Key Events This Week: It’s A Slow Start To The Unofficial Beginning Of Fall

After a burst of activity in the last week of August, and the summer, we start the first unofficial week of Fall with a slew of traders coming back from the Hamptons and a relatively muted calendar, which includes US factory orders (tomorrow) and more interestingly the ISM services and trade balance on Wednesday (economists expect the ISM gauge to drop to 52.5 from 52.7 in July). Consumer credit data on Friday will round out the week, and will be notable to watch after last month’s unexpected plunge in revolving credit, which turned negative for the first time since covid.

As DB’s Jim Reid notes, this week will be an interesting one for central banks. The RBA are expected to stay on hold tomorrow following recent softer data (Lowe’s final meeting) and then the BoC will now more likely stay on hold on Wednesday following a surprising -0.2% fall in Q2 GDP on Friday against expectations of +1.2%. Later on Wednesday the Fed’s Beige Book will show whether the strong start to Q3 US data is corroborated. Over in Europe, highlights include ECB’s consumer expectations survey and inflation expectations tomorrow. In addition, we will see the BoE’s Decision Maker Panel survey on Thursday as well as a long list of ECB speakers throughout the week, as there are with the Fed ahead of the coming quiet period. In Asia, two appearances from BoJ officials will also be of interest. That said, economists expects markets to be surprised if either emphasizes the need for policy normalization soon.

Back to economic data. Important releases for Germany include the trade balance on Monday and factory orders on Wednesday, followed by industrial production on Thursday. In France, similar indicators will be released, including the trade balance on Thursday and industrial production on Friday. Zooming out to the Eurozone-level data, the July PPI report tomorrow and retail sales on Wednesday will be among the highlights.

Trade data will be among the highlights in China this week, with the release due on Thursday. The Caixin services PMI release tomorrow will round out other PMI reports released last week that showed an improvement in manufacturing but a miss in the official non-manufacturing gauge.

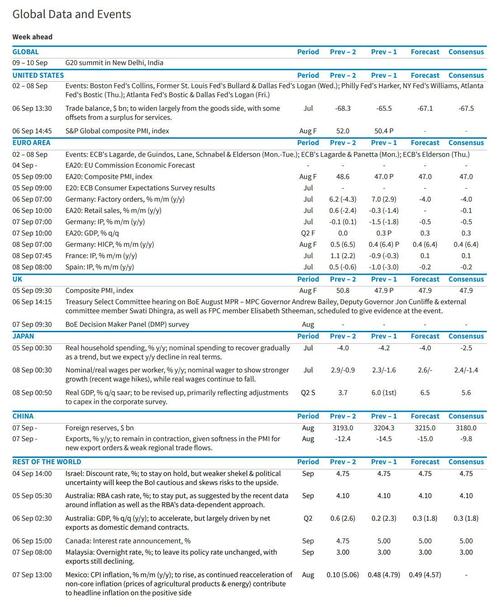

Below is a day-by-day calendar of events

Monday September 4

- Data: Japan August monetary base, Germany July trade balance

- Central banks: ECB’s Elderson, Nagel and Lane speak

Tuesday September 5

- Data: US July factory orders, China August Caixin services PMI, UK August official reserves changes, new car registrations, Japan July household spending, Italy August services PMI, Eurozone July PPI

- Central banks: ECB’s Lagarde, Schnabel and Guindos chair panels, ECB’s Visco speaks, RBA decision, ECB CES inflation expectations data

- Earnings: Partners Group

Wednesday September 6

- Data: US August ISM services, July trade balance, UK August construction PMI, Germany August construction PMI, July factory orders, Eurozone July retail sales, Canada Q2 labor productivity, July international merchandise trade

- Central banks: Fed’s Beige book, BoC decision, Fed’s Collins and Logan speak, BoJ’s Takata speaks

Thursday September 7

- Data: US initial jobless claims, China August trade balance, foreign reserves, Japan July leading and coincident indices, Italy July retail sales, Germany July industrial production, France Q2 total payrolls, July trade balance, current account balance, Canada July building permits

- Central banks: Fed’s Bostic, Williams and Harker speak, BoJ’s Nakagawa speaks, ECB’s Wunsch, Villeroy, Holzmann, Knot and Elderson speak, BoE’s DMP survey

Friday September 8

- Data: US Q2 household change in net worth, July wholesale trade sales, consumer credit, Japan August Economy Watchers survey, bank lending, July trade balance, labor cash earnings, BoP current account balance, France July industrial and manufacturing production, Canada Q2 capacity utilization rate, August jobs report

- Central banks: Fed’s Bostic and Logan speaks

Looking at just the US, Goldman writes that the key economic data release this week is the ISM services report on Wednesday. There are many speaking engagements from Fed officials this week, including governors Bowman and Barr, and presidents Williams, Collins, Logan, Harker, Goolsbee, and Bostic.

Monday, September 4

- There are no major economic data releases scheduled. The NYSE is closed for the US federal holiday.

Tuesday, September 5

- 10:00 AM Factory orders, July (GS -2.5%, consensus -2.5%, last +2.3%); Durable goods orders, July final (last -5.2%); Durable goods orders ex-transportation, July final (last +0.5%); Core capital goods orders, July final (last +0.1%); Core capital goods shipments, July final (last -0.2%)

Wednesday, September 6

- 08:30 AM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will discuss the economy and policy outlook at an event hosted by the New England Council in Boston. On August 24, Collins said, “I am not yet seeing the slowing that I think is going to be part of what we need for that sustainable trajectory to get back to 2% [inflation] in a reasonable amount of time…that resilience really does suggest we may have more to do.” She added, “We may be near, we could even be at a place where we would hold…But certainly additional increments are possible, and we need to look holistically and be really patient right now and not try to get ahead of what the data will tell us as it unfolds.”

- 08:30 AM Trade balance, July (GS -$68.0bn, consensus -$68.0bn, last -$65.5bn)

- 09:00 AM Ex-Fed official Bullard speaks: Former St. Louis Fed President James Bullard will participate in a live discussion with NABE President Julia Coronado. The hour-long webinar will include audience questions.

- 09:45 AM S&P Global US services PMI, August final (consensus 51.2, last 51.0)

- 10:00 AM ISM services index, August (GS 52.7, consensus 52.5, last 52.7): We estimate that the ISM services index was unchanged at 52.7 in August. Our forecast reflects net improvement in business surveys (services tracker +0.3pt to 52.7) but the pullback in the stock market and our GSAI.

- 02:00 PM Beige Book, September FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the July FOMC meeting period noted that overall economic activity increased slightly since late May. Consumer spending was mixed, manufacturing activity edged up in half the districts and declined in the other half, and demand for residential real estate remained steady. Overall expectations for the coming months continued to call for slow growth. In this month’s Beige book, we look for anecdotes related to growth, sentiment, and the evolution of labor market tightness and inflationary pressures.

- 03:00 PM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will take part in a community listening session to explore economic issues facing the Lubbock area. On July 6, Logan said, “I remain very concerned about whether inflation will return to target in a sustainable and timely way…the continuing outlook for above-target inflation and a stronger-than-expected labor market calls for more restrictive monetary policy.”

Thursday, September 7

- 08:30 AM Nonfarm productivity, Q2 final (GS +3.2%, consensus +3.4%, last +3.7%); Unit labor costs, Q2 final (GS +2.0%, consensus +1.9%, last +1.6%): We expect a 0.5pp downward revision to nonfarm productivity growth to +3.2% (qoq saar) in the final Q2 reading. We expect growth in unit labor costs—compensation per hour divided by output per hour—to be revised up by 0.4pp to +2.0%.

- 08:30 AM Initial jobless claims, week ended September 2 (GS 225k, consensus 234k, last 228k); Continuing jobless claims, week ended August 26 (consensus 1,715k, last 1,725k)

- 10:00 AM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will discuss the future of fintech in a speech at the Philadelphia Fed’s seventh annual Fintech Conference. On August 24, Harker said, “Right now I think that we’ve probably done enough…We are in a restrictive stance, do we have to keep going even more and more restrictive?” He added, “What I’ve heard loud and clear through my summer travels is, ‘please, you’ve gone up very rapidly.’ We need to absorb that.”

- 11:45 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver welcome remarks at the bank’s Fourth Annual Career Pathways in Economics and Related Fields Conference. On August 25, Goolsbee said, “I don’t know [if we’re done raising the fed funds rate] …It does feel like we’re in a period where if conditions keep going like what we’ve seen the last couple of months, our argument is going to revolve around how long should we keep rates at the level they are at rather than how much higher should the rates go.”

- 02:00 PM St. Louis Fed Hosts Public Engagement on Presidential Search

- 03:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a moderated discussion at the Bloomberg Market Forum. On August 2, Williams said, “Monetary policy is in a good place — we’ve got the policy where we need to be…Whether we need to adjust it in terms of that peak rate — but also how long we need to keep a restrictive stance — is going to depend on the data.” He added, “I expect that we will need to keep a restrictive stance for some time…Eventually, monetary policy will need over the next few years to get back to a more normal — whatever that normal is — a more normal setting of policy.”

- 03:45 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss the economic outlook in a moderated conversation with Broward College president Gregory Haile. An audience Q&A is expected. On August 31, Bostic said, “I feel policy is appropriately restrictive. We should be cautious and patient and let the restrictive policy continue to influence the economy, lest we risk tightening too much and inflicting unnecessary economic pain…that does not mean I am for easing policy any time soon.”

- 04:55 PM Governor Bowman speaks: Federal Reserve Governor Michelle Bowman will participate in a panel discussion at the Philadelphia Fed’s annual fintech conference on the future of money and consumer protection. A moderated Q&A is expected. On August 5, Bowman said, “I also expect that additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2% target…We should remain willing to raise the federal funds rate at a future meeting if the incoming data indicate that progress on inflation has stalled.”

- 07:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will deliver remarks at an event hosted by the Greater Fort Lauderdale Alliance. A Q&A with audience is expected.

- 07:05 PM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will discuss monetary policy at an event hosted by the Dallas Business Club at Southern Methodist University. Speech text is expected.

Friday, September 8

- 09:00 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will discuss payments innovation at the Philadelphia Fed’s annual fintech conference. Speech text and a moderated Q&A with audience are expected. Bloomberg reported last week that US regulators issued liquidity planning notices to regional lenders.

- 10:00 AM Wholesale inventories, July final (consensus -0.1%, last -0.1%)

Source: DB, Goldman, Barclays

Tyler Durden

Mon, 09/04/2023 – 12:50

via ZeroHedge News https://ift.tt/C4FjEPs Tyler Durden