“Not Enough For A June Hike”: Wall Street Reacts To Today’s CPI Report

The inflation crisis is now behind us.

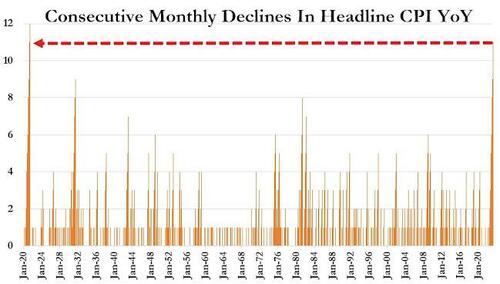

That was the (initial) response from the market to today’s cooling inflation report, where annual inflation declined for an 11th straight month (thank you base effect) …

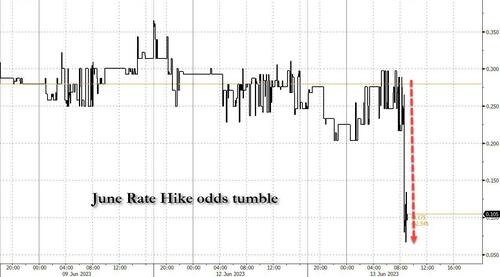

… and which still saw core CPI rise 0.4% which annualizes to around 5%, yet which was enough to convince traders that there will be no rate hike tomorrow (odds collapsed from 25% to below 10%), and odds of a July hike also dropped sharply from 90% to below 70%.

And while it is distinctly possible that the initial euphoria may fizzle after Timiraos gets his marching orders and publishes his pre-CPI guidance…

Headline CPI for May 2023

3-month annualized rate: +2.2%

6-month annualized rate: +3.2%

12-month change: +4.0%Headline CPI for May 2022

3-month annualized rate: +9.7%

6-month annualized rate: +9.2%

12-month change: +8.6% https://t.co/1shBCddjNH pic.twitter.com/y8z2qjnvAq— Nick Timiraos (@NickTimiraos) June 13, 2023

… here is the early reaction from several strategists and economists:

Anna Wong, Bloomberg chief US Economist

“May’s CPI likely won’t alter the FOMC’s inclination to temporarily pause its rate-hike campaign at the June 13-14 meeting. Details of the CPI print show the sort of progress on disinflation the Fed wants to see: Housing rents – expected to drive disinflation over the rest of the year — continue to edge down. The sturdy reading for core goods was driven mainly by used cars, while prices of new cars and a broad set of other goods saw moderating inflation.”

Ben Jeffery, rates strategist at BMO

“Not a strong enough read to warrant the Fed deviating from its telegraphed intention to skip tomorrow’s meeting, and the knee-jerk bull steepening represents a relief move now that the event risk is passed.”

Omair Sharif, founder of Inflation Insights:

“Quick take here is that this is a pretty good print in terms of signaling that we are likely to see the core CPI soften materially starting next month and through September. If you’re the Fed, you’ll want to look through this 0.44% rise in the core (just below my 0.46% forecast) because it looks likely to moderate sharply next month. Additionally, the piece they were most worried about, core services excluding housing, was just 11bps in April and now is only 24bps in May. The way things are going now, I suspect we’ll see a soft core that will tamp down odds of a July hike.”

Ed Al-Hussainy at Columbia Threadneedle

“I am note seeing a lot of significant progress in non-energy services or OER, but the bond market was a bit short into this meeting and the knee-jerk reaction is a relief rally in rates. The story for the Fed: The underlying thesis playing out is that there is not much in this data to compel them to hike tomorrow.”

Rubeela Farooqi, chief US economist at High Frequency Economics:

“The annual changes in overall, core and core services ex-shelter CPI remained elevated but showed improvement. In terms of tomorrow’s rate decision, these data are not likely to change expectations….Based on our current assessment of inflation and the labor market, we think the FOMC is likely to maintain rates at the current level, at least through year-end.”

Guy LeBas, at Janney Montgomery Scott

“The inflation crisis is over, so I’d expect markets to be less sensitive to small differences in CPI relative to expectations — and this one was very small. Moreover, other measures of inflation, including the ‘core services ex-shelter’ that Fed officials have focused on, were on the low side.”

Meanwhile, Academy’s Peter Tchir, takes the other side of the market’s dovish reaction:

“Bonds seem happy with headline dropping to 4% annual rate, but monthly at 0.4% for ex food and energy isn’t great (3rd month in a row, so staying close to 5% annualized on any run rate) and came in 5.3%. Seasonal adjustments should have played a big role on headline as “normally” gas prices go up into summer driving season and we haven’t seen that. Plus the shelter inflation – shelter is somewhat tame, but reflects price action from last year not current trends where sites like Zillow show rents going higher again. I’d fade the rally in treasuries on back of this number.”

Tyler Durden

Tue, 06/13/2023 – 09:30

via ZeroHedge News https://ift.tt/1dkW2Gc Tyler Durden