Authored by Alasdair Macleod via SchiffGold.com,

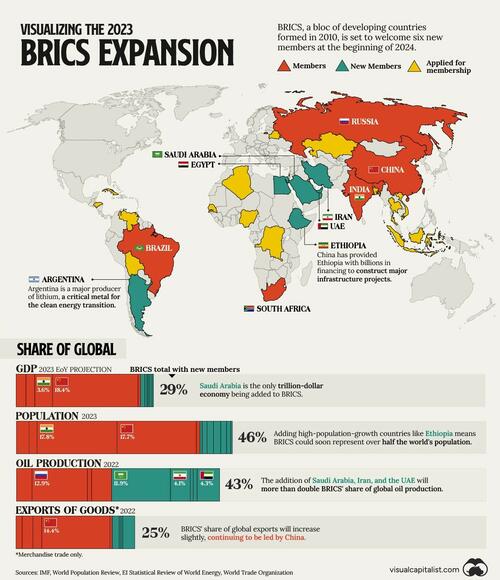

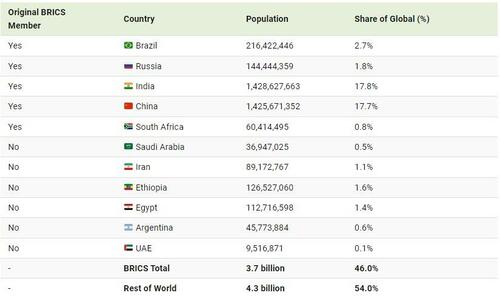

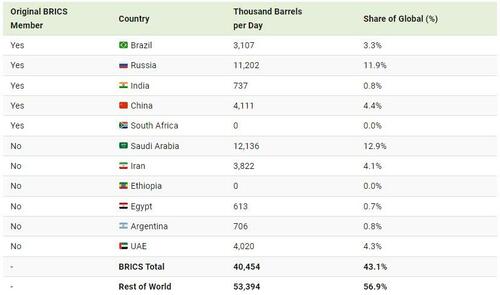

It is slowly coming clear that the fiat dollar’s hegemony is drawing to a close. That’s what the BRICS summit in Johannesburg is all about — rats, if you like, deserting the dollar’s ship. With the dollar’s backing being no more than a precarious faith in it, it is bound to be sold down by foreign holders. Being only fiat, it could even become valueless, threatening to take down the other western alliance fiat currencies as well.

How do you protect your paper wealth from this outcome? Some swear by bitcoin and others by gold.

This article looks at what is likely to emerge as a replacement currency system, and concludes that from practical and legal aspects, bitcoin and the entire cryptocurrency industry will fail with fiat, while mankind will return to gold, as it has always done in the past when state control over currency fails

Introduction

It is gradually dawning on market participants that the era of fiat currencies is drawing to a close. Monetarists, who first warned us of the inflationary consequences of the expansion of money and credit were also the first to warn us that the slowdown in monetary expansion would lead to recession, and since then we have seen broad money statistics flatline, with bank lending beginning to contract. This is interpreted by macroeconomists as the end of inflation, and the return to lower interest rates to stave off recession.

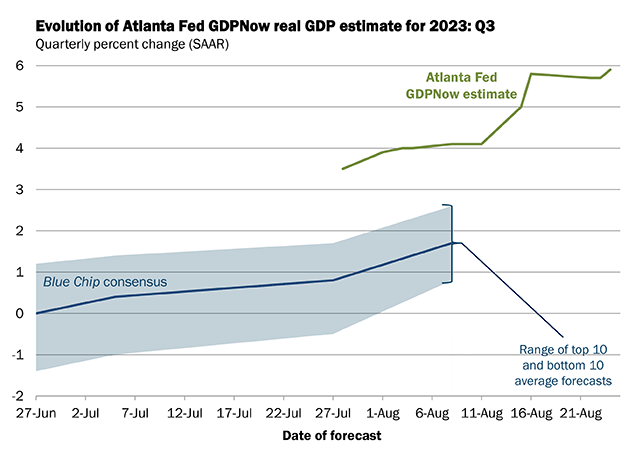

Unfortunately, this black-and-white interpretation of either inflation or recession but never both has been challenged by bond yields around the world which are rising to new highs. And the charts tell us that they are likely to go considerably higher. Consequently, conviction that inflation of producer and consumer prices will prove to be a temporary phenomenon is infected with doubt.

For those of us steeped in free market economics and with experience of the monetary and economic scene in the 1970s, the possibility of both inflation and recession occurring at the same time is less of a surprise. They called it stagflation, though the Keynesians never managed to reconcile the existence of the two conditions being present at the same time. The error, surely, is in Keynes’s denial of Say’s law, which postulates that we produce to consume. The Keynesian error was to ignore the plain fact that rising unemployment is the consequence of falling production first, so there can never be a general glut of goods in a slump which is the basis of Keynesian assumptions.

Consequently, we should concede that a return to stagflation, or worse, is eminently possible. And that rising bond yields from here are also possible, indeed even likely as the charts so clearly indicate. In the coming weeks and months as bond yields continue to rise dragging interest rates up behind them, the debate as to how to hedge this unexpected condition is bound to intensify. In one corner, we have gold, and in the other cryptocurrencies, headed by bitcoin. Both have their vocal enthusiasts.

But enthusiasm is not a sensible basis for an investment or trading strategy. It misleads investors and those seeking to protect their wealth from the debasement of currencies, which is what continuing and rising inflation of prices represents.

Sentiment driven investment tends to overlook important facts. In this article, I compare the relevant facts from very basic legal and monetary standpoints, first for cryptocurrencies represented by bitcoin and then for gold.

Bitcoin as practical money

Bitcoin and crypto currency fans argue that they are the future money. Bitcoin in particular is seen as incorruptible, secured, and self-audited on a blockchain. It is strictly limited to its hard cap of 21 million coins. It is this limitation which has led to estimates of its future value in fiat currency, depending on how much more fiat currency debasement a forecaster expects. And it can be convincingly argued that the fiat currency debasement rate is likely to accelerate further as stagflation returns, leading to ever greater government deficits and escalating increases in government debt. This might be expected to lead to a resurgence in interest in bitcoin, taking it to new highs.

Enthusiasts argue that bitcoin will increasingly replace fiat as the general public begins to realise that fiat currencies are losing purchasing power, which is why the general level of prices is rising. But we must make a distinction between using a currency, crypto or otherwise for day-to-day transactions and as a store of value. In the former case, the possession of currency resulting from the sale of something is temporary, so its changing value in terms of goods over time is of little interest to the seller of goods who receives it in payment. But it does matter to the saver with a longer time horizon.

Saving, or more correctly hoarding in the case of bitcoin, is the issue which we must address. To a saver an increasing purchasing power for currency units in which his savings are denominated is desirable. Therefore, it is likely that savers will hoard their bitcoin instead of letting them circulate because the hard stop on their quantity would be expected to continually increase its value. So powerful is this deflationary tendency likely to be that other than for bare essentials, all commerce, currently depending on credit, would grind to a halt. Taken to its logical conclusion, the world would simply regress to a feudal state with mass poverty.

The solution can only be for holders of bitcoin to lend their bitcoin to borrowers so that commercial activities could take place. This is credit and is the basis of all banking and all economic progress. The need for credit will not go away with the end of fiat currencies, nor will its counterpart, debt. Indeed, the possession of debt obligations is wealth and makes up the majority of it. I shall go into this topic later in this article. But for now, let us consider the difference between bitcoin and bitcoin credit.

In order to produce anything, capital is required. It is a simple fact that production precedes consumption. It can take years for factories to be built, and people with the relevant skills trained and employed. Most if not all of this funding requires credit. It entails a business plan to take all cost factors including the cost of funding into account in order to estimate a project’s viability.

When assembling a business plan, not only does an entrepreneur have to estimate all the input costs and the product’s final sales value, but he has to estimate the cost of repaying borrowed capital. But presumably, a hard stop of 21 million bitcoins will lead to higher bitcoin costs of future capital repayments. Uncertainty as to what bitcoin’s future value would be will likely scupper most projects, even before the difficulty of predicting future demand for goods priced in rising and volatile bitcoin. Bitcoin’s limitations would almost certainly lead to an intensely deflationary outlook, because it is simply not suited as a basis for valuing credit.

In this respect, bitcoin is fundamentally different from gold, the extraction of which in the long term has grown roughly in step with the world’s population. Furthermore, there are substantial reserves of above ground gold in the form of jewellery, which can be reallocated to monetary functions if markets demand its change of use. The flaw in the bitcoin as money argument is gold’s strength: its unsuitability to act as backing for credit, and its total inflexibility of supply.

I am not aware that anyone in the bitcoin camp has properly addressed these issues or is even aware of them. It appears that hodlers do not understand how dependent humanity is on credit. Instead, they tend to dismiss credit as being the problem. Nor is there any understanding of the relationship between money and credit in a functioning, stable economy. The very conditions which are supposed to give bitcoin its value as incorruptible currency are enough to render it entirely unsuited to act in that capacity.

The dismissal of credit is even before we are asked to swallow the fact that it is wholly inappropriate for the vast majority of users who are not tech savvy enough to even understand it. A currency must be simple enough to be understood by its users. The promotion of bitcoin and other cryptocurrencies is the dream of an elite of technological literates and speculators hitching a ride on its concepts.

Then there is the legal position. In the absence of specific legislation passed to give bitcoin or any other cryptocurrency the legal status enjoyed by gold it does not have the legal status required. Hodlers do not appreciate that legally only certain things can act as money.

In order to understand the distinction between what can pass as money and what cannot, we must define the difference between the right of possession and the right of property. If I lend a book to a friend, I allow him to have a right of possession for a period of time, but it still remains my property. The property in the book has not been transferred to him. If I went to his house to collect the book, and he was not at home, I would be free to recover the book if I saw it (though out of politeness I should let him know that I’ve recovered my property). This in Roman law was referred to as a commodatum, which is defined as “a gratuitous loan of movable property to be used and returned by the borrower”.

Money and credit are treated differently, along with consumable items, such as food and drink. When these are loaned, the property in them transfers absolutely, in return for which an obligation by the receiver is created to restore the equivalent of similar quality and quantity. To continue on from the example of the commodatum, if instead of a book I had loaned my friend $100, and going to his home to recover his obligation to me I found he was away but saw his wallet left behind, and I took $100 from it, I would be guilty of theft.

In Roman law, the loan of money, credit, and items to be consumed is a mutuum, which is defined as “a loan of a fungible thing to be restored by a similar thing of the same kind, quality and quantity”.

While in the English language the use of the terms lend and loan are ambiguous, the difference between commodatum and mutuum is still clearly recognised by us all to this day, as the examples of the different treatment of a loaned book and $100 illustrate. The same conditions apply with respect to criminal theft. If a thief steals your car and sells it on to an unsuspecting buyer, it remains your property and you are fully entitled to recover it without compensating the hapless buyer. But if a thief steals your wallet, or empties your bank account, you only have recourse against the thief and your property in the money or credit is lost.

In this legal context, the question arising is in the treatment of fully identifiable bitcoins, whose possession is recorded on a blockchain. Clearly, if someone sells you a bitcoin in return for currency you receive it as entering into your possession. But if the bitcoin had previously been stolen, say from a crypto wallet, it was nobody’s to sell and it almost certainly remains the possession of the person it was stolen from. The point is that while each bitcoin, or fraction of a bitcoin has the same value as another, the blockchain means that each bitcoin or part of it has a specific identity. Therefore, it is not fungible like banknotes or credit, nor is it consumed and so it almost certainly cannot be a mutuum. The precedents in law therefore point to the property in it having not been transferred if in the past it was the proceeds of crime, so it must be regarded as a commodatum.

This is a significant problem for bitcoin, which has become the money laundering medium of choice for criminals and tax evaders. While in Roman times, criminality was more basic, today governments have extended it to include mere suspicion as grounds for property confiscation. Software allows investigators to link bitcoin wallets with real world identities, which are easily available to the authorities from crypto exchanges. Companies such as Chainalysis have been working with the FBI successfully to identify wallets linked with criminal activity. The trail from these wallets clearly leads to those who subsequently bought bitcoin and are under the impression they are now their property.

Therefore, you cannot be sure that the bitcoin you have bought through an exchange will not be seized by the authorities on the grounds that a previous owner acquired it through the proceeds of crime. You cannot be certain you have clear title. On legal grounds alone, without the certainty of ownership bitcoin cannot act as a general medium of exchange.

Why credit matters

In discussing the practicality of bitcoin as money, its unsuitability as a medium from which credit takes its value has been mentioned, and that enthusiasts appear to have overlooked this vital function. Indeed, the creation of bank credit is seen by many in both gold and bitcoin camps as evil and therefore they say that one of the key benefits of bitcoin is it does away with the creators of credit. Those following this line of reasoning fail to understand that all money and obligations to pay are in fact credit, representing the temporary storage of unspent production. Because all of our consumption has its origin in production, the medium of exchange is a matter of intermediation.

There are two distinct forms of this credit, one in which there is no counterparty, and it is only in the form of gold, silver, or copper coined for convenience. It cannot be anything else if we rule out barter. The proper term for coin is money, to distinguish it from promises to pay in money at a future date, which is credit.

As a right to future payment, credit is always matched by an obligation on the part of the debtor. Ultimately, that right and corresponding obligation are to be settled in money — though in practice, today they are novated by way of settlement into other credit. It is not the transfer of money, but nevertheless credit is a form of property. That credit is property and has value in terms of goods and services arises from its transferability. This is apparent in valuations of financial assets, which together with the possession of the property in physical objects make up a person’s wealth.

In any economy which has progressed beyond a feudal state, it is credit which makes up the vast bulk, if not all of the circulating medium. And the more perfected the economic system becomes the less money circulates. It is simply more convenient to use credit, whether it be bank notes, bank deposits, or individual credit agreements, such as exist between families and friends.

Legally, money has a general and permanent value, while credit has a particular and precarious value. The problem we have today is that these distinctions between money and credit are poorly understood. Those who profess to support “sound money” rarely appreciate this vital distinction, routinely stating that sound money is a policy and not a definition. Accordingly, they incorrectly assume that bank notes issued by a central bank is money when it is in fact credit with counterparty risk, whose value in terms of goods and services can become subverted.

This leads us into the topic of how credit is valued. All credit, including bank notes issued by government authority, must take its value from something. But without being a credible substitute for what the Romans originally defined as money the value of credit obligations becomes inherently unstable. Furthermore, abandonment of credit’s attachment to money encourages a government to spend beyond its tax revenues by debasing the currency, and that is what is happening today at an increasing rate. It is not credit, which is the evil, but its detachment from money.

The legal position and history of gold as money

As a medium of exchange, the function of money is to adjust the ratios of goods and services one to another. Thus, the price expressed is always for the goods, money being entirely neutral. It is therefore an error to think of money as having a price. This should be borne in mind in the relationship between legal money whether it be gold or silver, which is habitually given a price nowadays in fiat currencies, and the fiat currencies themselves which, given the status of legal tender, are erroneously assumed to have the status of money. The relationship between money and credit has become stood on its head. The magnitude of this error becomes clear with understanding what legally is money, and what is credit. Again, this understanding starts with Roman law.

Roman law became the basis for legal systems throughout Europe, and by extension those of European settled regions, from North America, Latin America through Spanish and Portuguese influence, the Dutch in the Far East, and the entire British Empire. In common with the Athenians, Rome held that laws were the means whereby individuals would protect themselves from each other and the state. But it was particularly Rome which codified law into a practical and accessible body of reference generally.

The first records of Roman statutes and the case law which followed were the Twelve Tables of 449BC. These became the basis upon which individual jurors subsequently expounded, developed, and evolved their rulings over the next thousand years. The whole legal system was then consolidated into the Emperor Justinian’s Corpus Juris Civilis, otherwise known as the Pandects. When the empire relocated to Constantinople, the Corpus was translated into Greek and eventually reissued in the Basilica, at the time of the Basilian dynasty in the tenth century. It was that version which became the foundation for European law in the Middle Ages, except for England. As an eminent nineteenth century lawyer specialising in banking put it, the reason common law differed in England was that:

“The Romans abandoned Britain at the end of the fifth century and the common law of England on the subject of credit was exactly as it stood in Gaius which was the textbook of Roman law throughout the empire at the time when the Romans gave up Britain. But on the 1st of November 1875, the common law of England relating to credit was superseded by equity which is simply the law of the Pandects of Justinian.”[i]

In all, two thousand years of legal development had elapsed between the Twelve Tables and the reaffirmation of Justinian’s Pandects in Dionysius Gottfried’s version in Geneva of the Corpus Juris Civilis, translated back into Latin in 1583AD from the Greek Basilica.

It is the Digest section of the Corpus which is relevant to our subject. The Digest is an encyclopaedia of over nine thousand references of eminent jurors collected over time. Prominent in these references are those of Ulpian, who died in 228AD and was the juror who did much to cement the legal position and distinction between money and credit. The Digest defined property, contracts, and crimes. Our interest in money and credit is covered by rulings on property and contracts.

The regular deposit contract is defined by Ulpian in a section entitled Deposita vel contra (on depositing and withdrawing). He defined a regular deposit as follows:

“A deposit is something given another for safekeeping. It is so called because a good is posited (or placed). The preposition de intensifies the meaning, which reflects that all obligations corresponding to the custody of the good belongs to that person.”[ii]

Another jurist commonly cited in the Digest, Paul of Alfenus Varus, differentiated between the regular deposit contract defined by Ulpian above and an irregular deposit or mutuum. In this latter case, Paul held that:

“If a person deposits a certain amount of loose money, which he counts and does not hand over sealed or enclosed in something, then the only duty of the person receiving it is to return the same amount.”[iii]

So, a mutuum is taken into the possession of the person receiving it. In return for a right of action in favour of the depositor to be exercised by him at any time, the receiver has a matching duty to return the same amount until which it becomes the receiver’s property to do with as he wishes. This is the legal foundation of modern banking.

Clearly, the precedent in the Digest is that money is always metallic. While anything can be deposited into another’s custody, it is the treatment of fungible goods, particularly money, which is the subject of these legal rulings. It is only through an irregular deposit (or mutuum) that the depositor becomes a creditor. By laying down the difference between a regular and irregular deposit, the distinction is made between what has always been regarded as money from ancient times and a promise to repay the same amount, which we know today as credit and a matching obligation to pay.

There is still one issue to clarify, and that is to do with credit rather than money. As noted above, Justinian’s Pandects were compiled a century after the Romans had abandoned Britain. From what was subsequently unified as England and Wales out of diverse kingdoms, common law differed in that debts were not freely transferable. The transferee of a debt could only sue as attorney for the transferor. This placed debt as property in a different position from other forms of transferable property. Justinian took away this anomaly as a relic of old Roman law (the laws of Gaius, referred to above), allowing the transferee to sue the debtor in his own name. Without this amendment, the status of a particular and precarious debt as an asset would be in doubt.

This anomaly in English law was only regularised when the Court of Chancery merged with common law by Act of Parliament in November 1875. Since then, the status of money and credit in English law has conformed in every respect with Justinian’s Pandects.

While the legal position of money is clear, the economic position is technically different. Jean-Baptiste Say pointed out that money facilitates the division of labour. Technically, money is unspent labour, and is therefore a credit yet to be used. Various other classical economists made the same point. Adam Smith wrote that a guinea might be considered as a bill for a certain quantity of necessaries and conveniences upon all the tradesmen in the neighbourhood. Henry Thornton said that money of every kind [including credit] is an order for goods. Bastiat and Mill opined similarly.[iv] The similarity of function between money and credit has undoubtedly led to confusion over the true meaning of terms.

But it is the legal difference which is of overriding importance because it was founded on the principal that there is a clear distinction between metallic money and a duty to pay. Money is permanent while credit is not. Money has no counterparty risk, whereas credit does.

The modern belief that money can be done away with and substituted with banknotes is therefore incorrect. And it is common ignorance of the established relationship between money and credit both in law and in practice which has led to the error of thinking that bitcoin can be the new money for modern times. Accordingly, we must put any such thoughts out of our minds.

The future of cryptocurrencies

It has been easy to point to the benefits of the cryptocurrency revolution. The blockchain concept promises a transformation in the recording of property ownership. And the popularity of bitcoin has alerted a wider public to the debasement of fiat currencies by governments — that surely is a public good. But it appears to have done nothing to enhance anyone’s understanding of money and credit.

The crypto revolution has created a potential evil in the form of central bank digital currencies, originally conceived by central bankers, seemingly ignorant of their own craft as a response to the threat from private sector money to their fiat monopolies. Their ignorance is of the legal position described above: after all, to detach a national fiat currency from legal money requires a denial of the true, legal position on the part of the perpetrator.

Central banks further demonstrated their denial of the laws of money by appointing a committee of the Bank for International Settlements, which coordinates central bank policies, to examine the benefits of a CBDC to a central bank and its government. Pursuing statist interests, the BIS committee’s conclusion is that CBDCs could give governments totalitarian control over economic activity. Nowhere has the legal position established millennia ago been respected, or even mentioned in their deliberations.

The reason the legal position of gold as money has persisted as authoritarian governments have come and gone is that the Romans defined an entirely natural relationship between money, what it is, and credit. Originally, money was and still is determined by people who are its users. And they create credit based upon money’s value. The practice evolved from the creation of credit based on goods that could be bartered. Credit must have been the way the Phoenicians financed their trade long before their city-states took to the convenience of coining metals, thought to be at about the same time as Rome’s Twelve Tables.

While the Romans paid close attention to the practicalities of trade and the natural evolution of payment in gold, silver, copper, or bronze coin and embodied it in their law, the state theory of money has always failed. The introduction of CBDCs is just another state theory of money. And while it promises to further the objectives of authoritarianism, it is bound to fail as well.

The sheer impracticalities involved have already caused the Bank of England in its White Paper to reject the BIS’s central proposition, that a sterling CBDC will bypass the commercial banking system and be totally under a central bank’s control. The reasons for the Bank’s approach are entirely sensible: the bureaucracy involved in setting up a CBDC, with everyone and every business required to open an account at the Bank of England would take years in the planning, testing, and implementation. And in the US, where the large majority of lawmakers depend on contributions from the banks to fund their election expenses, we can be certain that if any CBDC proposition was to be put forward by the Federal administration, it would be heavily watered down so as to not undermine existing banking interests.

The fate of the entire CBDC saga is likely to turn out to be a red herring. And in this article, I hope I have demonstrated convincingly the impossibility that bitcoin or any other cryptocurrency can fulfill the role of a currency. There only remains the question over their future if this role is denied to them.

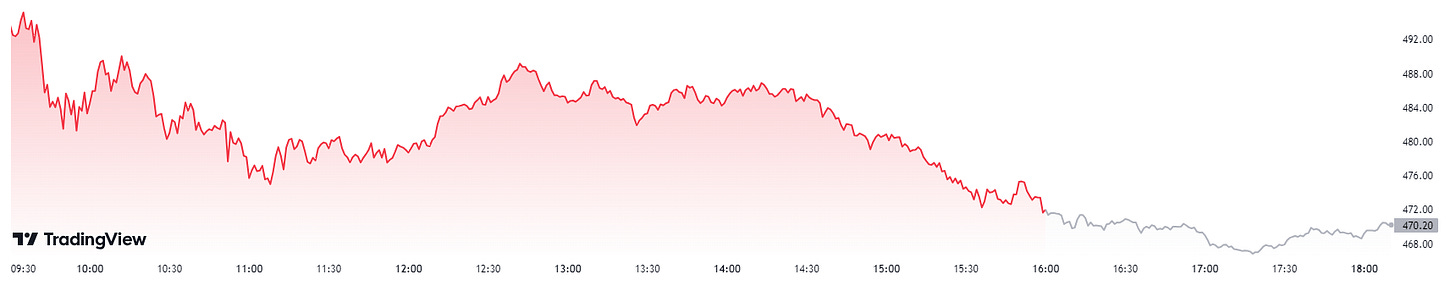

It is now 52 years since the dollar and all other currencies with it became entirely fiat. While it is beyond the scope of this article to describe the factors involved, there is growing evidence that the current dollar-based fiat currency episode, like all others before it, is coming to an end. That being so, we can expect a new monetary system to replace it. But with bitcoin not suited to the task, we can be sure that the reason for bitcoin’s existence will turn out to have been purely speculative.

Therefore, when fiat dies, we can expect the whole cryptocurrency and the CBDC phenomenon to die with it. Mark it down as a modern Mississippi venture, or South Sea Bubble, both of which owed their existence to speculative excesses financed by credit — just like bitcoin.

50% OFF ALL SUBSCRIPTIONS: Subscribe and

50% OFF ALL SUBSCRIPTIONS: Subscribe and