Futures Drift Lower Ahead Of CPI Report

S&P 500, Nasdaq 100 futures drifted lower overnight, and were last down modestly ahead of the US CPI release (previewed here), as European markets tumbled across the board on signs the region is quickly sliding into stagflation. As of 7:40am, S&P and Nasdaq 100 futures traded down 0.1% as Apple looked set for a second day of declines after China flagged security problems with iPhones, while saying it isn’t barring purchases. . The dollar remains steady ahead of the US CPI release due later Wednesday, while European stocks and German bunds slipped as markets boost bets on ECB policy tightening. Gold is down slightly and oil is up 0.68% rising to a new 2023 high after deficit warnings from the International Energy Agency.

In premarket trading, electric-vehicle makers including XPeng and Nio lead a drop in US-listed Chinese stocks after the European Union launched an investigation into Chinese subsidies for EVs. Apple fell 0.5%, erasing earlier gains, as China flagged security problems with iPhones. Here are some other notable premarket movers:

- Ford gains 1.6% after UBS double-upgrades its rating to buy from sell, citing greater-than-expected earnings resilience driven by the automaker’s Ford Pro segment.

- Grab fell 6.3% as some investors took money out for investing in IPO of Ryde, a smaller ride-hailing rival based in Singapore, according to Aletheia Capital.

- Rocket Pharmaceuticals shares jump 18% after the gene-therapy developer said it’s in alignment with the US Food and Drug Administration on the global Phase 2 trial of RP-A501 for Danon disease, which is a fatal inherited cardiomyopathy.

- Workhorse rose 18% after saying it received IRS approval as a qualified manufacturer for the Commercial Clean Vehicle Credit.

Arm Holdings Plc’s long-anticipated initial public offering is set to price Wednesday in the largest listing of the year. Arm is now looking to price the IP0 shares a dollar or more above the $47 to $51 target range, Bloomberg News reported.

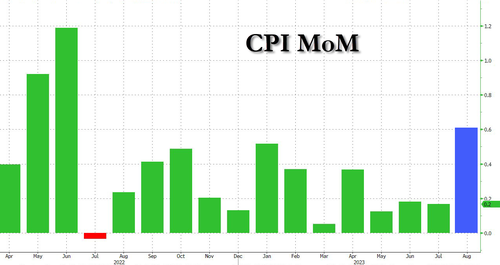

Traders are bracing for the US CPI data (full preview here) on Wednesday and a faster-than-forecast print would likely rattle markets given the economic concerns in Europe. Economists at Bloomberg Economics say a third month of subdued core inflation would bolster the case for the Federal Reserve to cease rate increases, although the recent surge in oil prices means that headline inflation is about to jump the most since Since 2022.

Here is a bank by bank summary of CPI forecasts:

- 3.7% – Barclays

- 3.7% – Citigroup

- 3.7% – HSBC

- 3.7% – UBS

- 3.6% – Bank of America

- 3.6% – Goldman Sachs

- 3.6% – JP Morgan Chase

- 3.6% – Morgan Stanley

- 3.6% – Wells Fargo

“Markets appear on edge ahead of US inflation and the ECB’s rate decision,” Citigroup Inc. strategists including Luis Costa and Alexander Rozhetskin wrote in a note. “With oil edging above $90, fears of stickier inflation are increasing, while some reports indicate that the ECB’s latest staff projection might prompt a more hawkish stance.”

The US data are expected to send a mixed message on the US economy, according to Bloomberg Economics. Monthly headline inflation is seen at 0.6%, while annualized core inflation will stay near the Fed’s 2% target for a third straight month.

“Given stocks are currently quite directionless a faster-than-expected CPI reading can raise investors nerves and refocus their minds on the risks of high energy price volatility,” said Janet Mui, head of market analysis at RBC Brewin Dolphin. “If both headline and core surprised up then it could trigger a negative market reaction.”

In Europe, the Stoxx 600 Index retreated 0.9% and the Stoxx 50 fell 0.7%. FTSE 100 outperforms peers, dropping 0.2%, IBEX lags, dropping 1.2%. Here are the most notable European movers:

- European auto shares rise, sending the Stoxx 600 Automobiles & Parts Index to its biggest intraday gain since July 27, after the EU began an investigation into Chinese subsidies for electric vehicles.

- HHLA shares jump as much as 48%, the most intraday on record, after a unit of MSC offered to buy part of the Hamburg port services provider for €16.75 per A-share.

- On The Beach shares gain as much as 15% after the online seller of packaged vacations forecast full-year adjusted pretax profit at the top end of market expectations.

- Aroundtown shares rise as much as 5.8% after Goldman Sachs raises PT on the stock by 15% to €1.50, saying the German real estate firm has “sufficient headroom” on debt leverage.

- Redrow shares gain as much as 4.1% after the UK homebuilder delivers an earnings statement which Goodbody says is “comforting.”

- TeamViewer shares rise as much as 3.4% in Frankfurt, the most in a month, after the German software maker said it will cut back on its sponsorship deal with Manchester United from the start of the 2024 to 2025 season to boost profits.

- AB Foods shares drop as much as 1.1% after Deutsche Bank cut its recommendation on the British conglomerate to hold from buy, citing limited scope for further earnings upside.

- Unieuro shares fall as much as 9.8% in Milan as Banca Akros downgraded the Italian consumer electronics chain to reduce from neutral.

- Knorr-Bremse, Alstom shares fall as Barclays rates the companies underweight, citing high valuations and headwinds.

- Kingspan shares decline as much as 3% after JPMorgan downgraded the stock to neutral from overweight, saying catalysts have largely played out for the company, while stocks in the construction sector could be vulnerable for the rest of the year.

Markets in Europe were looking past the US data to the ECB’s meeting on Thursday. After reports that the central bank’s new economic estimates will show an inflation forecast for 2024 above 3%, traders upped wagers on policy makers raising rates at the meeting to a 70% chance, compared with a 20% probability earlier this month. The German two-year yield — among the most sensitive to monetary policy — rose five basis points to 3.18%, the highest level since mid-August.

In the UK, the pound sank as much as 0.4% against the greenback, before paring losses. Data showed the economy shrank at the fastest pace in seven months in July as strikes and wet weather hit activity harder than expected. That may prompt a pause when policy makers decide next week whether to raise interest rates again.

Earlier in the session, Asian stocks slipped, with tech stocks in Japan and China leading the drop as traders geared up for the release of US inflation figures. The MSCI Asia Pacific Index fell as much as 0.4% as tech names including Alibaba, Hitachi and Tencent headlined the losses. All equity benchmark gauges in the region were in the red as caution reigned ahead of the US inflation print which is likely to help shape the outlook for Federal Reserve policy. There’s “a heightened risk” that the data may come in above consensus expectations, which will push up Treasury yields and “put a ceiling on the bulls” for the Asian equity benchmark, according to Kelvin Wong, senior market analyst at Oanda.

- A gauge of Chinese tech firms listed in Hong Kong headed for its longest run of declines since April, while a tech-heavy small-cap index in South Korea dropped more than 1%.

- Japan’s Nikkei 225 swung between gains and losses with early advances seen following mixed PPI data and the improvement in BSI large industry surveys, although the index eventually slipped with money markets now pricing the BoJ to exit negative rates in January compared to a previous pricing of an exit in September next year.

- Australia’s ASX 200 declined as tech stocks mirrored the underperformance seen in US counterparts and with nearly all sectors on the retreat aside from energy and utilities after further upside in oil prices.

- India’s Sensex index closed higher for the ninth straight session, its longest winning run since April, and outperformed regional peers as banks and energy companies rallied. The S&P BSE Sensex rose 0.4% to 67,466.99 in Mumbai, while the NSE Nifty 50 Index advanced by the same magnitude to close above the 20,000-mark for the first time ever.

In FX, the Bloomberg Dollar Spot Index edged up 0.2%, recovering from a 0.7% slide on Monday. All G-10 FX traded lower versus the dollar; NZD and CAD are the strongest performers in G-10 FX, SEK and AUD underperform. Sterling at ~$1.24 after UK GDP data. The pound tested a three-month low and the euro weakened. Traders ramped up bets price pressures will force the European Central Bank to hike rates at its meeting on Thursday even as the German government was said to predict a contraction for this year and the UK economy shrank at the quickest pace in seven months.

- EUR/USD falls 0.4% as investors wait to see whether the European Central Bank will hold off from raising interest rates at its meeting on Thursday

- GBP/USD slides 0.4%, approaching its lowest in three months after data showed that the UK labour market was showing signs of cooling

- USD/JPY climbs 0.8% to 147.42

Data dependence remains “the law of the land” when it comes to the dollar’s path, TD Securities strategists including Mark McCormick wrote in a note. “While our signals are currently biased in favor of the USD, we’re suspicious about the durability of the King’s return”

In rates, Treasuries traded near session lows reached during London morning amid bigger losses in bunds after Reuters reported that the European Central Bank expects inflation to hold above 3% next year. US yields are cheaper by 1bp-2bp across the curve led by long-end, steepening 2s10s, 5s30s spreads by ~1bp; US 10-year around 4.30% is 2bp cheaper on the day, bunds by an additional 2bp in the sector. Two-year TSY yields, which are more sensitive to Fed policy than longer maturities, stayed above 5%, while their 10-year peers held at 4. Short-dated European yields edged up, while UK gilts were little changed; European money markets shifted to price in a 25bp of rate hikes from the ECB this year, with 17bp of hike premium priced in for Thursday’s policy decision after the Reuters report dropped late Tuesday. Dollar IG issuance slate empty overnight and expected to be muted because of CPI; eleven names priced $19 billion Tuesday, taking weekly volume to $30 billion, and one elected to stand down. Treasury auction cycle concludes with $20 billion 30-year reopening; Tuesday’s 10-year stopped on the screws as it drew highest yield since 2007; WI 30-year yield at 4.380% is above auction stops since 2011 and ~19bp cheaper than last month’s. Focal points of US session are August CPI data and 30-year bond sale, following decent demand for Tuesday’s 10-year note auction.

In commodities, Crude gained after the IEA warned supply cuts by Saudi Arabia and Russia will drive volatility. West Texas Intermediate climbed for a second day and Brent extended gains above $92 per barrel as the IEA said production cuts will create a “significant supply shortfall.” Spot gold falls roughly $3 to trade near $1,911/oz.

To the day ahead now, and data releases include the US CPI print for August, along with UK GDP for July and Euro Area industrial production for July.

Market Snapshot

- S&P 500 futures little changed at 4,462.25

- MXAP down 0.2% to 161.48

- MXAPJ down 0.2% to 502.29

- Nikkei down 0.2% to 32,706.52

- Topix little changed at 2,378.64

- Hang Seng Index little changed at 18,009.22

- Shanghai Composite down 0.4% to 3,123.07

- Sensex up 0.5% to 67,530.25

- Australia S&P/ASX 200 down 0.7% to 7,153.91

- Kospi little changed at 2,534.70

- STOXX Europe 600 down 0.5% to 452.95

- German 10Y yield little changed at 2.66%

- Euro down 0.1% to $1.0740

- Brent Futures up 0.8% to $92.78/bbl

- Gold spot down 0.1% to $1,912.42

- U.S. Dollar Index little changed at 104.70

Top Overnight News from Bloomberg

- Tech stocks were in retreat as Oracle Corp. posted slowing cloud sales, while the euro and pound weakened on concern the Europe faces a growing threat of stagflation.

- The European Central Bank’s decision is a cliffhanger for investors, but even participants in the meeting have no inkling of the likely outcome, according to people familiar with the matter.

- The new Cold War is a business opportunity, and Mexico looks better placed than almost any other country to seize it.

- The global economy is shifting toward a higher-for-longer period for interest rates, making the coming flurry of monetary decisions across the developed world pivotal in mapping out that plateau.

- Apple Inc.’s biggest day of the year has arrived, and the company is set to unveil updated versions of its iPhone, smartwatch and AirPods.

- Arm Holdings Ltd.’s initial public offering is already oversubscribed by 10 times and bankers plan to stop taking orders by Tuesday afternoon, according to people familiar with the matter.

- The luxury armored train carrying North Korean leader Kim Jong Un crossed into Russia ahead of a summit with President Vladimir Putin that the US said would focus on supplying weapons for Moscow’s war on Ukraine.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured following the tech-led declines on Wall St owing to the post-Apple event disappointment and with participants cautious ahead of the upcoming US CPI data. ASX 200 declined as tech stocks mirrored the underperformance seen in US counterparts and with nearly all sectors on the retreat aside from energy and utilities after further upside in oil prices. Nikkei 225 swung between gains and losses with early advances seen following mixed PPI data and the improvement in BSI large industry surveys, although the index eventually slipped with money markets now pricing the BoJ to exit negative rates in January compared to a previous pricing of an exit in September next year. Hang Seng and Shanghai Comp were initially kept afloat amid strength in the energy names and with developers underpinned as some cities further loosened restrictions for the sector, but then conformed to the soured mood.

Top Asian News

- China will extend tariff exemptions for imports of some US products until April 30th, 2024.

- Japanese Finance Minister Suzuki said PM Kishida asked him to stay on in the current job in the cabinet reshuffle, while he added that they need to respond appropriately to market moves and will decide on the size and content of the new economic package from now on, according to Reuters.

- PBoC will support prices to rise moderately, and will pay close attention to the effect of financial policies, via Central Bank Publication. Will strengthen the guidance of expectations.

European bourses are in the red, Euro Stoxx 50 -0.8%, following on from risk-off sentiment seen in the Asian markets overnight. Within Europe, sectors are primarily in the red featuring underperformance in Retail and Consumer Discretionary following earnings from Inditex while Auto names saw marked upside after von der Leyen’s announcement on Chinese EVs, though much of this has since pared. Stateside, futures are marginally weaker with the general tone a tentative one ahead of the US CPI report, ES -0.1%; NQ & RTY in-fitting. As a reminder, Asia-Pacific stocks were pressured following the tech-led declines on Wall St owing to the post-Apple event disappointment and with participants cautious ahead of the upcoming US CPI data

Top European News

- Hamburg Port Surges on MSC Bid as Billionaire Kühne Circles

- ECB Says Italy Bank Tax May Create Problems of Legal Uncertainty

- Sharp Decline in UK Economy in July Revives Recession Risk

- Tullow Shares Slump 11% After 1H Miss, Oil Guidance Narrowed

- Kingspan Says Deal Discussions With Carlisle Have Ended

- Saudi Oil Cuts Threaten Surge in Price Volatility, IEA Warns

FX

- The DXY is on a modestly firmer footing overall, but caged to a tight range above 104.50 in the run-up to the US CPI metrics later today.

- EUR and GBP are modestly softer against the Buck whilst the GBP is modestly softer against the EUR following soft UK GDP data and hawkish ECB sources.

- The antipodeans trade on either side of the spectrum, with the NZD resilient against the Buck following yesterday’s notable losses, whilst the AUD remains subdued by the woes in China alongside the broader cautious mood ahead of the US inflation metrics.

- Substantial strength was seen in the Polish Zloty after the Polish PM’s Adviser said the PLN has weakened beyond the optimal level for Poland and added the optimal level for EUR/PLN is between 4.40-4.60 range.

- Polish PM Adviser says the PLN has weakened beyond the optimal level for Poland; says optimal level for EUR/PLN is between 4.40-4.60 range; have the tools to ensure the PLN is at an optimal level.

- PBoC set USD/CNY mid-point at 7.1894 vs exp. 7.2783 (prev. 7.1986)

Fixed Income

- EGBs are under modest pressure with participants skewing their expectations hawkishly following Tuesday’s late-doors ECB sources piece; BTP-Bund yield spread has hit multi-month highs as a result, though remains markedly shy of the YTD peak.

- Gilts are firmer in contrast following particularly soft GDP data which has prompted a number of desks to trim their UK 2023 growth view, though a 25bp hike in September continues to be the base case from a market pricing perspective.

- Stateside, USTs are a touch softer taking cues from the above EGB move with US participants entirely focused on the upcoming CPI release.

Commodities

- Crude benchmarks are modestly firmer following the rally seen yesterday, which resulted in the contracts settling higher by around USD 1.50/bbl apiece.

- The weekly Private Inventory data proved to be bearish, with builds seen in headline crude stocks; following on from bullishly-received OPEC OMR and subsequent Brent oil price forecast upgrade via the EIA.

- Spot gold is subdued amid the firmer Dollar, but the yellow metal’s prices remain north of USD 1,900/oz and in a tight range in the run-up to the US CPI report, with the 21 DMA to the upside at USD 1,916.44/oz while downside levels include yesterday’s low of USD 1,907.62/oz.

- Base metals meanwhile now trade relatively mixed and with the breadth of the market narrow as markets await the US CPI data, 3M LME copper is back towards the session highs above USD 8,400/t after finding a floor near USD 8,350/t overnight.

- US Energy Inventory Data (bbls): Crude +1.2mln (exp. -1.9mln), Gasoline +4.2mln (exp. +0.2mln), Distillate +2.6mln (exp. +1.3mln), Cushing -2.4mln.

- All Libyan eastern oil ports have reopened following a shutdown on September 9th due to a storm, via the port agent.

- Hungarian Farm Minister Nagy says they have agreed on a unilateral extension of the import ban on Ukrainian grains beyond September 15th, agreement with Romania, Slovakia and Bulgaria. Ban will be imposed on a broader range of products.

- IEA OMR: Maintains 2023 and 2024 global oil demand growth forecast steady; says extension of oil-output cuts by Saudi and Russia will lock in a substantial market deficit through Q4 2023; OPEC+ cuts tempered by sharply higher Iranian oil flows.

Geopolitics

- Russian-installed Governor of Sevastopol said Ukraine launched an air attack on Sevastopol in Crimea, while the air attack sparked a fire at Sevastapol’s shipyard and 24 people were injured, according to Reuters.

- Russian President Putin and North Korean leader Kim met at the Vosotchny Cosmodrome for talks. Russian President Putin responded that it is why they have come to the Vostochny Cosmodrome when asked if Russia will help North Korea build satellites, while he added that they will discuss all issues and that North Korean Leader Kim is showing a big interest in Russian rocket equipment.

- Romanian Defence Ministry says elements of possible drone found on Romanian territory (NATO).

- North Korea fired projectiles believed to be ballistic missiles which landed outside of Japan’s exclusive economic zone, according to NHK citing the Japanese Coast Guard.

- Taiwan’s Defence Ministry said 28 Chinese military aircraft entered Taiwan’s air defence zone on Wednesday morning and some Chinese aircraft crossed the Bashi channel to carry out drills with Chinese carrier Shandong, while it also showed a picture of a Taiwanese warship shadowing the Shandong.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications -0.8%, prior -2.9%

- 08:30: Aug. CPI YoY, est. 3.6%, prior 3.2%

- 08:30: Aug. CPI MoM, est. 0.6%, prior 0.2%

- 08:30: Aug. CPI Ex Food and Energy YoY, est. 4.3%, prior 4.7%

- 08:30: Aug. CPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%

- 08:30: Aug. Real Avg Weekly Earnings YoY, prior 0.2%

- 08:30: Aug. Real Avg Hourly Earning YoY, prior 1.1%

- 14:00: Aug. Monthly Budget Statement, est. -$230b, prior -$219.6b

DB’s Jim Reid concludes the overnight wrap

Welcome to what is likely to be the most inflationary monthly US CPI day since June 2022 when the headline YoY rate was 9.1%. This will be followed by a knife-edge ECB’s policy decision tomorrow where market pricing is now pointing to a 53% chance of a hike. So it doesn’t get much more finely balanced than that.

For the US CPI print today, our economists are expecting monthly headline CPI to come in at +0.61%, which as discussed would be the fastest pace of monthly inflation since June 2022 thanks to the impact of higher gasoline prices. That’s in line with the consensus for a +0.6% print, as well as inflation swaps that are pricing in a +0.64% print so broadly speaking that’s the level markets will be benchmarking against. Assuming we get a monthly 0.6% print, then that would push up the year-on-year CPI print by four-tenths to +3.7%. But since higher gasoline prices won’t affect the core CPI number, they see that coming in at just +0.22% on a monthly basis, which would take the year-on-year core CPI print down four-tenths to 4.3%. See their full preview here for further details.

Whilst energy prices are expected to push up the CPI print today, there was little sign of further relief in the pipeline ahead, since Brent Crude oil prices closed above $92/bbl for the first time since November. That came as data from OPEC showed that oil markets faced a 3.3 million barrel per day shortfall in Q4, which is creating a very tight market. It’s also led to a notable uptick in inflation expectations, with the 2yr US breakeven (+4.4bps) now at 2.24%, which is its highest level since late April. This drove the 2yr Treasury yield back above 5% and to its highest level in over two weeks (+3.0bps to 5.02%) but a decline in real rates meant that the 10yr yield still ended the day -0.9bps lower at 4.28%.

With fresh signs of inflationary pressures, investors also moved to price in a growing chance that the ECB would in fact go ahead with another hike tomorrow. In fact, overnight index swaps are now pricing a better-than-even chance of a 25bp hike at 53%, up from 41% on Monday and 24% a week earlier. So this is something markets have been taking increasingly seriously. Then late yesterday evening we saw a Reuters story saying the updated ECB forecasts will see 2024 inflation at above 3%, bolstering the case for another hike on Thursday, according to “a source with direct knowledge of the discussion”. While a 2024 inflation forecast a touch above 3% would not be a major surprise, such a story shortly before the meeting is rather unusual for the ECB. The euro initially rallied by around +0.30% against the dollar following the report but has given half back in Asia.

Against that backdrop, but before the Reuters report, sovereign bond yields moved modestly higher across Europe on Tuesday, with those on 10yr bunds (+0.4bps), OATs (+0.8bps) and BTPs (+0.7bps) all rising. And there were larger moves at the front-end, with yields on 2yr German debt up +3.1bps.

It was a different story in the UK, where yields on 10yr gilts fell by -5.6bps yesterday. That followed some weaker-than-expected employment data, with the number of payrolled employees falling -1k in August (vs. +30k expected). Furthermore, the unemployment rate over the three months to July rose from 4.2% to 4.3%, which is its highest level since September 2021. In response, investors moved to lower the odds of another hike from the BoE next week to 77.5%, which is the smallest chance of a September hike since early June.

Equities generally saw a weak performance yesterday, with the S&P 500 down by -0.57%, whilst Europe’s STOXX 600 also fell -0.18%. Tech stocks led the moves lower in the US, with the NASDAQ (-1.04%) and the “Magnificent Seven” (-1.52%) posting larger declines. That included Apple, which fell -1.71% after the company unveiled their new iPhone. The stock did partially recover late in the US session having traded -2.5% lower intra-day, and was actually a mid-ranking performer amid the “Magnificent Seven” by the end of the day (with Tesla the weakest at -2.23%). Staying with tech, Oracle (c.$300bn market cap) fell -13.5%, its’ worst day since 2002 after a cloud sales disappointment. On the other hand, energy stocks in the S&P 500 (+2.31%) were the biggest sectoral outperformer thanks to the latest rise in commodity prices. The Dow Jones index (-0.05%) and small cap Russell 2000 (+0.01%) were near flat.

Asian equity markets are softer this morning due to a sell-off in tech stocks. As I type, the Nikkei (-0.31%), Hang Seng (-0.14%), CSI (-0.66%), Shanghai Composite (-0.18%) and KOSPI (-0.12%) are edging lower. S&P 500 (-0.17%) and NASDAQ 100 (-0.13%) futures are also trading in the red.

In terms of data, producer prices in Japan rose +3.2% y/y in August (+3.3% expected), slowing from a revised +3.4% increase in the prior month.

Elsewhere, South Korea’s unemployment rate on a seasonally adjusted basis unexpectedly dropped to a record low of 2.4% in August from a level of +2.8% in July, thus putting pressure on the Bank of Korea to retain a hawkish bias.

There were a few other data releases out yesterday. One was the ZEW survey from Germany, where the current situation reading fell to a 3-year low of -79.4 (vs. -75.5 expected), but the expectations indicator ticked up to -11.4 (vs. -15.0 expected). Separately in the US, the NFIB’s small business optimism index fell to 91.3 in August (vs. 91.5 expected), ending a run of three consecutive increases in the measure.

To the day ahead now, and data releases include the US CPI print for August, along with UK GDP for July and Euro Area industrial production for July.

Tyler Durden

Wed, 09/13/2023 – 08:07

via ZeroHedge News https://ift.tt/zjPDJqF Tyler Durden