous bear markets.

This has been a two-speed market this year. That’s why it makes more sense to look at the underlying picture rather than focusing solely on the broad index.

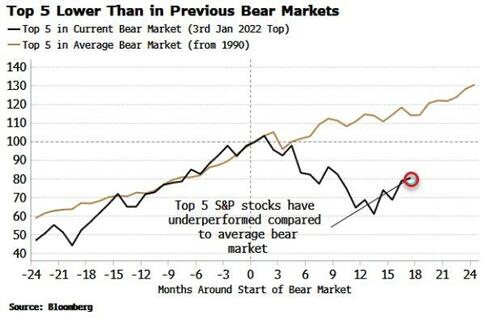

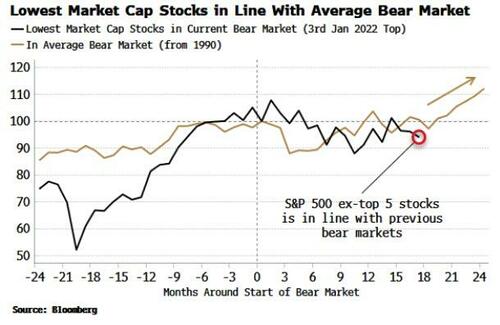

In this vein, we can create a “Top 5” index of the largest S&P 500 stocks by market cap through time, and a residual index of the remaining stocks. We can then look at how these indexes have typically behaved in bear markets to get a better historical perspective.

We can see in the chart below that far from being overbought, the Top 5 stocks are underperforming where they have normally been at this point in a bear market.

We can also see that the residual index is pretty much in line with its historical bear-market performance. But around now it has typically started to rally.

Therefore, purely from a historical price perspective, the Top 5 stocks could continue to rally, taking the residual index with it.

This accords with the year-on-year series of the Top 5 index, which shows it in the process of bouncing from very oversold conditions, and looks to be overshooting.

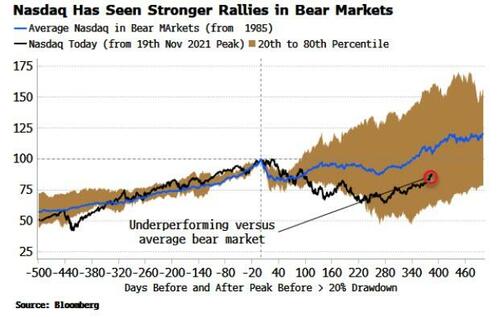

It also chimes with the Nasdaq. That index has bounced almost 40% off its lows. But compared to historical bear markets it is, perhaps surprisingly, underperforming.

Markets have been incredibly resilient, to the point even a recession may not be biggest risk they face.

Anything could happen of course to upset the apple cart, but from a purely price-based historical perspective, there is little saying markets can’t just plow on for now.

Tyler Durden

Wed, 06/07/2023 – 10:45

via ZeroHedge News https://ift.tt/SvyHpB5 Tyler Durden