Fed’s Favorite Inflation Indicator Jumps Higher In July, Wage Growth Slowed

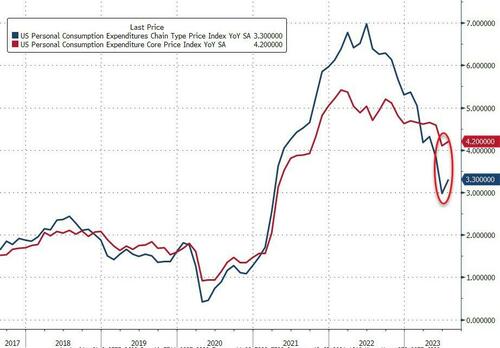

One of The Fed’s favorite inflation indicators – Core PCE Deflator – rose 4.2% YoY in July (as expected but higher than June’s +4.1%). Headline PCE jumped up to +3.3% YoY (also as expected) – the biggest jump in YoY prints since June 2022…

Source: Bloomberg

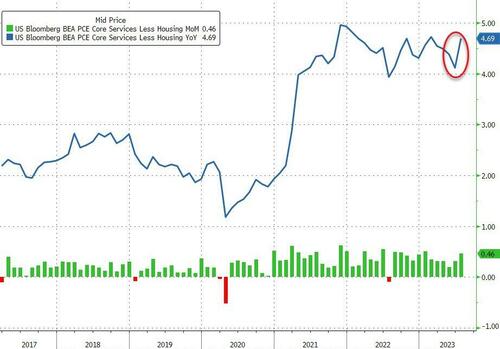

Even more focused, is the Fed’s view on Services inflation ex-Shelter, and the PCE-equivalent shows that is very much stuck at high levels…

Source: Bloomberg

Services inflation accelerated in July but Goods saw the biggest MoM deflation since 2022…

Source: Bloomberg

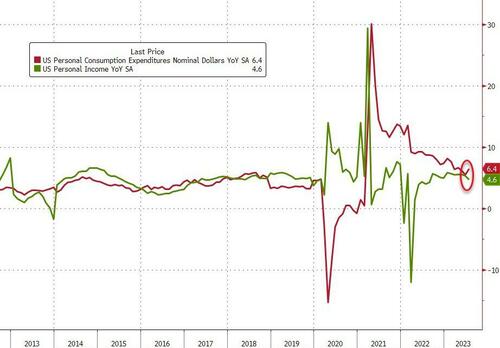

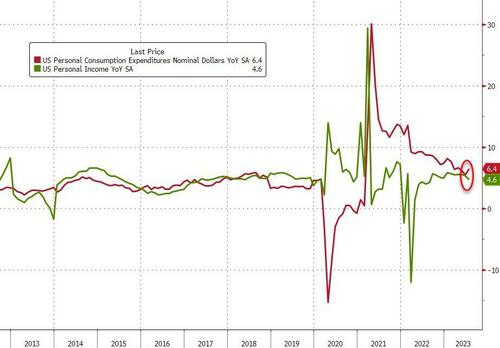

Personal Income growth slowed for the 2nd month in a row as Spending accelerated for the 2nd month in a row…

Source: Bloomberg

On a year-over-year basis, spending accelerated as income growth decelerated…

Source: Bloomberg

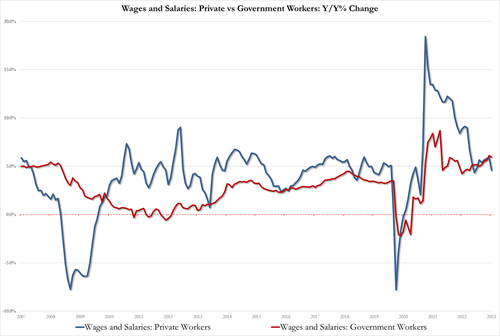

Wage growth slowed:

-

Private workers wages and salaries 4.6%, down from 5.9%

-

Govt workers wages and salaries 6.0%, down from 6.1%

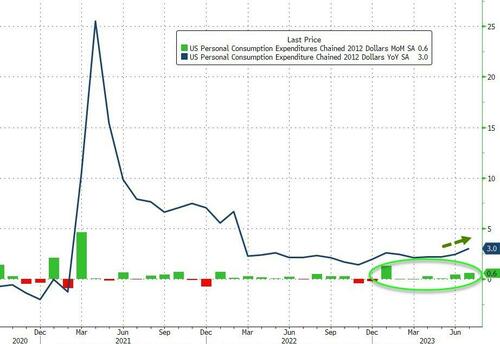

Adjusted for inflation, ‘real’ personal spending was higher in July (up 3.0% YoY)…

Source: Bloomberg

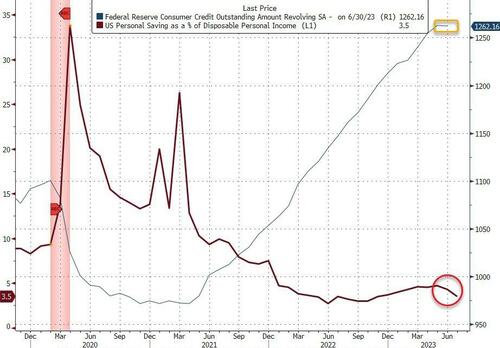

But real disposable income fell 0.2% MoM – its biggest decline since June 2022…

Putting all that together, we see that the savings rate plunged to 3.5% – the lowest since Oct 2022 – down from 4.3% – the biggest drop since Jan 2022….

It appears the American consumer is completely tapped out – consumer credit has flatlined (maxx’d out) and now savings are plunging again.

Tyler Durden

Thu, 08/31/2023 – 08:41

via ZeroHedge News https://ift.tt/RgLhqDQ Tyler Durden