BOJ Policy Shift Intensifies Existing Yen Tailwinds

Authored by Simon White, Bloomberg macro strategist,

The BOJ’s policy adjustment adds to tailwinds for the yen.

The BOJ unexpectedly changed the upper limit of its 10y rate so that 0.5% is now a reference point, not a ceiling, and up to 1% will be tolerated. 10y JGB yields are about 11 bps higher, at 56 bps, on the announcement. USDJPY has whipsawed around and is currently about ~0.7% lower than Wednesday’s close, but the central bank’s actions only intensify sizable tailwinds.

The BOJ hasn’t lost its capacity to surprise. Perhaps officials became unnerved by the fact that CPI – just released today and higher than expected – is showing signs of becoming persistent; or that the real policy rate is near 45-year lows; or perhaps that its balance sheet is the largest in the world after huge JGB purchases to defend the yield cap. Whatever the reason, tightening has begun.

The change should provide more support for the yen, but capital flows and structural undervaluation in the currency are already pointing that way.

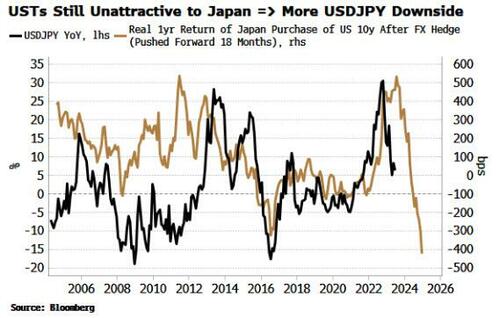

Japan is one of the largest buyers of US Treasuries, and this typically dictates the prevailing trend of USD/JPY. But as the US curve has inverted, it has become progressively less attractive for Japan-based investors to buy USTs and hedge the currency.

It’s even less alluring when we factor in inflation. The sharp decline in the real net cost of buying USTs points to lower demand for dollars from Japan, and thus a weaker USDJPY.

10y USTs are up about 10 bps since yesterday, but 10y JGBs are up a similar amount, so the relative (un)attractiveness of USTs has not so far changed.

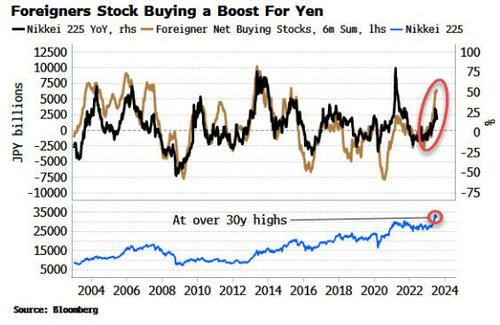

Falling UST demand from Japanese investors comes at the same time as a renewed verve for Japanese stocks from foreign buyers. Japan has long been a favored investment destination of mine due to the rise in global inflation.

Equity inflows began to pick up sharply in the past few months, taking the Nikkei to 30+ year highs. Such inflows tend to be unhedged, boosting the yen.

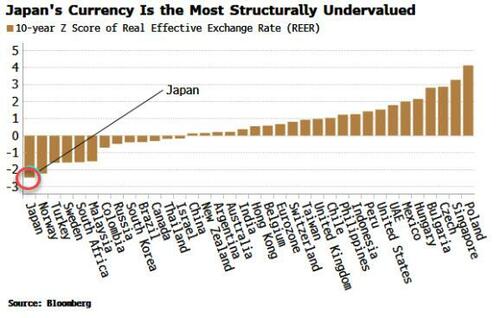

On top of that, the yen remains one of the world’s structurally weakest currencies.

The chart above shows Japan’s REER (real effective exchange rate) is the farthest below its long-term mean of all major EM and DM countries.

Tyler Durden

Fri, 07/28/2023 – 11:30

via ZeroHedge News https://ift.tt/GKNklow Tyler Durden