A Tale Of Two Yuans & The Ongoing Dollar Saga

Authored by Simon White, Bloomberg macro strategist,

The divergence between the yuan’s weakness versus the dollar and its strength against most other currencies is driven principally by the primary trend in the greenback.

This curtails the effectiveness of China’s efforts to limit further downside in its currency against the dollar.

China today announced further measures to rein in dollar strength versus its currency, by attempting to curb speculation and one-way bets on the yuan.

This follows the US currency hitting an all-time high against the Chinese unit.

Despite this weakness, the yuan has continued to strengthen against the yen. Japan’s currency has faced ongoing pressure as the BOJ maintains one of the loosest monetary policies in the world.

The yen bounced today on the back of speculation Japan may soon lift its short-term rate out of sub-zero territory.

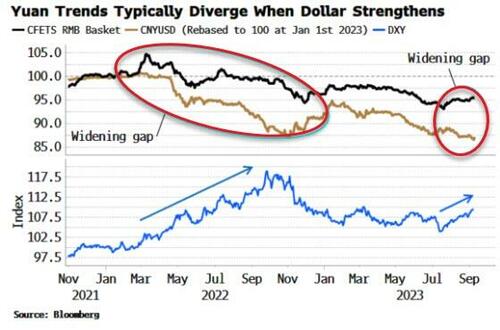

The bigger picture, though, when it comes to the yuan, is the dollar. In recent years, dollar strength has coincided with yuan weakness against the US currency, but strength against the FX basket.

When the dollar is in an uptrend, the yuan weakens more against it than it does against other currencies, meaning the yuan rallies against those other currencies (or sells off less than them). This can be seen in the chart below.

The dollar has risen in recent months, but is short-term overbought, and its primary trend remains down. Medium-term leading indicators (the real yield curve, long-run short-term rate expectations), as well as structural ones (the Treasury put, and a historically large Fed balance sheet) anticipate the downward trend in the dollar that began last October will re-assert itself.

That will at the margin support liquidity in China. Money and credit data released today (M1 and M2 growth fell slightly from last month) shows China’s economy is still struggling to get a foothold, but a more stable currency against the dollar will limit capital outflow pressures, which will ease the fall in domestic liquidity (and in turn support global liquidity).

The dollar’s star may have peaked, but it has a long way to go before it is not consequential for global markets and economies.

Tyler Durden

Mon, 09/11/2023 – 12:25

via ZeroHedge News https://ift.tt/d8EQWuY Tyler Durden