Inflation Is Dead… Long Live Inflation

Submitted by Sebastian Bea of One River Asset Management

60 years. That’s the median age of FOMC members. It puts their prime college learning years from 1983 to 1988, a period of exciting change in economics. Policy was attentive to taming inflation and shrinking the role of the government. Academicians calibrated how to keep future policy from cheating once price stability was achieved. And the world settled on inflation targeting, with New Zealand the first responder.

“It was a bit of a shock to everyone, I think,” offered Roger Douglas, New Zealand’s finance minister in the late 1980s. “I just announced it was gonna be 2%, and it sort of stuck.” Global monetary policy can credit its current north star to “Rogernomics” – 2% became the global norm, agreeing with the direction of the wind. It was low enough to make inflation irrelevant and high enough to give policy a margin of error, greasing the wheels of an economy.

But inflation targeting failed to achieve its objective. And for predictable reasons.

“When a measure becomes a target, it ceases to be a good measure,” Charles Goodhart quipped in 1975 at a time when statistical techniques were on the rise. Models that looked useful when fitted to the past would become useless once policy used them, as everyone would anticipate their effects. And despite the vintage of policymakers learned in this era of thought, the lessons were brushed aside. The consequences cannot be. The amplitudes of financial asset prices have never been greater than in the era of “price stability.”

And so, the pattern continues. Today, the global goods sector is in a deep recession. Industrial powerhouses of Europe’s north have become the weakest links in the global economy. Downward pressure on inflation from these sources is welcomed in overheated economies, like the US where nominal GDP is 14% above its 2010-2020 trend. One-year US inflation swaps have collapsed to 2%, a Pavlovian green light to be long growth equities. Only, that’s not really the story.

Last year was a deflationary board, not an inflationary one. Yes, global CPI inflation rocketed to 9%, the highest in nearly two decades. But from any other vantage point, 2022 was deflationary. The US dollar rose. Equities evaporated. Bonds busted. Crypto cratered. Commodities collapsed. These are not outcomes of a world seeking inflation protection. There was a strongly held belief that inflation would be contained by rate hikes. And we got a lot of them. Cash was king.

Now, the board is inflationary in the face of declining consumer price growth. Weak growth and low inflation in China open the door for aggressive easing, executing targeted stimulus to boost the consumer. Inflationary. Global equity gains are multiple expansion, discounting higher nominal GDP. Also, inflationary. Financial markets are internalizing the other lesson of the 1970s – monetary policy can’t do it alone in taming inflation, a fiscal anchor is needed. It isn’t there.

Growth assets are leading performers this year with all eyes on scalable virtual worlds. Artificial intelligence. The Metaverse. Virtual currencies. Investors are enamored by scale. And like macro models, the past 20 years of scaling solutions are not the right guide to the future. Scaling the new generation of technologies will require enormous resources at a time when they are in sparse supply. A commodity supercycle will focus investors back to the need for physical investment.

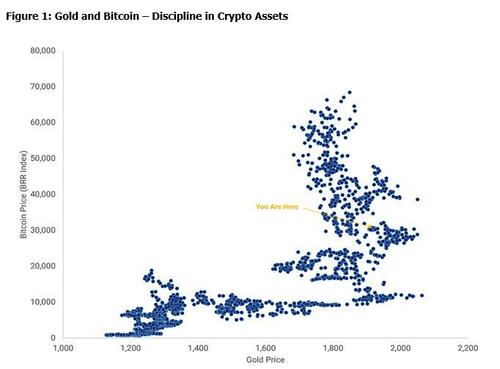

Signs are already there. Despite higher-for-longer policy rates, inflation commodities are firming. Gold is approaching cycle highs. Its correlation to bitcoin has averaged 65% this year (Bloomberg, CBAM calculations). The levels look nothing alike – bitcoin is still 57% from all-time highs. But there are two distinct patterns in the relationship between gold and bitcoin. One where bitcoin follows gold in a low-beta manner, and the other where digital gold surges in the phase of speculative excess (Figure 1).

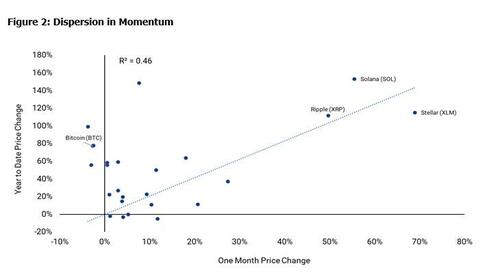

We have yet to see the unabashed speculative excess that derailed past cycles – crypto-asset markets are avoiding past mistakes. It’s a disciplined rally. Digital Financial Conditions are tight. Capital is available, but only for those with strong projects anchored to conservative planning. Even where momentum and speculation show signs of building, it is localized. Figure 2 makes the point with a scatter of one-month price changes against the year-to-date.

The upward-sloping line is indicative of momentum. Those winning for the month are now winning for the year. Narrow momentum is the story of July, a bet on previously lagging assets racing ahead, like Stellar, Ripple, and Solana. This cycle’s early movers, dominated by Bitcoin and Ethereum, delivered mostly nothing in July despite an inflationary board in traditional markets. The gift of nothing is welcomed. Durable trends are built on discipline. It’s the prevailing theme in crypto-asset markets.

Tyler Durden

Sun, 07/30/2023 – 17:30

via ZeroHedge News https://ift.tt/Unxf1uI Tyler Durden