Futures, Global Markets Rise As Yields Drop Ahead Of PCE Data

US stock futures, European bourses and Asian markets all rose, while the 10-year Treasury yield traded near a three-week low and the USD eeked out its first gain of the week as traders reacted to a modest improvement in China’s mfg PMI and looked ahead to Thursday’s PCE data and Friday’s jobs report. At 7:45am ET, S&P futures rose 0.25% to 4,535 while Nasdaq 100 futures reversed earlier losses. Europe’s Stoxx 600 benchmark stayed in the green, buoyed by record profits at UBS as a result of its emergency takeover of Credit Suisse. Commodities are stronger led by oil and metals with natgas and wheat the biggest laggards. Today’s macro data focus includes jobless claims, income/spending and the PCE Deflator. Chicago PMI, expected to rise to 44.2, may point to a stabilization in mfg. Tomorrow we cap off the week with NFP.

In premarket trading, the retail rout continued with Dollar General plunging more than 13% after the company cut its 2024 net sales and profit forecast; Chewy also fell 5.3% as analysts say the pet products company’s customer growth disappointed in the second quarter amid macro uncertainties. Evercore ISI downgraded its rating. Okta jumped 11% after it reported second-quarter results that beat expectations and raised full-year forecast. Analysts highlight improvement in margins and the company’s sales strategy. Here are some other notable premarket movers:

- Arista Networks gains 2.3% after Citi upgraded the communications-equipment company to buy from neutral, citing an expected 400G cloud spend recovery into next year.

- CrowdStrike climbed 1.4% as it again delivered strong results with consistent execution and outperformance across metrics, analyst Matthew Hedberg says he likes the continued momentum and the opportunity to consolidate security spend, seeing this as a building tailwind.

- Palantir declines 4% after Morgan Stanley cut its rating, saying that near-term optimism about the AI product cycle and valuation premium make for an “unfavorable risk-reward.”

- Salesforce rises 5.6% after the software firm reported second-quarter results that beat expectations and gave an outlook that is seen as strong.

- Shopify’s US shares rise 5.6% after Amazon announced an app integration to allow merchants to offer Buy with Prime on Shopify stores.

- UGI jumps 7.3% after the natural gas and electric power distribution company said its board is reviewing strategic alternatives to unlock shareholder value.

- Victoria’s Secret falls 5.3% after the lingerie retailer’s second-quarter results fell shy of estimates and it forecast a sales decline ahead.

Sentiment was modestly boosted after China’s NBS PMIs showed that Manufacturing came in at 49.7 (up from 49.3 in Jul and ahead of the Street’s 49.2 forecast) and Manufacturing new orders back in expansion mode for the first time in 5 months; on the other hand, Non-Manufacturing ticked down to 51 (down from 51.5 in Jul and below the Street’s 51.2 forecast).

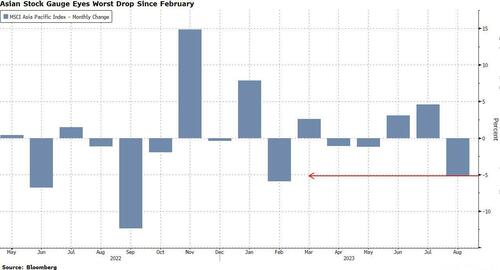

The S&P 500 was headed for the worst month since February, while the Nasdaq 100 is set for the largest decline this year. Asian and global stocks are also on pace for the biggest monthly losses since February.

Traders are closing out the month with economic data and China’s bruised markets center stage. Thursday’s mixed moves come after stocks and bonds pared their August losses in the past week. US jobless numbers picked up slightly to 235,000 according to economists polled by Bloomberg ahead of initial claims data due Thursday. Friday’s non-farm payrolls are seen at 170,000 in August versus 187,000 in July, while hourly wage growth is predicted to slow slightly. Weaker-than-expected economic numbers supported predictions for the Fed to ease back on interest-rate hikes on Wednesday.

“The big market catalyst we’re looking for in September is the Fed meeting,” Hugh Gimber, global market strategist at JPMorgan Asset Management, said by phone. “Tomorrow’s payrolls data will be hugely relevant for that meeting. Without a slowdown in wages, a soft landing is impossible.”

European stocks were higher with the Stoxx 600 rising 0.4%. The financial services, retail and real estate sectors are leading gains. The euro dropped 0.5% versus the dollar as euro-zone inflation stopped slowing in August, according to data on Thursday. That presents European Central Bank officials with a quandary as they weigh the possibility of tighter policy against signs of flagging growth. Here are the biggest European movers:

- UBS shares climb as much as 7.2% to their highest level since October 2008 after the bank posts 2Q net income of $29 billion, bolstered by negative goodwill from Credit Suisse acquisition

- Rockwool rises as much as 6.5%, making it the biggest gainer on Europe’s Stoxx 600 index, after the Danish insulation firm increased its guidance for the second time in two months

- Dormakaba shares soar as much as 13%, most since April 2015, after the Swiss access and security company reported Ebitda for the full year that beat average estimates

- Grafton shares rise as much as 3.5% as analysts highlight optionality from the UK construction and materials company’s strong balance sheet, as evidenced by a new share buyback

- Pernod Ricard falls as much as 5.3%, the most in more than a year, after the maker of Absolut Vodka reported results that were hit by negative FX effects and said it expected a “soft” quarter ahead

- Eiffage drops as much as 2.6% after the construction and concessions company delivered 1H results which Jefferies describes as “soft,” highlighting an increase in net debt and a miss on profit

- Adevinta shares fall as much as 2.7%. The Norwegian classifieds company said on an earnings call its German vehicle marketplace may merely see “more normal” growth rates going forward

- Recticel shares slumped as much as 15% after the Belgian company’s first-half earnings missed estimates due to challenging conditions in the European construction markets

- Ion Beam Applications plunged 15%, the most since March 2020, after the Belgian medical technology company reported first-half earnings that analysts say were below expectations

Earlier in the session, Asian stocks were mixed, heading for their worst monthly drop since February, as the rally in Chinese equities faltered amid worries about growth and the property crisis in Asia’s largest economy.

The MSCI Asia Pacific Index erased earlier gains of as much as 0.4% to trade little changed. Benchmarks in Japan and Singapore rose, while those in South Korea, Taiwan and Australia were lower. Equities in mainland China were set to extended their losses for another session after factory output contracted again, with the onshore stock benchmark poised for its biggest monthly decline since October. Gauges in Hong Kong fluctuated.

After suffering most of August on China’s growth concerns, the main Asian stock benchmark was on course for about a 5% drop this month, even after the recent recovery in Chinese stock markets helped narrow the loss. Equities rebounded earlier this week on the mainland following Beijing’s latest steps to shore up investor confidence in capital markets on Sunday but the rally lost steam after mid-week.

- Japan’s Nikkei 225 saw mild gains although the machinery sectors were in the red following the dire Japanese industrial output data, with a Japanese government official highlighting a decline in demand both domestically and abroad, with output falling in several areas including production machinery.

- Australia’s ASX 200 was flat on either side of 7,300 as the gains in the Telecoms and Financial sectors were offset by losses in Energy and Consumer Staples.

- Stocks in India posted their biggest decline this week, weighed by a regional selloff. Investors will look forward to release of quarterly GDP data due after close of markets. The S&P BSE Sensex fell 0.4% to 64,831.41 in Mumbai, while the NSE Nifty 50 Index declined 0.5%, their biggest single-day declines since Aug. 25. For the month, the gauges fell more than 2.5% each, their first retreat since February. The selloff in India has come on the back of rising worries over inflation and insufficient rains in many regions.

Asian stocks have been driven by “a combination of what’s happening in the US macro cycle and what’s happening in the Chinese macro cycle,” as well as the “ongoing AI bubble,” Mixo Das, Asia equity strategist at JPMorgan Securities, said in an interview with Bloomberg TV.

In FX, the Bloomberg Dollar Spot Index rose to session highs and after falling as much as 0.2% earlier. The yen rose the most among the Group-of-10 currencies. The greenback is likely to be “somewhat” volatile over the data release as PCE is the Fed’s preferred inflation measure, said Richard Grace, a senior currency analyst at InTouch Capital Markets Pte. “The market appears to still trying to work out the recent pattern of stronger-than-expected US economic data for a number of weeks, and now a pattern of weaker-than-expected US economic data for a number of days”

The euro fell as traders bet the ECB will hold off on raising rates next month, even as recent data shows inflation is still running above target. The repricing in ECB rates comes after policymaker Isabel Schnabel highlighted the mounting risks to growth and said she can’t say how long rates will remain in restrictive territory. “If the weakness we have seen so far is not enough to bring inflation down, the economy needs to weaken even more,” said Athanasios Vamvakidis, head of G-10 FX strategy at Bank of America. “That’s the main concern for the euro.” AUD/USD rose 0.2% to 0.6488, paring an earlier rise of as much as 0.5%.

In rates, treasuries held small gains in early US trading, paced by UK and euro-zone bond markets, with yields mostly inside Wednesday’s ranges. TSY yields are lower across the curve by 1bp-3bp; Wednesday’s ranges included lowest levels in more than two weeks for all benchmarks except the 30-year. Month-end index rebalancing at 4pm will extend its duration by an estimated 0.12 year as Treasuries issued during the month are added. Bunds are higher while the euro has extended declines as traders seem to focus on the slowdown in euro-area core inflation rather than the headline rate which held steady. Market pricing now suggests a less than 30% chance the ECB raises rates in September, down from ~40% before the data. German 10-year yields are down 5bps at 2.49% while two-year yields drops 9bps. The US economic calendar includes weekly jobless claims and July personal income and spending at 8:30am New York time and August MNI Chicago PMI at 9:45am. Focal points of US session include personal income and spending data that includes PCE deflator, Fed’s preferred inflation gauge, and month-end index rebalancing.

In commodities, Brent crude oil advanced for a third day with WTI rising 0.5% to trade around $82. Spot gold rises 0.1%.

Bitcoin was under modest pressure holding around the USD 27k mark within fairly narrow ranges above the figure. Pressure which eminates from the firmer USD in European trade.

Looking to the day ahead now, and data releases include the Euro Area flash CPI print for August, as well as the unemployment rate for July. In the US we’ve got the weekly initial jobless claims, PCE inflation for July, and the MNI Chicago PMI for August. From central banks, we’ll hear from the Fed’s Bostic and Collins, ECB Vice President de Guindos and the ECB’s Schnabel, and the BoE’S Pill. We’ll also get the ECB’s accounts of their June meeting. Finally, earnings releases include Lululemon, Dollar General and Broadcom.

Market Snapshot

- S&P 500 futures up 0.1% to 4,529.00

- MXAP little changed at 161.98

- MXAPJ down 0.4% to 507.25

- Nikkei up 0.9% to 32,619.34

- Topix up 0.8% to 2,332.00

- Hang Seng Index down 0.5% to 18,382.06

- Shanghai Composite down 0.6% to 3,119.88

- Sensex down 0.2% to 64,966.59

- Australia S&P/ASX 200 up 0.1% to 7,305.27

- Kospi down 0.2% to 2,556.27

- STOXX Europe 600 up 0.3% to 460.38

- German 10Y yield little changed at 2.52%

- Euro down 0.3% to $1.0886

- Brent Futures up 0.2% to $85.99/bbl

- Gold spot up 0.2% to $1,945.26

- US Dollar Index up 0.23% to 103.39

Top Overnight News

- China’s NBS PMIs are mixed for Aug, with Manufacturing coming in at 49.7 (up from 49.3 in Jul and ahead of the Street’s 49.2 forecast) and Manufacturing new orders back in expansion mode for the first time in 5 months, but Non-Manufacturing ticked down to 51 (down from 51.5 in Jul and below the Street’s 51.2 forecast). RTRS

- Chinese president Xi Jinping is not planning to attend the G20 leaders’ summit in New Delhi next weekend and is expected to be replaced by the country’s premier, according to western officials briefed on the situation. FT

- Toyota Motor seeks to shatter its production record this year, aiming to manufacture 10.2 million vehicles globally, the Nikkei has learned, and cross the eight-figure milestone for the first time. Nikkei

- Europe’s CPI in Aug szx mixed, with headline running hot at +5.3% Y/Y (unchanged vs. Jul and above the Street’s +5.1% forecast) while core was +5.3% (down from +5.5% in Jul and inline w/the Street). BBG

- UBS soared to the highest since 2008 after it posted the biggest-ever quarterly profit for a bank and CEO Sergio Ermotti said inflows are climbing across the board. The bank sees positive underlying pretax profit in the second half and will cut about 3,000 jobs as it targets cost savings of $10 billion by end-2026 from its takeover of Credit Suisse. BBG

- The EU’s agriculture chief has proposed that the EU subsidize the cost of transiting Ukrainian grain through the bloc after Russia pulled out of an initiative to allow exports via the Black Sea. FT

- Fed’s Bostic warns that US monetary policy should avoid overtightening (“I think we should be cautious and patient and let the restrictive policy continue to influence the economy, lest we risk tightening too much and inflicting unnecessary economic pain”). BBG

- Facing the prospect of a politically damaging government shutdown within weeks, House Speaker Kevin McCarthy is offering a new argument to conservatives reluctant to vote to keep funding flowing: A shutdown would make it more difficult for Republicans to pursue an impeachment inquiry against President Biden, or to push forward with investigations of him and his family that could yield evidence for one. NYT

- Visa and Mastercard are planning to increase credit-card fees. The changes could result in merchants paying an additional $502 million annually in fees, according to a consulting company. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mostly negatively following a marginally positive handover from Wall Street, which saw an equity bid underpinned by dovish US economic data. ASX 200 was flat on either side of 7,300 as the gains in the Telecoms and Financial sectors were offset by losses in Energy and Consumer Staples. Nikkei 225 saw mild gains although the machinery sectors were in the red following the dire Japanese industrial output data, with a Japanese government official highlighting a decline in demand both domestically and abroad, with output falling in several areas including production machinery. Hang Seng and Shanghai Comp varied at the open but later succumbed to losses, whilst Baidu soared 4.6% after winning Chinese approval for its AI model. The Mainland was more cautious from the start following mixed PMI data which saw Manufacturing topping expectations but remaining in contraction.

Top Asian News

- Baidu (BIDU/9888 HK) is reportedly among the first firms to win China approval for AI models, according to Bloomberg. Baidu rolled out its Chat GPT-rival AI app to the public, according to a statement cited by AFP

- PBoC said it will continue to step up loans to private firms and will use stocks and bonds to deal with risks of private property developers in a prudent way, according to Reuters. PBoC added it will encourage and guide institutional investors to buy bonds of private firms and will support IPO and refinancing of private firms.

- PBoC injected CNY 209bln via 7-day reverse repos with the rate at 1.80% for a CNY

- The Japanese government cut its assessment of industrial production and noted industrial output is seesawing, according to Reuters.

- Japanese government official on industrial output said demand fell both domestically and abroad in July, and noted that output fell in many areas including production machinery. The official said the decrease in chip manufacturing machinery is due to weak demand abroad, the outlook appears to be severe; chip shortage is easing in autos, which is on a steady recovery, according to Reuters.

- Japanese government official said the electronics device market in China is in a severe state; Domestic material industries are partially affected by China’s real estate concerns, according to Reuters.

- BoJ Board Member Nakamura said the BoJ must patiently maintain easy policy for the time being, and need more time to shift to monetary tightening; Japan’s economy is no longer in deflation; tweaks to policy must be cautious. Was not against making YCC flexible, opposition was re. timing. July decision was not part of any exit from ultra-loose policy. BoJ will closely watch impact on Yen moves on economy and prices. FX is not driven by interest rate differentials alone.

- Japanese PM Kishida said to be considering lifting the minimum wage to JPY 1500/hr by mid 2030s, via NHK.

- Japan’s major five banks are to increase housing loan interest rates by 0.1% to 0.2%, according to Jiji News.

- Fitch affirms China at A+, outlook stable; revises lower 2023 China GDP Growth forecast to 4.8% (prev. 5.6%).

European bourses are modestly firmer, Euro Stoxx 50 +0.1%, having trimmed initial upside throughout a session of significant Central Bank updates. Downside which has occurred despite a dovish-shift to pricing for the ECB post-HICP & Schnabel; within Europe, Real Estate leads the sectors while Banking names lag as both areas of the economy take impetus from yield action. Though, the Banking pressure is offset somewhat by marked upside in UBS +4.5% post-earnings; SAP modestly firmer after CRM earnings, CRM +5.5% in pre-market. Stateside, futures are mixed around the unchanged mark with some slight underperformance in the NQ -0.1% ahead of key data and despite the broader European-driven yield action.

Top European News

- ECB’s Schnabel says outlook for the Euro Area remains highly uncertain, activity has moderated visibly, and forward-looking indicators signal weakness ahead. Cannot predict where the peak rate is going to be, or for how long rates will have to be held at restrictive levels, cannot commit to future actions. Within the remarks, Schnabel is very balanced and holds open the door for a hike or a skip at the September gathering. For reference, the remarks were published pre-HICP

- ECB’s Holzmann says August inflation data is a conundrum for the ECB; we are not yet at the highest level for rates, another hike or two is possible. ECB should consider needing PEPP reinvestments before the end of next year. Based on current data, would not exclude a rate hike in September but hasn’t made mind up yet. Much closer to terminal rate but likely not there yet. Remarks published after the HICP data

- BoE’s Pill says the UK faces second-round inflation effects and inflation is too high, cases for caution on inflation despite the declines in the headline. There is a lot of policy in the pipeline to come through. There is the possibility of doing too much when it comes to the fight against inflation. Policy needs to be sufficiently restrictive for long enough.. Adds, one option for policy is to hold rates steady for longer; tends to favour that approach.

- UK PM Sunak is expected to announce a new Defence Secretary to replace Ben Wallace on Thursday, according to government officials cited by the FT. Grant Shapps is a surprise frontrunner for the role, according to insiders.

FX

- DXY rebounds firmly from 103.000 to 103.550, while Euro reels from 1.0939 to 1.0865 vs the Buck after mixed EZ data and less hawkish remarks from ECB’s Schnabel.

- Yen relishes softer yields as it continues consolidation against Greenback either side of 146.00 irrespective of mixed Japanese macro releases.

- Sterling buffeted as BoE’s Pill warns against complacency on inflation given second round effects, but backs a steady for longer strategy rather than overtightening.

- Cable wanes around 1.2700 pivot, EUR/GBP eases from 0.8598 towards 0.8560.

- PBoC sets USD/CNY mid-point at 7.1811 vs exp. 7.2765 (prev. 7.1816)

- China’s major state-owned banks seen selling USD in onshore spot foreign exchange market; Banks spotted swapping CNY for USD in onshore forwards market, via Reuters citing sources.

- Brazil’s 2024 Budget Law revenue measures will reportedly reach BRL 168bln, according to Estadao sources. The revenue package will consider ending the deductibility of Interest on Equity for all sectors.

Fixed Income

- Bonds approaching month end on the up, but not before overcoming several wobbles.

- Bunds towards top of 132.87-131.83 range and perhaps latching on to soft EZ core inflation and less hawkish vibes from ECB’s Schnabel.

- Gilts also bid between 95.28-94.66 parameters as BoE’s Pill states preference for a longer period of steady rates rather than overtightening.

- T-note more restrained within 111-00/110-24+ confines awaiting PCE, IJC, Fed’s Collins and Chicago PMI.

- Following the European data and ECB speakers, pricing for a 25bp hike at the September meeting has dropped to a 30% probability from over 60% in recent sessions.

- UK DMO intends to hold 15 Gilt auctions between October-December, and a syndicated sale of a new long-dated conventional in November.

Commodities

- Crude benchmarks are a touch firmer on the session with specific details light as we await an update from the BSEE on how much, if any, production has been lost due to Hurricane Idalia.

- Gas markets are bid but off highs while spot gold is little changed and torn between the softer risk tone and stronger USD.

- For Ags., Reuters citing Turkish sources reported that President Erdogan is to meet Russia President Putin in Sochi on September 4th to discuss Ukraine and the grain deal. As a reminder, earlier in the week reports indicated that the nation’s Foreign Ministers are to speak in today’s session as Turkey looks to bring Russia back to the Black Sea grain deal.

Geopolitics

- US approves first arms to Taiwan under foreign aid program, according to AFP citing an official.

- US reportedly restricts the export of some AMD (AMD) chips to Middle Eastern countries, according to Reuters sources.

- North Korea conducted full-force command training in response to the SK-US joint exercise, according to Yonhap.

- Japanese PM Kishida has requested top LDP lawmaker Nikai to visit China to resolve the Fukushima water issue, according to local press.

- Australia and EU to resume free-trade deal talks on Thursday via teleconference, a month after the sides failed to reach a deal, according to Reuters.

US Event Calendar

- 07:30: Aug. Challenger Job Cuts 266.9%; YoY, prior -8.2%

- 08:30: Aug. Initial Jobless Claims, est. 235,000, prior 230,000

- Continuing Claims, est. 1.71m, prior 1.7m

- 08:30: July Personal Income, est. 0.3%, prior 0.3%

- Personal Spending, est. 0.7%, prior 0.5%

- Real Personal Spending, est. 0.5%, prior 0.4%

- 08:30: July PCE Deflator MoM, est. 0.2%, prior 0.2%

- PCE Deflator YoY, est. 3.3%, prior 3.0%

- PCE Core Deflator MoM, est. 0.2%, prior 0.2%

- PCE Core Deflator YoY, est. 4.2%, prior 4.1%

- 09:45: Aug. MNI Chicago PMI, est. 44.2, prior 42.8

DB’s Jim Reid concludes the overnight wrap

Markets had plenty to chew on yesterday, as the latest round of data offered support to both sides of the hard vs soft landing debate. We again had some underwhelming US releases which suggested that growth and inflation were slowing further which could be used to support either side of the debate. However for yesterday the soft landing argument continued to win out with yields on 10yr Treasuries (-0.7bps) inching down to a 3-week low of 4.11% and the S&P 500 (+0.38%) hitting a 3-week high. But in Europe, markets saw a clear underperformance thanks to resilient inflation numbers from Germany and Spain, which added to speculation that the ECB might deliver a 10th consecutive rate hike next month.

With the conflicting releases, all eyes are now on tomorrow’s US jobs report to see if that can shift the narrative one way or the other. Our US economists are expecting nonfarm payrolls to slow down further to 150k, and yesterday we had some further evidence of a softening labour market from the ADP’s report of private payrolls. That showed growth of +177k in August (vs. +195k expected), which is the smallest gain since March. On top of that, there was a continued slowdown in pay growth, with the rate among job-changers down to +9.5% year-on-year, which is the slowest since June 2021, whilst the rate among job-stayers fell to the slowest since September 2021, at +5.9%.

That ADP report came just before the second estimate of Q2 GDP growth, which indicated that the economy was a bit weaker than previously thought. For instance, overall growth came in at an annualised rate of +2.1%, which was down from the initial estimate of +2.4%. And more promisingly for the Fed, both PCE and core PCE for Q2 were each revised down a tenth, with the latest estimate putting them at +2.5% and +3.7% respectively.

These indications of a slowing economy led to a fresh rally among US markets. The main reason for that is because expectations of another rate hike from the Fed have continued to come down, and now stand beneath 50% for the first time since last week. So bad news on the economy is still being treated as good news (for now), since optimism about fewer rate hikes is outweighing the prospects of slower growth. In turn, that led to a rally among US Treasuries, although one that lost steam during the day with yields on 2yr Treasuries (-1.0bps) and 10yr Treasuries (-0.7bps) down only a little by the close. The 2yr yield had traded as much as -6bps lower shortly after the US data in the morning. As discussed, equities put in another decent performance as well, with the S&P 500 (+0.38%), advancing for a 4th consecutive session. On a sectoral basis, it was tech stocks that led the advance once again, and the NASDAQ (+0.54%) hit a 4-week high.

Over in Europe it was a rather different story, since the latest data suggested that inflation was proving more resilient than expected. In particular, the German flash CPI print for August only fell back to +6.4% on the EU-harmonised measure (vs. +6.3% expected). At the same time, Spanish inflation ticked up three-tenths to +2.4%, whilst Irish inflation was also up three-tenths to +4.9%. That sets the stage for the Euro-Area wide print this morning, which is out at 10am London time. Following yesterday’s prints, our European economists see both the headline and core inflation prints coming in at between +5.3% and +5.4%. This would represent a near stable headline reading (+5.3% prev.) and a slight easing in core (+5.5% prev.).

Those CPI numbers led to growing expectations that the ECB might proceed with another hike at their next decision in two weeks’ time. Indeed, market pricing is now suggesting a 55% chance of a 25bp hike at the September meeting, so back up to its level prior to the underwhelming flash PMI data last week. It also led to a significant underperformance among European sovereign bonds, with yields on 10yr bunds (+3.4bps), OATs (+3.7bps) and BTPs (+4.4bps) all moving higher on the day, whilst the STOXX 600 fell -0.15%. The big concern now is that the European outlook is looking increasingly stagflationary, with inflation remaining stubborn whilst there’s few signs of growth either. On the topic of European inflation, our economists yesterday published the results of their latest dbDIG consumer survey, which has shown an uptick in inflation expectations during July and August. See their note here.

Overnight in Asia, several equity markets have lost ground this morning, which follows the release of the official PMIs from China. They showed that manufacturing contracted for a fifth consecutive month, with a 49.7 reading but it was higher than the 49.2 reading expected by the consensus, and above the 49.3 reading in June. However, the non-manufacturing PMI fell a bit more than expected to 51.0 (vs. 51.2 expected).

Against that backdrop, most of the major indices have struggled this morning, with declines for the CSI 300 (-0.54%), the Shanghai Comp (-0.53%), the KOSPI (-0.36%) and the Hang Seng (-0.26%). The main exception is in Japan, where the Nikkei (+0.80%) and other indices including the TOPIX (+0.79%) have seen a decent advance this morning. That comes amidst better-than-expected retail sales data overnight, which grew by +2.1% in July (vs. +0.8% expected). That said, industrial production fell by -2.0% (vs. -1.4% expected).

Looking at yesterday’s other data, there were further signs of resilience in the US housing market, as pending home sales unexpectedly grew by +0.9% in July (vs. -1.0% expected). That said, the July data was before the most recent rise in mortgage rates into August, and separate data from the MBA yesterday showed that the 30yr average fixed rate remained at 7.31% in the week ending August 25.

To the day ahead now, and data releases include the Euro Area flash CPI print for August, as well as the unemployment rate for July. In the US we’ve got the weekly initial jobless claims, PCE inflation for July, and the MNI Chicago PMI for August. From central banks, we’ll hear from the Fed’s Bostic and Collins, ECB Vice President de Guindos and the ECB’s Schnabel, and the BoE’S Pill. We’ll also get the ECB’s accounts of their June meeting. Finally, earnings releases include Lululemon, Dollar General and Broadcom.

Tyler Durden

Thu, 08/31/2023 – 08:14

via ZeroHedge News https://ift.tt/q9oEgmr Tyler Durden