Amid Dismal Credit Data, China Reportedly Mulling “Broad Stimulus”… But Nobody Believes It Anymore

Just hours after the PBOC unexpectedly cut its 7-day reverse repo rates from 2% to 1.9%, the first such reduction in 10 months, and after we commented that by doing so “China Opens The Gates To More Easing“, China’s added to the monetary boost when its central bank lowered interest rates on the PBOC’s standing lending facility (SLF) by 10 basis points to 2.75 percent.

Larry Hu, head of China economics at Macquarie Group said the rate cut signals Beijing’s stance is turning more supportive, and various policy steps will be taken in the same direction.

“Policy is the only game changer” in the face of weak consumer and business confidence in the economy, Hu said. “The rate cut today sent a clear signal that policy would turn more supportive in the coming months, a significant shift from the tapering in stimulus since April.”

Of course, such modest monetary stimuli do little to stimulate the (formerly) world’s most populous country; and so, perhaps to underscore that Beijing is far behind the curve when it comes to boosting the economy in general, and demand in particular, Bloomberg reported that China is also considering a broad package of fiscal stimulus measures “as pressure builds on Xi Jinping’s government to boost the world’s second-largest economy.”

The stimulus proposals, drafted by multiple government agencies “include at least a dozen measures designed to support areas such as real estate and domestic demand” and also include more aggressive interest-rate reductions.

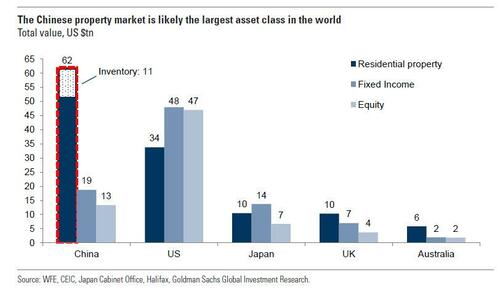

As reported previously, a key part of the proposed stimulus package involves supporting the Chinese real estate market, the world’s largest asset class.

Regulators are seeking to lower costs on outstanding residential mortgages and boost relending through the nation’s policy banks to ensure homes are delivered, one of the people said.

The plan has yet to be finalized and may be subject to change, the people added. The State Council may discuss the policies as soon as this Friday but it’s unclear when they will be announced or implemented, the people said. Further details on the scope of the proposed stimulus package weren’t immediately available.

And yet, for all the reports of “imminent” watershed stimulus, now punctuated by actual (tiny) rate cuts, China’s stimulus remains very much lacking as the latest Chinese credit data revealed. Indeed, the just reported May loan, Total Social Financing and M2 data all came in below expectations again after the disappointing credit data in April. This, according to Goldman (full report available to pro subscribers), likely contributed to the policy interest rate cut decision by the PBOC this morning.

Here are the details:

- New CNY loans: RMB 1.36 tn in May; missing consensus: RMB 1.55tn.

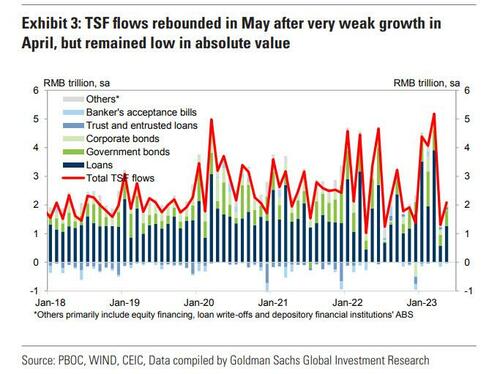

- Total social financing: RMB 1.56 tn in May, missing consensus: RMB1.9tn

- TSF stock growth: 9.5% yoy in May, vs. 10.0% in April.

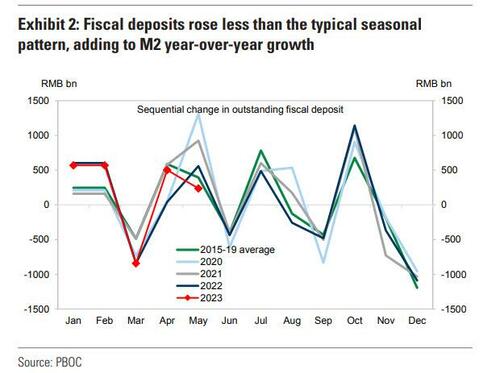

- M2: 11.6% yoy in May; missing consensus: 12.0% yoy; down from April: 12.4% yoy

RMB loan month-over-month annualized growth was 8.2% in May, higher than 6.6% in April. Considering the low base in April, the 8.2% month-over-month annualized growth of RMB loans was still quite sluggish. The composition of loan data suggests the deterioration of the property market dragged on credit growth, as household medium to long term loan growth was weak. Overall total social financing month-over-month annualized growth was 6.8%, slower than overall RMB loans due to lower corporate bond issuance. M2 growth slowed to 11.6% yoy in May from 12.4% in April. Fiscal deposits rose by RMB 237bn in May, smaller than the RMB 503bn increase in May 2022, which added to M2 growth, suggesting faster pace of government spending in May.

Looking at the data, Goldman said that it expects more monetary policy easing measures to be announced, including MLF rate and LPR cuts over the next few days, and another RRR cut in Q3 to facilitate activity growth.

Others are more skeptical: in fact, as Bloomberg reports, the lack of confidence is so entrenched among China’s equity investors that government efforts to boost growth are repeatedly met by calls for Beijing to do more.

To wit, the modest PBOC rate cut drew little enthusiasm from equity traders, with volumes about 25% lower than recent averages. Even the subsequent news that China is considering a broad package of stimulus measures only boosted the CSI 300 Index by half a percentage point. It’s been languishing in a bear market for close to one and a half years.

It’s no secret that this was supposed to be the year to buy Chinese stocks as investors counted on Beijing to supercharge the economy and revive the property market after years of deleveraging and Covid restrictions. Such certainty has instead been replaced by weak sentiment that’s proving particularly hard to reverse, making light of government efforts to boost growth and wrong-footing Wall Street’s China stock bulls for a second year.

“Domestic sentiment is very weak,” Carlos Casanova, senior Asia economist at Union Bancaire Privee, told Bloomberg. “China needs to create a situation where producer prices recover, the equity market takes off and people stop panicking over LGFV credit risks,” as he referred to local government financing vehicles.

Unfortunately, for that to happen, Xi Jinping – whose consolidated debt of 300% is higher than the US – must be willing to accept that its debt is about to explode to new record highs.

Even back in 2022, when China’s strictest Covid measures paralyzed large swathes of the economy, stimulus promises were enough to excite traders and briefly helped reverse a rout in March. Consumers now see few signs record youth unemployment and the longest-ever downturn in the housing market will end any time soon. A sense of lost animal spirits risks becoming a self-fulfilling prophecy, with some fearing that China is undergoing a Japan-like “balance-sheet recession.”

Overnight, an index of developers’ shares barely rose following news that multiple government agencies are drafting further stimulus proposals with a focus on reviving the property market. An earlier cut to the seven-day reverse repo rate, which will make it cheaper for banks to borrow from each other, increases the likelihood Chinese lenders will reduce the cost of loans that underpin mortgages.

The market reaction underscores the difficult Chinese authorities have been facing as they struggle to revive investor and economic confidence after President Xi Jinping scrapped Covid Zero at the end of last year and unleashed a string of market-friendly reversals for beleaguered sectors like property. The CSI 300 Index and the Hang Seng gauge of Chinese shares remain down for the year, underperforming the markets in Japan, South Korea and Taiwan by a wide margin.

The ball is now in Beijing’s court, where anything less than a “big bank” stimulus will lead to even more disappointment, similar to how OPEC is losing the speculator war for now.

According to Bloomberg’s Sogia Horta e Costa, more stimulus could come as soon as this week, with the central bank set to decide on its one-year policy rate on Thursday — the same day May data on industrial production and retail sales are due (and is expected to be another major disappointment). Additional support measures would be welcome, market watchers (i.e., disgruntled China bulls) said, as would a more proactive approach from Beijing.

“It’s the signaling that’s most important,” Altaf Kassam, head of investment strategy & research EMEA at State Street Global Advisors, told Bloomberg TV. “China has the capacity to offer stimulus. It’s in a different place to developed markets and inflation is under control. It’s got a lot of dry powder.”

Dry powder which it has so far refused to use.

Tyler Durden

Tue, 06/13/2023 – 11:40

via ZeroHedge News https://ift.tt/HeyD2EC Tyler Durden