If This Is A Stock Bear Market Rally, It’s An Unprecedented One

Authored by Simon White, Bloomberg macro strategist,

The likelihood stocks are in a bear-market rally is receding as the current upturn exceeds historical precedents.

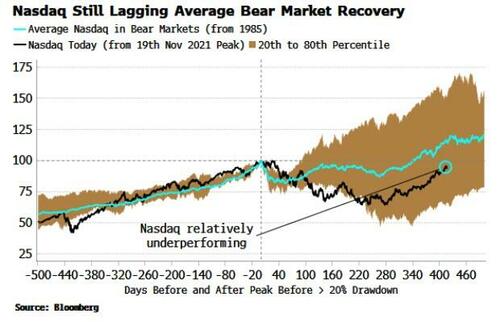

I posted a chart on Wednesday showing that the Nasdaq’s net move from the high reached in November 2021 at the start of the bear market is – despite the hype over the current rally – historically unremarkable.

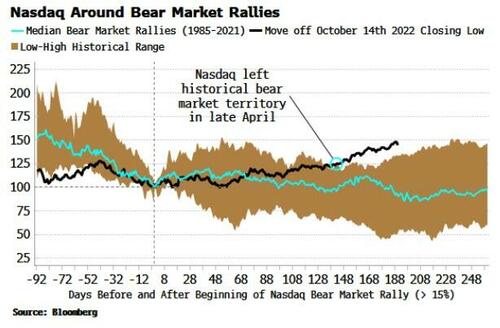

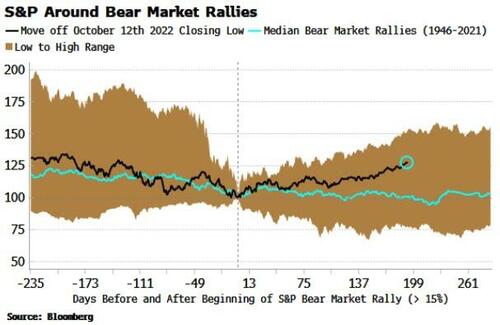

But if the current move off the recent low (reached in October) is a bear-market rally, how would it look versus previous similar episodes?

In this case, the current rally has already exceeded all historical analogs.

As the chart above shows, the Nasdaq rose above the low-to-high historical range, as reflected in the brown region, in late April and has carried on steadily rising.

If this is a bear-market rally for the Nasdaq, it has no historical precedent (using the definition here that we are in a bear market until the old highs are breached).

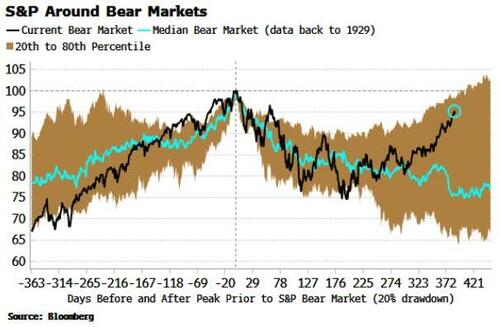

The S&P’s net move from the highs is more impressive than the Nasdaq’s (with the proviso that the data history is longer for the S&P). The S&P is currently well above its historical median, unlike the Nasdaq.

But, despite being within 6% of its highs, the S&P is still in historical bear-market territory.

It could of course fail and significantly correct before new highs are reached, and so could the Nasdaq, which is even closer to its all-time high (the Nasdaq hit some resistance on Thursday, dropping 2.3%).

However, that does not look too likely at the moment.

Although both indexes are short-term overbought, and sentiment is on the contrarian over-bullish side, the broader picture from long-term technicals, excess liquidity, and a less negative economic backdrop is constructive.

Tyler Durden

Fri, 07/21/2023 – 13:05

via ZeroHedge News https://ift.tt/sqtHUYN Tyler Durden