Bonds, Stocks, Commodities, & Crypto Hit In ‘Hawkish’ August As Dollar Soared

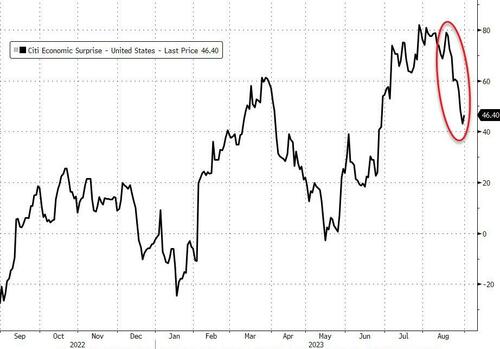

August saw the landing narrative shift from ‘soft’ to ‘more aggressive’ as macro data serially disappointed as the month wore on – to make the biggest monthly decline since May 2022…

Source: Bloomberg

Of course tomorrow’s payrolls print is all that matters now (until next week’s CPI), but this week saw the ‘core services’ inflation print at the second highest since 1985, while durable goods prices dropped most since 2017 MoM. GDP growth was revised lower (and is negative based on GDI). The labor market is clueless as JOLTS, ADP, Challenger-Gray, and Continuing Claims all worsened significantly while initial jobless claims fell to 2023 lows.

The last two months have seen ‘soft’ survey data improving while ‘hard’ data has disappointed…

Source: Bloomberg

Slowing growth and persistent inflation used to be the makings of a ‘stagflation’ scare and a reason to de-risk portfolios.

Source: Bloomberg

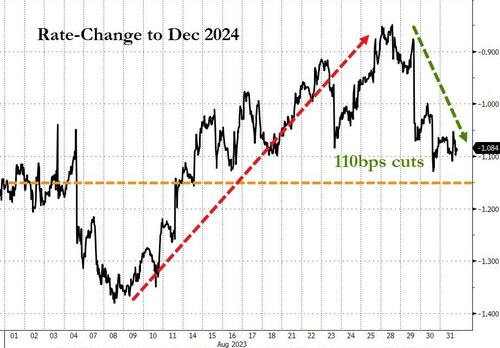

Nevertheless, despite the very recent dovish decline, rate-change expectations rose (hawkishly) on the month…

Source: Bloomberg

But the market is still pricing in 110bps of rate-cuts by the end of next year…

Source: Bloomberg

The slight hawkish bias sent the dollar higher – biggest monthly jump since Feb – but it has broadly speaking gone nowhere for the last two weeks…

Source: Bloomberg

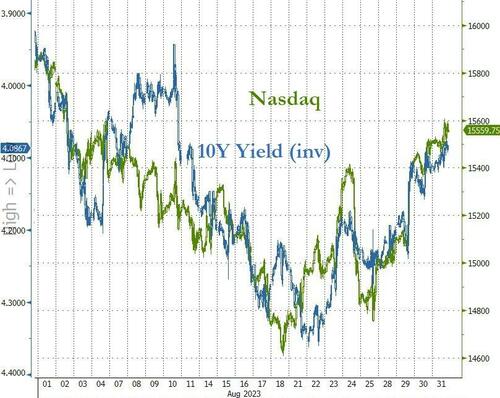

And despite the rebound of the last few days, left stocks lower on the month (with Nasdaq suffering its worst monthly return since Dec 2022). Small Caps were the worst on the month…

Source: Bloomberg

The Energy sector was the only one to close green in August with Utilities weakest…

Source: Bloomberg

At one point in August, the S&P 500 was down almost 5% for the month as yields on 10-year US Treasuries hit 4.34% – their highest level since BEFORE the Great Financial Crisis – an event that ushered in a decade of ultra-low inflation and rates.

Spot the difference…

Source: Bloomberg

Most of the Treasury market was lower in price (higher in yield) on the month but, the short-end of the yield curve outperformed in August (2Y -2bps, 30Y +19bps)…

Source: Bloomberg

Commodities were broadly lower on the month with copper ugly, PMs weak, but energy was higher (with Nattie best and WTI managing to get green

Source: Bloomberg

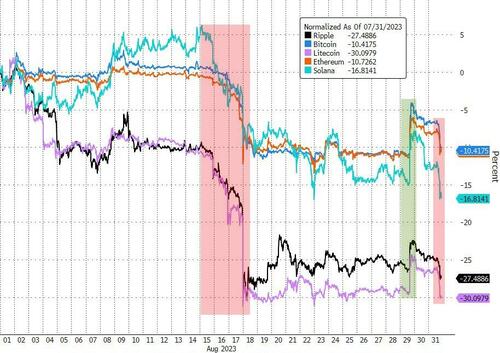

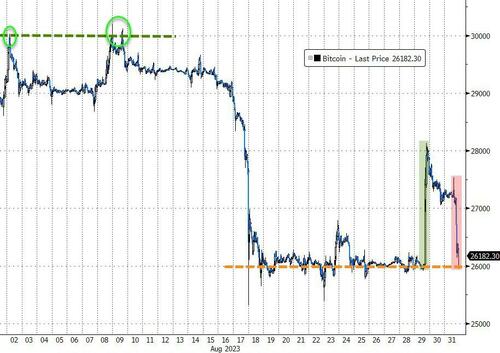

It was an ugly month for cryptos with Bitcoin and Ethereum both down over 10% with an ugly day to close it out…

Source: Bloomberg

Today saw a wave of selling in Bitcoin, erasing the GBTC-SEC win spike, back down to $26k…

Source: Bloomberg

Finally, stocks remain decoupled from bank reserves at The Fed…

Source: Bloomberg

Maybe the consumer finally tapping out will bring the two back together again in September.

Tyler Durden

Thu, 08/31/2023 – 16:00

via ZeroHedge News https://ift.tt/K7mRkDe Tyler Durden