Argentina Devalues Peso, Hikes Rates After Libertarian Outsider’s Shock Win In Presidential Primary

The Argentine peso, already at historic lows, puked immediately after far-right political outsider Javier Milei won the country’s primary election on Sunday. He wants a dramatic overhaul of the country’s entire political and economic system, even vowing to ditch the peso.

Milei is a rock-singing libertarian outsider candidate, an admirer of Donald Trump and self-described anarcho-capitalist, and his primary win headed into the October general election is being widely viewed as punishment for Argentina’s two main political establishment blocs – the center-left Peronist coalition and the main Together for Change conservative opposition bloc.

After winning 30% of the vote, beating the main conservative opposition bloc (at 28%) and the ruling Peronist coalition which came in third place, it’s being hailed in Argentine media as a “political earthquake”.

The 52-year old Milei might also be called the Ron Paul of Argentine politics, given his willingness to controversially raze entire longstanding institutions, including pledges to abolish Argentina’s central bank. He has also talked about replacing the peso with the US dollar and privatizing state-run firms.

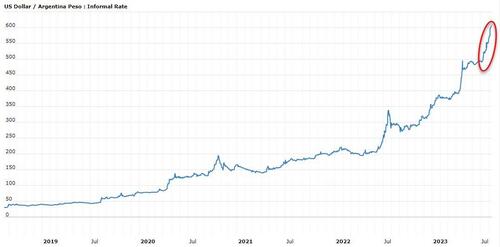

Multiple administrations have overseen a years-long spiral into a persisting economic crisis, with year-on-year inflation above 115%, and one in four people living in poverty. The peso has in recent months plummeted such that foreign soccer fans now regularly taunt locals at matches by burning and ripping up the Argentine currency.

Milei’s win, which is being taken as a clear sign of what lies in store for the Oct.22 election, is voters’ attempt to “shock” the system and try something new.

Javier Milei, argentinian presidential candidate, shows in an eccentric manner which ministries (like Health and Education) he would abolish if elected. pic.twitter.com/p8Bx3Jg4rX

— Crazy Ass Moments in LatAm Politics (@AssLatam) August 7, 2023

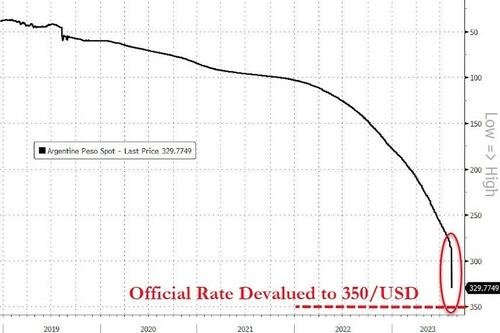

The peso’s plummet prompted the Argentine central bank to hike rates (to 118%!) and devalue the official peso rate to 350/USD in an effort to reassure markets and to prevent a broader selloff of assets from spreading. It hasn’t worked yet as the peso plunge continued and a US-traded Argentina ETF plunges most since March 2020.

Bloomberg reports Monday, the government’s moves is “a drastic policy shift as it runs out of funds to defend its currency.”

However, the official rate remains dramatically deocoupled from the reality of perceived value on the street, with the so-called ‘blue dolar’ trading at almost 600/USD…

His ultra anti-establishment views will continue to have ripple effects. Bloomberg Economics economist Adriana Dupita previews more of the uncertainty ahead based on the central bank’s latest actions:

If the past is any guide, a sharp peso depreciation would definitely add some inflationary pressure but not sufficient to tip the country into hyperinflation. We estimate that a 25% depreciation of the peso could add some 8 percentage points to the year-over-year CPI one year after it happens — on top of what inflation would be with the currency stable, in real terms. Most of the impact would happen in the first month after the currency shock.

That pressure is relevant but not sufficient per se to trigger an inflation spiral. The rise in interest rates announced by the BCRA helps mitigating the hyperinflation risk, but the problem is that the devaluation is happening in a moment when fiscal policy is lax and amid expectations of new rounds of depreciation — illustrated by the plunge in dollar blue, and fueled by the prospect of a dollarization in case Milei wins. That renders the impact of the devaluation on prices a lot more uncertain.

Milei had told supporters on Sunday that “we have managed to build this competitive alternative that will put an end to the parasitic, thieving, useless political caste.”

Good morning to a world in which a libertarian who says that he wants to burn down the central bank and considers it a crime for the government to print money is the top vote getter among #Argentina‘s presidential candidates.https://t.co/jO80vpkPF6

— Eric Martin (@EMPosts) August 14, 2023

Tyler Durden

Mon, 08/14/2023 – 11:00

via ZeroHedge News https://ift.tt/79YhuZy Tyler Durden