Oil Soars In July As Massive Short-Squeeze Sends Stocks Up For 5th Month In A Row

While the Chinese manufacturing economy continued its contraction overnight, July saw the 3rd straight month of upside economic data surprises in the US – now at its most positive since March 2021 – crushing talk of ‘any’-landing at all…

Source: Bloomberg

Interesting, despite the surprising macro picture, rate-change expectations for the rest of the year were little changed MoM (albeit with a big dovish drop early on followed by a hawkish shift back to high-for-long by the end of the month)…

Source: Bloomberg

That ‘good’ news lifted stocks – all of them – on the month, with Dow Transports leading the month (along with Small Caps) and the S&P and Dow Industrials lagging (but still up 3% on the month). That’s the 5th straight month of gains in a row – the longest win streak since Aug 2020 …

Source: Bloomberg

The last couple of minutes of the month saw a mini-melt-up in stocks…

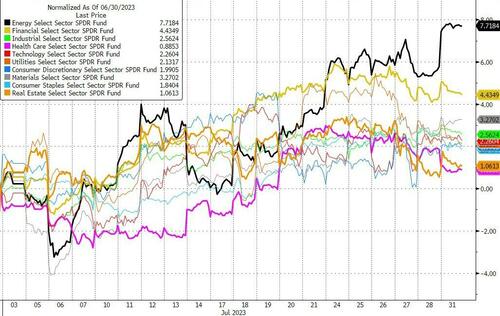

Energy stocks outperformed on the month (along with financials?) while Defensives (Healthcare and Real Estate) lagged…

Source: Bloomberg

Cyclicals only marginally outperformed Defensives on the month…

Source: Bloomberg

The gains were supported by another huge squeeze. ‘Most Shorted’ stocks accelerated higher in July by the most since Jan (the 3rd straight month of squeeze/covering – the biggest 3 month rally since March 2021)

Source: Bloomberg

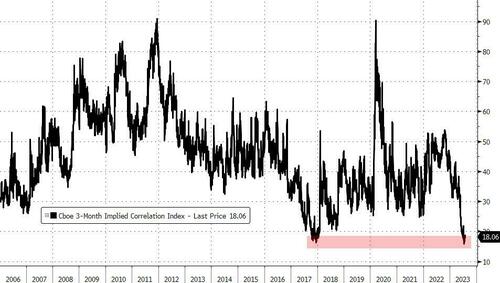

The implied correlation embedded within S&P 500 options crashed to a record low in July (i.e. the index-level risk plunged relative to that of the idiosyncratic risk of all the components as traders sold index vol relative to single-stocks like there was no tomorrow)…

Source: Bloomberg

VIX went basically nowhere in July as stocks soared…

Source: Bloomberg

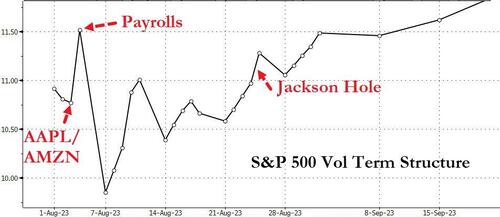

But this week could be fun…

Source: Bloomberg

Bonds were mixed in July with the short-end outperforming (2Y -7bps, 30Y +15bps)…

Source: Bloomberg

The 10Y yield tried (and failed) twice during the month to break above 4.00%…

Source: Bloomberg

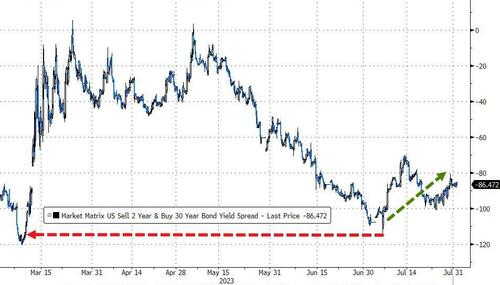

Which meant the yield curve (2s30s) steepened significantly on the month – but only after it flattened to its most-inverted since SVB’s collapse…

Source: Bloomberg

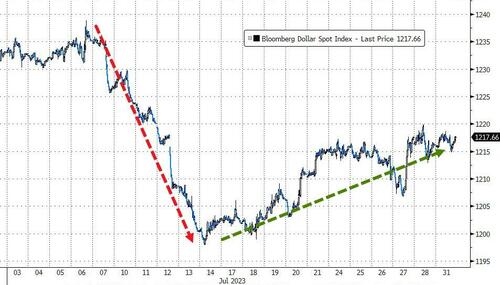

The dollar fell for the second straight month in July, but bounced back from an ugly intra-month low

Source: Bloomberg

Cryptos were very mixed on the month with BTC and ETH down around 4%, Solana and Ripple ripping higher and Litecoin flailing…

Source: Bloomberg

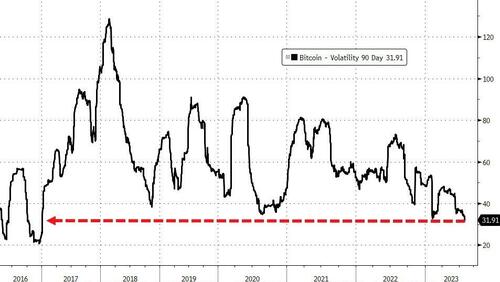

Perhaps most notably, Bitcoin volatility dropped to its lowest since 2016…

Source: Bloomberg

July was Oil’s best month since Jan 2022, with WTI hitting $82, back above pre-OPEC-Cut levels from March/April…

Gold rallied in July – up around 3% for its best month since March with futures back above $2000…

Finally, as Goldman sums up the strong market performance ahead of the recent positive economic data as “Uncomfortably Long”. Because the market has already taken meaningful credit for better growth and inflation news, the road ahead could be a little bumpier than in the last few weeks. US equities are the poster child for the tension between macro news and valuation.

Source: Bloomberg

Stocks do not look cheap, but there is little doubt that the macro news – higher growth, lower inflation – is a more equity-friendly mix than was expected. BUT For now, credit markets ain’t buying it…

Source: Bloomberg

With Thursday and Friday being VERY event-risk-heavy, catalysts for some tactical pull-back to reality in stocks are high.

Tyler Durden

Mon, 07/31/2023 – 16:00

via ZeroHedge News https://ift.tt/OlPGwnJ Tyler Durden