Near-Term Inflation Expectations Tumble To 2-Year Low As Economic Outlook Worsens: NY Fed

If Powell was on the fence about a Fed “hawkish skip” or whatever the June pause is now called, the latest monthly data just released by the NY Fed Consumer Survey should help allay his fears.

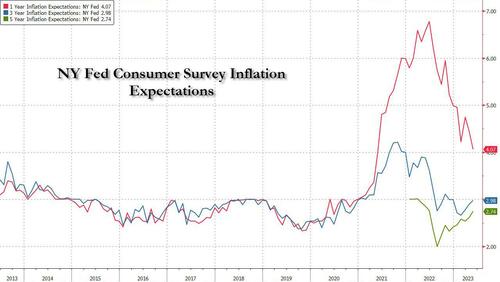

According to the NY Fed, near-term inflation expectations – those for the one-year horizon, and which traditionally just follow the latest move in the price of gasoline – dropped again to 4.07% in May from the previous month’s 4.45%, the lowest reading since May 2021; This drop, however, was offset by a modest increase in inflation expectations at both the three-year-ahead horizon (which rose to 2.98% from 2.89%) and five years (which rose to 2.72% from 2.64%).

The drop in inflation expectations was perhaps driven by growing nervousness about consumer finances: expectations for what earnings growth will be one year from now fell for the first time in five months, sliding to 2.8% from 3.0%. The drop was larger among respondents who had only a high school education, although judging by the market’s chatGPT euphoria, it is those who have a highly overpriced college degree that are most at risk.

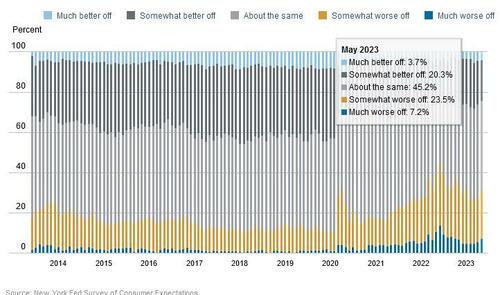

Confirming the deteriorating outlook, a larger share of households said their finances were worse now than a year ago. The outlook for the future also deteriorated, with fewer respondents saying they expect to be better off a year from now, while those expecting to be “somewhat” or “much worse off” jumped to 23.% and 7.2% (from 22.2% and 5.5%, respectively).

It will also come as no surprise that more consumers said it was harder to access credit now compared to a year ago. At the same time, more households said they expect to see tighter credit conditions in one year.

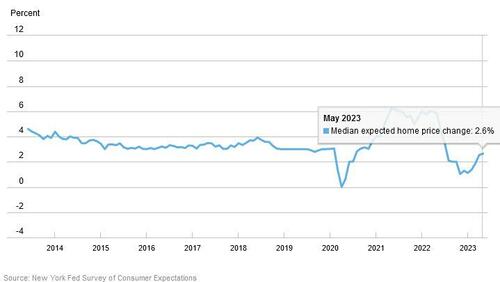

On the other end, median home price growth expectations increased to 2.64% from 2.52%, the highest reading since July 2022 despite mortgage rates that are again back around 7%; not surprisingly, the increase was most pronounced among respondents with household income above $100k: after all, they are the only ones who can afford a house.

Respondents were also cheerful on the jobs front: the perceived probability of job loss in the next year fell to 10.9%, the lowest since April 2022 and close the lowest level on record in data stretching back to 2013. Households also said they expected it would be easier to find a new job if they lost their current position.

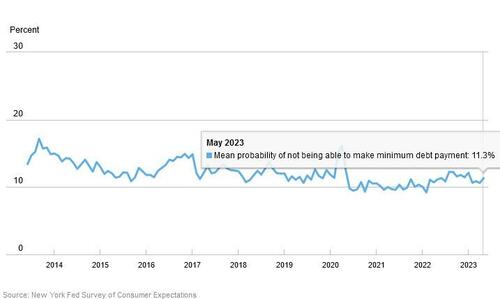

Optimism was more muted when it comes to one-year-ahead expected earnings where the median expected growth fell to 2.8% from 2.96%. Linked to that, a larger percentage of consumers, 11.32% vs 10.60% in prior month, expect to not be able to make minimum debt payment over the next three months.

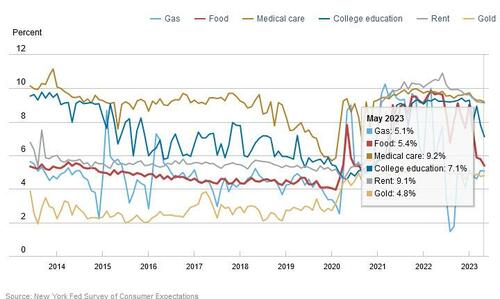

Separately, over the next year consumers expect gasoline prices to rise 5.07%; food prices to rise 5.39%; medical costs to rise 9.18%; the price of a college education to rise 7.12%; rent prices to rise 9.13%; most of the categories posted modest declines from the previous month.

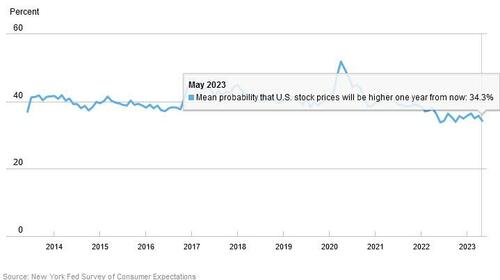

Finally, and perhaps a testament to a market that has gone nowhere in the past year, the percentage of respondents who expect a higher stock market one year from now is just shy of the lowest level in the past ten years.

Tyler Durden

Mon, 06/12/2023 – 11:30

via ZeroHedge News https://ift.tt/61mIdLo Tyler Durden