Rate-Hike Odds Plunge After CPI; Stocks & Bonds Jump As Dollar Dumps

A mixed bag from CPI if we are completely honest with a little for everybody – headline down but core still super-high; goods prices reaccelerating; and SuperCore accelerating – but overall, the market is seeing doves fly.

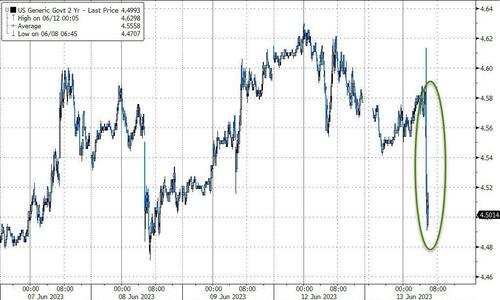

Rate-hike odds tumbled for July (and June is now almost guaranteed a pause)…

Source: Bloomberg

Stocks jumped, led by the manic Nasdaq of course (though the move is less than expected)…

Treasury yields are down across the curve with the short-0end outperforming…

Academy Securities’ Peter Tchir had a quick take:

Bonds seem happy with headline dropping to 4% annual rate, but monthly at 0.4% for ex food and energy isn’t great (3rd month in a row, so staying close to 5% annualized on any run rate) and came in 5.3%.

Seasonal adjustments should have played a big role on headline as “normally” gas prices go up into summer driving season and we haven’t seen that.

Plus the shelter inflation – shelter is somewhat tame, but reflects price action from last year not current trends where sites like Zillow show rents going higher again.

I’d fade the rally in treasuries on back of this number.

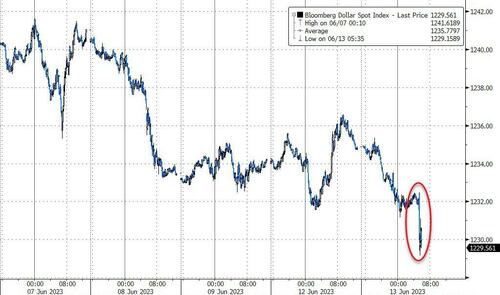

The dollar is down on the dovish print…

Gold and crypto both dropped on the headline print, but quickly reversed those losses. Oil is extending gains with WTI back above $69…

For now, it’s stocks that love this the most… as always, but 0-DTE traders are fading the gains…

Do you feel lucky into tomorrow’s ‘hawkish pause’?

Tyler Durden

Tue, 06/13/2023 – 09:04

via ZeroHedge News https://ift.tt/0pVKYPc Tyler Durden