Mediocre, Tailing 3Y Auction Sees Fewest Foreign Buyers Since October

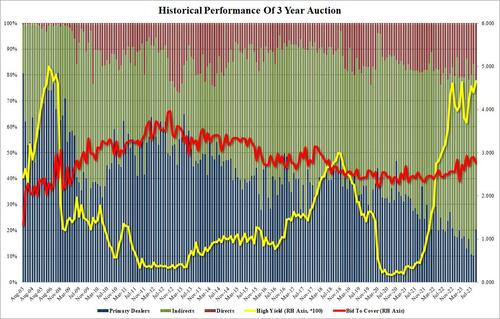

The Treasury’s first coupon auction came a day earlier, and instead of the usual Tuesday offering, moments ago Janet Yellen’s department sold $44BN in 3 Year paper at a yield of 4.660%, higher than last month’s 4.398%, and the highest since Feb 2007. The auction also tailed the 4.650% When Issued by 1 basis point, the first tail since June.

The Bid to Cover of 2.751 was below last month’s 2.901 – in fact, it was the lowest since June – and just below the six-auction average of 2.788.

Internals were on the soggy side, with Foreign official and private buyers (i.e., Indirects) taking down only 57.7%, the lowest since Oct 22, and well below the 67.0 recent average. And with Directs awarded 22.1%, the highest since June ’22, Dealers were left holding 20.3%, the highest since Nov ’22.

Overall, this was a subpar, lackluster 3Y offering, and one which if nothing else confirms that the prevailing demand for US paper is mediocre at best, which is hardly what the market wants to hear ahead of tomorrow’s 10Y benchmark sale. If this foreign demand for US paper continues to slide, how long before the Fed has to step in and start monetizing the US deficit all over again?

Tyler Durden

Mon, 09/11/2023 – 13:21

via ZeroHedge News https://ift.tt/7rgJEhH Tyler Durden