The Bull Case For Banks Looks Good Only On Paper

By Michael Msika, Bloomberg markets Live reporter and strategist

Europe’s banking stocks are cheap and are supported by some of the strongest fundamentals since the global financial crisis, with elevated rates and solid capital buffers. But worries that it may not last long is spoiling the bull case.

Valuations and cash returns look appealing, balance sheets are robust and there are few threats to the earnings trend, according to Morgan Stanley strategist Graham Secker. That hasn’t stopped him from downgrading the sector this week to neutral in the view that lenders will struggle to outperform in the current environment. “Right place, wrong time,” he writes in a note.

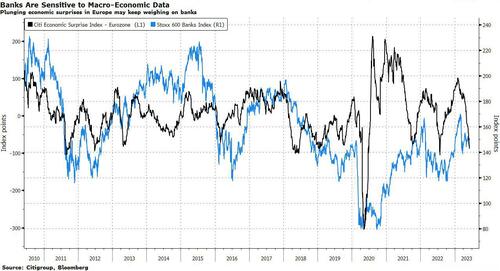

Secker says the best part of the macro cycle has now passed, and sees reasons to be cautious. He cites slowing economic growth, the coming end of the rate-hiking cycle and lower bond yields — a key factor in determining how much money banks make on lending.

While underperforming the broader market by just two percentage points this year, European banks have only recouped a third of the losses induced by the US banking crisis and the Credit Suisse collapse. The sector is down 12% since the end of February in a flat market.

Yet from a bottom-up view, the sector looks cheap. With a forward P/E of 6, it trades at a 50% discount to the broader Stoxx 600 and offers the highest dividend yield of all industry groups at 7.6%. It’s also the sector offering the most upside based on analysts’ price targets, with 32% returns expected over 12 months.

Still, analysts see headwinds building, including the risks brought by the lagged impact of higher rates plus the ongoing tightening of credit standards. Liberum analyst Nick Anderson points to weakness in US banks as regulators could raise capital requirements by 20%, while noting some lenders are offloading commercial real estate loans at a loss while returns on equity may be peaking as rising deposit costs squeeze net interest margins.

Meanwhile in Europe, there were some cautious comments from UniCredit‘s CEO saying rising deposit costs will start to erode NIM from the second quarter onward. The UK was said to consider a reform of the deposit system that could require larger fees from banks to fund it.

Some investors are keeping a positive view. “We still have a bit of a tilt toward European banks as we think the full impact of higher interest rates is yet to feed through,” says Helen Jewell, deputy CIO for BlackRock EMEA Fundamental Equities. She acknowledges the need to be selective given recent banking sector volatility.

Investors are unlikely to gain more confidence until regulators release industry-wide stress tests at the end of July, according to Christophe Boucher, CIO at ABN AMRO Investment Solutions.

“I would rather be cautious,” Boucher says in interview. He notes that while most banks do well amid higher borrowing costs, the proportion of lenders struggling to maintain comfortable capital buffers in the stress tests will be closely monitored.

Tyler Durden

Wed, 06/07/2023 – 13:20

via ZeroHedge News https://ift.tt/poLOiVa Tyler Durden