Stocks’ Gains Should Not Be Mistaken For Confidence That There’s No Recession Imminent

Authored by Mark Cudmore, Bloomberg macro strategist,

A surging S&P 500 index makes sense based on recent data, but such gains should not be mistaken for confidence that there’s no recession on the horizon.

The empirical evidence suggests the stock market is a poor leading indicator for the economy. This is contrary to the oft-repeated cliche that it is forward-looking; a mistaken assertion that also gets used to cite stock-market gains as confirmation that the economic outlook is positive in a flawed self-reinforcing spiral.

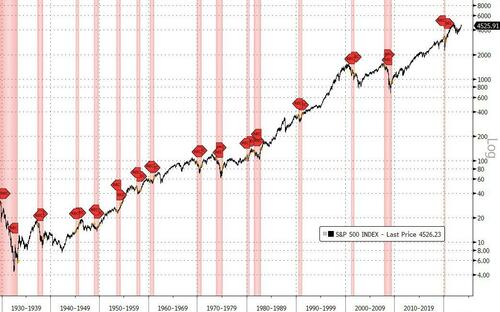

The S&P 500 US equity benchmark data on the terminal goes back more than 95 years (to when it was a 90-stock index produced by the Standard Statistics Company). There have been 15 recessions over that period. The stock market only peaked out beforehand on 10 of the 15 occasions, for a median lead time of two months (average of 3 months). It twice peaked in the same month, twice after the recession started, and, in the 1945 post-WWII recession, rallied all the way through it.

It was only in 1957 that the index was actually expanded to 500 members. Since then, the hit ratio is 7 out 10, with a median lead-time of 2.5 months, and average of 4.8 months. Let’s take out the pandemic recession as being unique (but aren’t they always unique?!) to improve our hit ratio to 7 out of 9, with a median lead-time of 3 months, and 5.3 month average.

So, even with selective data-mining/trimming, we find the stock market is a low-conviction (not statistically significant) lead indicator by three months (with large variability).

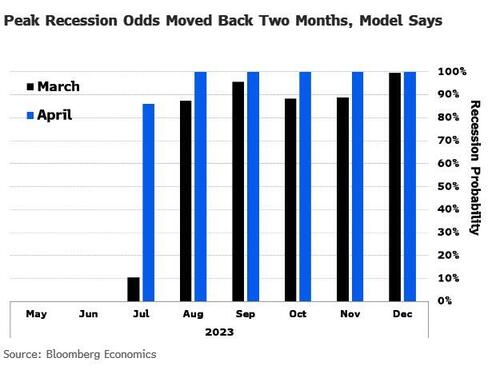

That’s relevant, given Bloomberg Economics is now validating my call for a US recession beginning in 4Q, which would imply the most likely time for the S&P 500 to peak out is between July and September (July 31 providing this cycle’s peak so far).

That clashes harshly with the soft-landing narrative that has become entrenched in markets, but even this exact economic complacency has dangerous precedent, as Bloomberg’s Chief US Economist Anna Wong highlights.

In October 2007, the FOMC was opining on the economy’s resilience amid an overall soft-landing narrative. It was that same month that the S&P 500 topped out, with the Great Recession starting just two months later. And the trite repetition that this would be the most-forecast recession in US history is the flip side of registering that every prior economic downturn has been underestimated.

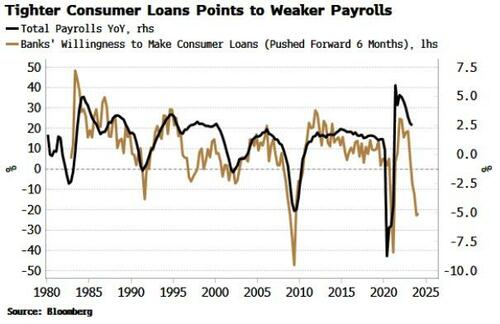

On Monday, we had an update on one of the most reliable predictors of US recessions — the Senior Loan Officer Opinion Survey (SLOOS) — and it was another strong indicator of a downturn likely beginning toward the end of the year.

On Wednesday, the Brookings Institution warned that aggressive consumption will soon come to a rapid halt as consumers run out of cash.

The dynamic will be compounded after the amnesty in student loan repayments ends this month.

That’s extremely relevant as it has been my conviction in the resilience of the consumer sector that has driven my economic optimism (beginning to turn!) and stocks bullishness.

We know from base effects that the US Misery Index will climb into year-end, after having declined significantly since last August.

That means that the macro environment for consumers will be deteriorating at the exact same time as personal finances capitulate: A painful coincidence not seen since the first couple of months of the pandemic.

Almost every major input – the consumer, SLOOS, ISM, the yield curve, policy-tightening that impacts with a lag – is pointing toward a US recession probably beginning in 4Q.

A rising stock market right now chimes perfectly with that, but we should start becoming alert to the equities end game.

An extra potential dynamic to be wary of is that recession starts are rarely acknowledged as consensus in real time. Officially, they are only declared in hindsight, with the National Bureau of Economic Research (NBER) never declaring the start date within less than four months. That increases the tail risk that the Federal Reserve’s economic projections and dots at its December meeting fuel complacent optimism from investors (and hence higher yields) just as the economy is beginning to crumble beneath the surface.

Oh, and yes, just in case you were wondering, equity investors should absolutely care if a recession is looming. Excluding the aforementioned 1945 exception, the average S&P 500 decline associated with the other 14 recessions has been 35%.

Tyler Durden

Fri, 08/04/2023 – 12:25

via ZeroHedge News https://ift.tt/lKe3p2M Tyler Durden