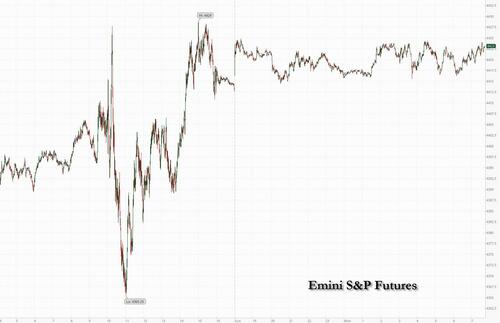

Futures Rise After Traders Digest Powell’s J-Hole Nothingburger, China Market Stimmy

US futures ticked up Monday in a muted session with the UK on holiday, after China unveiled a raft of modest stimulus measures meant to lift its equity market (it worked… for a few hours) and as the market looked set to build on gains made Friday on Powell’s cautious Jackson Hole comments on future interest rate moves. S&P futures climbed 0.2% while contracts on the Nasdaq 100 rose 0.3% by 7:42 a.m. ET; stocks also advanced in Europe and in China, where the government announced support for equity markets; however what was the biggest rally in 5 years quickly fizzled as a gain of over 5% in the CSI300 quickly faded to just 1%. Both the S&P 500 and Nasdaq are set for their first monthly decline since February amid concerns that the Fed could keep a hawkish policy outlook given the resilience of the US economy.

In premarket trading, 3M gained 4% after Bloomberg News reported it tentatively agreed to pay more than $5.5 billion to resolve lawsuits claiming it sold the US military defective combat earplugs. Hawaiian Electric surged as much as 43% in US premarket trading Monday, after subsidiary Hawaiian Electric released a statement on the fires, saying its power lines to Lahaina were not energized when an afternoon fire broke out on Aug. 8. Xpeng’s shares advance 4.5% after it agreed to buy Didi Global Inc.’s smart-car development arm in a deal that both eliminates a potential competitor in the crowded electric-vehicle market and gives it a tech-savvy partner in a new venture.

Chinese stocks listed in the US will be closely watched after Chinese authorities asked some mutual funds to avoid selling equities on a net basis a day after financial regulators announced a slew of measures to boost the local stock market.

In his Friday speech in Jackson Hole, Wyoming, Powell did not break new ground, and reiterated that the Fed will proceed “carefully,” leaving room for the Fed to hold rates steady at its next meeting in September without committing in either direction. He also signaled rates will stay high and could rise even further should the economy and inflation fail to cool.

Powell stuck to the script in his Jackson Hole speech, saying that the Fed is “prepared to raise rates further if appropriate,” even as he stressed that the central bank would “proceed carefully,” guided by economic data. Lagarde, likewise, said the ECB would set borrowing costs as high as needed to keep inflation in check but stopped short of signaling an increase at the next meeting.

“Not much was said that changed our outlook for US equities,” RBC Capital Markets strategist Lori Calvasina wrote in a note. “Equity investors have already been wrapping their heads around the idea that rates may be higher for longer, that it’s possible the Fed’s job may not be done just yet, and that they are data dependent. That message seemed reinforced Friday.”

Echoing what we said, John Stoltzfus, chief investment strategist at Oppenheimer, said that there were no real surprises from Powell’s comments on Friday, and despite some progress on the inflation front, uncertainty regarding the next monetary policy moves remains high.

“We remain positive on stocks at this juncture recognizing that some volatility and market chop are likely to be expected as the process of arresting inflation remains a work in progress,” he said, noting that “exiting a crisis or a period of high inflation are never easy nor overnight achievements”.

European stocks also rose on Monday as China’s stimulus to lift its equity market boosted risk sentiment, while investors considered the outlook for interest rates after cautious remarks from Federal Reserve Chair Jerome Powell. The Stoxx 600 Index was up 0.7% tracking a rally in Asian peers as China cut stamp duty on stock trades for the first time since 2008 and pledged to slow the pace of initial public offerings. Technology and construction stocks led the gains in Europe as all industry sub-indexes advanced. With UK markets closed for a bank holiday, trading volumes were two-thirds lower than the 30-day average for this time of day. Here are the most notable European movers:

- Deutsche Pfandbriefbank shares gain as much as 2% after Warburg initiated coverage of the German real estate lender with a buy recommendation, saying its outlook is promising amid rising rates in a “challenging environment”

- Valneva jumped as much as 6.9% in early trade after the French biotechnology company reported positive initial Phase 3 safety data in adolescents for its single-dose chikungunya virus vaccine candidate

- BW Offshore falls as much as 12%, the most since March 2022, after the Norwegian offshore vessel operator reported a disappointing 2Q, according to analysts, with the impact of cost inflation on its Barossa gas project the key negative

Ulrich Urbahn, head of multi-asset strategy and research at Berenberg, said that while the new stimulus measures from China should boost stocks in the short term, US labor market data this Friday will have a strong bearing on the market. “Central banks remain data-dependent, which makes the outlook more uncertain,” Urbahn said.

Trading could also be more volatile as, starting Monday, Deutsche Boerse AG’s Eurex will list Euro Stoxx 50 0DTE derivatives that expire every weekday, following US peers who introduced the now-booming contracts tied to the S&P 500 last year. Every trading session, investors in Europe will be able to buy and sell derivatives expiring the same day, known as zero-days-to-expiration contracts.

Earlier in the session, Asian markets rose after Beijing reduced the levy charged on stock trades, among other measures. Chinese stocks pared most of their early gains, however, showing once again that efforts to boost its markets are falling flat in the face of economic worries. The MSCI Asia Pacific Index advanced as much as 1.7%, on course for its best day this month, with Tencent and Alibaba among the biggest boosts. China’s key mainland stock gauge and a measure of Hong Kong-listed tech stocks each soared more than 5% in early trading before paring gains to almost nothing as foreign funds accelerated their selling through the day, poised to take this month’s outflows to the biggest on record.

“The China authorities are clearly stepping up efforts to rebuild confidence in Beijing’s policy commitment to achieve growth and support the market,” said Xiaojia Zhi, chief China economist at Credit Agricole. “But then a fundamental growth improvement as well as tangible policy action onshore is needed to really turn the mood around, and therefore more time could be needed.” China Evergrande Group slumped as much as 87% in Hong Kong trading

China was the main focus of attention after Beijing announced a series of steps to shore up investor confidence, including lowering a stamp duty on stock trades for the first time since 2008 and pledging to slow the pace of initial public offerings. Some brokerage and property stocks rose by their daily limits on the government’s efforts.

- Japan’s Nikkei 225 was supported by its energy sector, with the index eventually surging above the 32k mark seeing some early resistance around the level.

- ASX 200 was supported by the energy and gold sectors whilst the broader mining sector was subdued by Fortescue Metals Group, which missed on net expectations and reported an impairment charge.

- Stocks in India advanced on Monday, tracking gains in most regional peers. The small-sized companies’ gauge extended yearly gains to more than 25%, helped by a rally in capital goods and industrial stocks. The S&P BSE Sensex rose 0.2% to 64,996.60 in Mumbai, while the NSE Nifty 50 Index advanced by a similar measure. S&P BSE Smallcap Index rose 0.6% to its record.

In FX, the Bloomberg Dollar Index was little changed, with the Swiss franc 0.1% higher and outperforming G10 counterparts while the Norwegian krone lagged peers. The Aussie dollar rose on leveraged demand in view of sharp gains in Chinese stocks, according to Asia-based FX traders, who added an estimate beat in Australian retail sales also helped. Currencies in the Central European region turned weaker after central bankers from the Fed and the ECB indicated the possibility of higher core interest rates.

In rates, 10-year Treasuries rose for a second day, with the yield dropping 2bps to 4.22%. The yield curve was flatter and 2-year yields near YTD high ahead of a compressed auction schedule that includes both 2- and 5-year note sales Monday. Current 2-year touched 5.102%, highest since July 6, when YTD high 5.118% was reached. WI yield exceeds 2-year auction results since 2006. 10-year yields little changed at ~4.23% with 2s10s and 5s30s spreads flatter by 2bp-3bp on the day; bunds underperform slightly and UK markets are closed for bank holiday. Compressed auction schedule begins with $45b 2-year at 11:30am followed by $46b 5-year sale at 1pm. Money markets raised peak Fed wagers, pricing 17bps of hikes by year-end compared to 16bps on Friday.

In commodities, WTI held a gain as China announced measures to boost its stock and property markets, helping offset concerns about increased supply and monetary tightening in the US and Europe.Gold was unchanged around $1915, while bitcoin was as usual lower.

Market Snapshot

- S&P 500 futures up 0.2% to 4,423.75

- MXAP up 1.0% to 159.62

- MXAPJ up 0.7% to 500.83

- Nikkei up 1.7% to 32,169.99

- Topix up 1.5% to 2,299.81

- Hang Seng Index up 1.0% to 18,130.74

- Shanghai Composite up 1.1% to 3,098.64

- Sensex up 0.5% to 65,202.12

- Australia S&P/ASX 200 up 0.6% to 7,159.84

- Kospi up 1.0% to 2,543.41

- STOXX Europe 600 up 0.6% to 454.32

- German 10Y yield little changed at 2.57%

- Euro little changed at $1.0800

- Brent Futures up 0.2% to $84.68/bbl

- Gold spot down 0.0% to $1,914.01

- U.S. Dollar Index little changed at 104.17

Top Overnight News

- Foxconn founder Terry Guo formally entered the Taiwanese presidential race on Monday (Guo is in favor of conducting talks with China to preserve peace). FT

- China confirmed recent media reports and said it would slash the stamp duty on stock trading by 50%, a move aimed at restoring market confidence. China also said it would slow the pace of IPOs in an effort to bolster its stock market. BBG

- Evergrande shares reopened for trading for the first time in nearly 1.5 years and the Chinese property developer saw its stock collapse ~80%. FT

- BOJ’s Ueda says Japan’s underlying inflation is still a bit below the central bank’s target, which is why the present monetary policy framework remains appropriate. Nikkei

- Germany’s ruling Social Democratic party will propose a three-year rent freeze in a bid to clamp down on inflation and provide relief on soaring housing costs. FT

- President Volodymyr Zelensky of Ukraine said on Sunday that he believes Washington will offer his country security guarantees similar to those Israel enjoys in its relationship with the United States, a durable partnership that does not depend on which party controls the White House. NYT

- The FTC suspended its challenge of Amgen’s $27.8 billion acquisition of Horizon Therapeutics giving the agency time to weigh a settlement that would allow the deal to close with conditions. WSJ

- Trucking industry is set to see a pickup in demand as retailers end their aggressive destocking cycles and begin preparing for the holidays. RTRS

- The US will release a list of 10 drugs this week that Medicare will be able to negotiate prices for, potentially saving taxpayers billions of dollars and squeezing profits for pharma companies. Analysts expect J&J’s Xarelto blood thinner and Eli Lilly’s Jardiance for diabetes to be among the medications chosen. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks kicked off the week in the green, following a similar lead from Wall Street, whilst the focus overnight was on Chinese stocks after Friday’s support measures announced by authorities. ASX 200 was supported by the energy and gold sectors whilst the broader mining sector was subdued by Fortescue Metals Group, which missed on net expectations and reported an impairment charge. Nikkei 225 was also supported by its energy sector, with the index eventually surging above the 32k mark seeing some early resistance around the level. Hang Seng and Shanghai Comp were boosted at the open with the Mainland posting gains north of 3% as markets reacted to Friday’s measures to boost investor confidence. In Hong Kong, China Evergrande slumped 80% after resuming trade following a 17-month hiatus.

Top Asian News

- China’s Finance Ministry said China will cut stamp duty on stock trading by half from August 28th, according to Reuters.

- The Chinese Securities Regulator said China will slow the pace of IPOs and further regulate share reductions. The regulator added that exchanges will also lower margin requirements, according to Reuters.

- China today suspended some quantitative T+0 algorithmic trading via brokers amid concerns that T+0 may encounter one-sided market conditions and lead to risk exposure, STCN media reported

- China Evergrande (3333 HK) H1 2023 (CNY): Net -33bln (prev. -64.2bln YY). Revenue 128.2bln (prev. 89.3bln). Co. said its ability to continue will depend on a successful implementation of an offshore debt restructuring plan, and successful negotiations with the rest of the lenders on repayment extensions, according to Reuters.

- China has asked some funds to refrain from net equity sales in order to boost the market, according to Bloomberg News.

- PBoC injected CNY 332bln via 7-day reverse repos with the rate at 1.80% for a CNY 298bln net injection, according to Reuters.

- Foxconn (2317 TT) founder Terry Gou is to run for the Taiwanese presidency, according to Reuters.

- New Zealand said it is to trim budget allowances and measures amid a deterioration in the global economy and particularly in China, according to Reuters.

- BoJ Governor Ueda said underlying inflation is still below 2%, which is a reason to stick to the current monetary policy approach. He added that domestic demand is still on a healthy trend, although this needs to be confirmed by Q3 data, according to Reuters. He added that for Japan, the US strength is offsetting some of China’s weakness, and the weakness in China appears to be centred on the property market.

- Japan raises view on exports in August for the first time in 3 months says the trend is “picking up recently”; Overall view on economy, saying it is “recovering moderately”.

European bourses are in the green, Euro Stoxx 50 +0.6%, as the region derives impetus from APAC strength in holiday-thinned trade on a UK Bank Holiday. Sectors post similar performance and feature outperformance in Tech names after SCMP reports Chinese demand for ASML’s lithography machines has already eclipsed the 2023 projection. Real Estate names lag after reports that Germany is to vote on a proposal to lower rent increase limits. Stateside, futures are incrementally firmer, ES +0.2%, taking cues from the above narrative with fundamentals light otherwise. The US session features commentary from Fed’s Barr.

Top European News

The UK Metropolitan Police is on high alert following a significant security breach that led to officers’ and staff’s details being hacked. All 47k personnel have been notified about the potential exposure of their photo, names, and ranks, according to Sky News. Germany’s ruling Social Democratic Party will vote on a proposal to lower limits on rent increases in a bid to tackle inflation. The proposal calls for a three-year residential rent cap of 6%, according to Bild citing a draft resolution. EU Council President Michel says the EU must be prepared to accept new member states by 2030, via FT citing written remarks. ECB’s Holzmann (Hawk) sees case for rate hike if no surprises turn up; says should start debate on ending PEPP reinvestments, according to Bloomberg; behind the curve, can start assessing policy when at 4.0%. Fitch affirms the Czech Republic at “AA-“; outlook Negative.

FX

- DXY dips below 104.000 and further from Friday’s 104.440 best, but the Buck retains a firm underlying bid.

- Euro regroups after losing 200 DMA, but is capped by decent option expiry interest extending from 1.0795 to 1.0900.

- Yen hovers near circa 146.63 lows as BoJ Governor Ueda underlines reasons to remain ultra-accommodative.

- Aussie fades amidst hefty option expiries vs. Greenback just above 0.6400 after a brief boost from better-than-expected retail sales data and Yuan rebound.

- Sterling sags in UK holiday-thinned trade and irrespective of BoE’s Broadbent saying rates may have to stay restrictive for some time.

- Cable unable to hold above 1.2600

- PBoC sets USD/CNY mid-point at 7.1856 vs exp. 7.2854 (prev. 7.1883)

Fixed Income

- Bonds back to bearish path of least resistance and pick-up in trading volumes infers more conviction on the sell-side.

- Bunds have moved convincingly below Friday’s low at 86, now at the trough of 132.33-131.72 parameters.

- T-note a tad more resilient within 109-19/10 range ahead of Dallas Fed manufacturing survey, 2- and 5-year auctions.

Commodities

- Crude benchmarks are a touch firmer with the broader macro narrative deriving impetus from Chinese stimulus, though brief pressure was seen as the USD printed a fresh intra-day peak; currently, WTI & Brent Oct’23 are holding around USD 80.00/bbl and USD 84.50/bbl respectively, within relatively narrow sub-1/bbl parameters

- Gas is in the green though only modestly so as the Offshore Alliance now has the mandate from workers for potential strike action, but is yet to give notice for protected industrial action.

- An oil leak has been found in a transmission pipeline linking Kharg Island to Iran’s Genaveh port, according to Tasnim. The magnitude of the spill was not specified, according to Reuters.

- Chevron (CVX) Australia LNG workers at Wheatstone offshore have voted to authorise the union to call strike action if needed; the Offshore Alliance says protected industrial action notices against Chevron (CVX) will be filed shortly.

- NHC says Tropical Storm Idalia about 125 miles south of the western tip of Cuba has maximum sustained winds of 65mph; expected to become a hurricane today.

- Spot gold is unchanged at the midpoint of USD 1913-1917/oz bounds and similarly to the USD is struggling for clear and lasting direction, base metals are firmer given Chinese stimulus.

Geopolitics

- Russia’s Investigation Committee confirmed Wagner leader Prigozhin was among those who died in the plane crash, according to Reuters.

- Russian SU-30 plane escorted a US drone Reaper over the Black Sea, according to Ria.

- Russian Foreign Minister Lavrov and the Turkish Foreign Minister are to hold discussions in Moscow, Russia soon, via Tass.

- US Trade Secretary Tai reportedly raised concerns with India over its new order mandating licenses for the import of some tech products such as personal computers, laptops, and tablets, according to a statement cited by Reuters.

- Three US marines have died and five have been seriously injured after a helicopter crashed during a military exercise in Australia, according to Sky News.

- China will hold the third China-Africa peace and security forum between August 28th and September 2nd, according to the Chinese Defence Ministry cited by Reuters.

- The Taiwan Defence Ministry said 6 Chinese aircraft crossed the Taiwan Strait median line in the past 24 hours.

- Chinese Commerce Minister met with US counterpart Raimondo on Monday; Raimondo said the US wants healthy competition with Beijing, does not intend to hinder Chinese progress, and sees many areas they can work with China, according to Bloomberg.

US Event Calendar

- 10:30: Aug. Dallas Fed Manf. Activity, est. -19.0, prior -20.0

Tyler Durden

Mon, 08/28/2023 – 08:16

via ZeroHedge News https://ift.tt/TJqbKzY Tyler Durden