As Panama Canal Hit With Draft Restrictions, Goldman Says Shippers Have Three Options

Panama Canal officials have enforced a vessel draft restriction because of a severe water crisis. We noted in a piece weeks ago titled “Panama Canal Hit By Shipping Restrictions As Water Crisis Set To Worsen” that some of the largest vessels in the world had to comply with new restrictions.

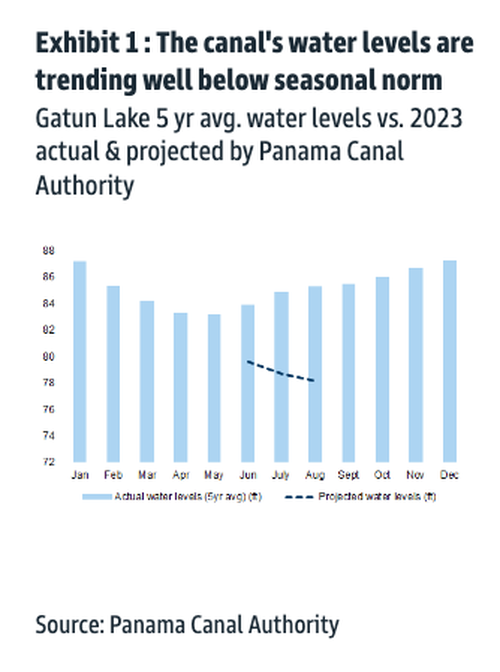

Goldman’s Patrick Creuset told clients Monday morning that water levels on the Panama Canal are 5% below the five-year average, with forecasts by the Panama Canal Authority that point to a drop of 8% by August.

Creuset said the average draft needed for the largest neo-Panamax vessels to sail the canal is 50 feet or 15.2 meters. But since the end of May, draft restrictions have been enforced for vessels to maintain 44.5 feet or 13.6 meters, which will likely be reduced to 43.5 feet or 13.3 meters in the coming weeks.

“This would mean that the largest neo-Panamax vessels that hold c.14,000 TEU [Twenty-foot equivalent unit] may need to cross nearly half-empty,” Creuset continued. As a result, this would reduce cargo for some of the world’s largest containerships traversing major shipping lines, such as those between Asia and the US Gulf Coast and US East Coast.

Unprecedented drought in Panama Canal forcing some ships to offload 40% of their cargo.

Yet another #supplychain risk likely causing firms to keep considering reshoring. pic.twitter.com/lGiZtGdr79

— Yuri Khodjamirian, CFA (@YuriKhodjam) June 12, 2023

Unlike corporate media, Creuset points to El Nino as the reason for drought conditions across Panama, which links the Atlantic and Pacific oceans.

The Goldman analyst said, “The main tradelane that would be affected is the Asia-US East Coast trade, accounting for about half of the cargo capacity crossing the canal.” He added, “Other trades, such as USEC (US East Coast) to LatAm West Coast (2nd largest trade) or LatAm intercoastal, appear less likely to be affected, given the generally smaller vessel sizes deployed.”

There are three options to deal with the draft restrictions. He laid out the following:

- The first option is to continue to use the Panama Canal and deploy more ships for the same amount of cargo, while optimizing cargo mix (heavier boxes onto smaller vessels).

- The second would be to reroute via Suez on even larger vessels (=lower unit costs), however adding c.15% to the voyage time, e.g. from China to the USEC.

- The third option is to go through US West Coast ports & intermodal.

However, Creuset pointed out, “This last option, however, looks less certain, given the uncertainty around current labour tensions on the USWC. We therefore see a combination of options 1 and 2 as the most likely.”

The average vessel size crossing the canal in 2022 was around 7,000 TEU. Current draft restrictions wouldn’t affect these vessels, though much larger vessels (>9,000 TEU) sailing from Asia to US East Coast would be impacted.

“These types of vessels would need to load at least 20% less cargo than normal to comply with the new draft restrictions, and up to 40-50% less for the largest vessels, we estimate,” Creuset said.

About 7% of all global container trade crosses the canal. “If the majority of vessels currently transiting had to load between 20-40% less than normal, this could potentially absorb around 2% of world container shipping capacity. Some of this we believe could be cushioned by a shift of services through Suez, where the added voyage distance can be largely offset by the lower unit cost of using of larger vessels,” the analyst noted.

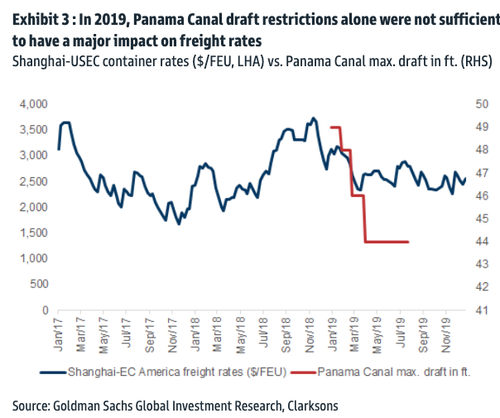

Creuset said canal draft restrictions fell to 44 feet in the summer of 2019 without causing major supply chain disruptions.

But with El Nino impacts underway, what disruptions could be sparked later this summer remains to be seen.

And the good news:

Overall, we believe temporary draft restrictions on the Panama Canal alone would not be sufficient to materially alter the supply-demand balance in shipping.

But he notes supply chain disruptions could emerge if this happens:

We think it would likely take a confluence of shocks to create renewed, material supply chain stress. For example, prolonged draft restrictions on the Panama Canal coupled with extensive labour disruption in USWC ports amid a strengthening of consumer & import demand in 2H could be enough to tighten shipping capacity on a regional basis. This could lead to temporarily higher rates on the Pacific and perhaps some long-haul LatAm trades.

Keep an eye on the Panama Canal’s situation this summer, as well as any potential supply chain disruptions resulting from additional draft restrictions.

More in the full note available to pro subs.

Tyler Durden

Mon, 06/12/2023 – 19:20

via ZeroHedge News https://ift.tt/CmZ8QuI Tyler Durden