WTI Holds Yesterday’s Gains Despite Big Crude/Product Builds, US Production Hike

Oil prices extended gains overnight after EIA confirmed OPEC’s report that the world faces a huge supply shortfall.

Demand will eclipse supply by 1.2 million barrels a day on average during the second half, the IEA projected Wednesday. That follows a forecast from the Organization of Petroleum Exporting Countries that the fourth quarter may see the biggest deficit in more than a decade.

“The market is really tightening in the second half of the year,” Toril Bosoni, head of the IEA’s oil market division, said in a Bloomberg Television interview.

“We’re at risk of seeing continued tightness in the market, especially for distillates, coming into the winter months.”

The CPI print dragged oil prices lower (hot inflation, hawkish Fed, slower demand) into the DOE print.

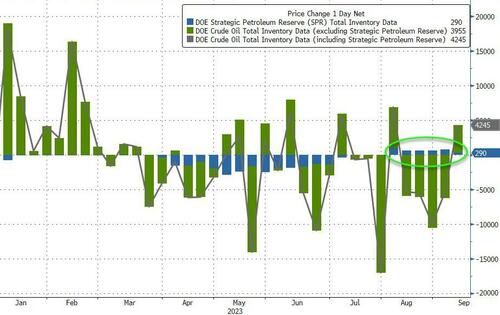

API

-

Crude +1.174mm (-1.9mm exp)

-

Cushing -2.417mm

-

Gasoline +4.21mm (-300k exp)

-

Distillates +2.59mm (+400k exp)

DOE

-

Crude +3.955mm (-1.9mm exp)

-

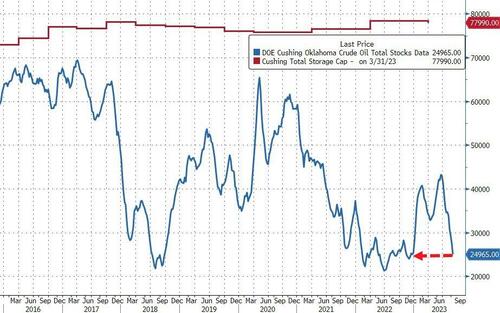

Cushing -2.45mm – 10th weekly draw of last 11

-

Gasoline +5.56mm (-300k exp) – biggest build since July 2022

-

Distillates +3.93mm (+400k exp)

The official data confirmed API’s report – an unexpected crude build and major builds in products (while Cushing stocks continue to draw)

Source: Bloomberg

The Biden admin added to crude stocks at the SPR for the 6th straight week…

Source: Bloomberg

Stocks at the Cushing hub dropped to their lowest since Dec ’22…

Source: Bloomberg

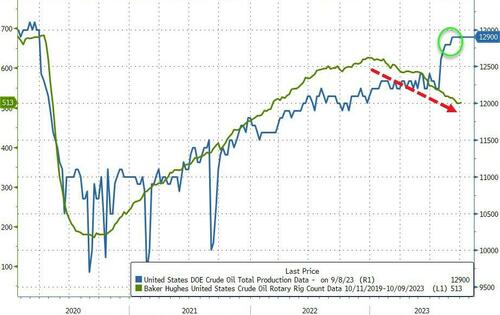

US crude production rose to post-COVID highs (despite the ongoing decline in rig count)…

Source: Bloomberg

WTI was trading just below $89 ahead of the official data release.

All of which leaves President Biden with a major problem. Inflation is resurgent (on the back of soaring gasoline prices) and looks set to go higher…

Source: Bloomberg

…but Biden’s strategic election-saving reserve is already at its lower limits and the diesel market is pricing in a crisis, one that could get soon get even worse because of a lack of the type of crude that’s good for making the fuel.

Tyler Durden

Wed, 09/13/2023 – 10:38

via ZeroHedge News https://ift.tt/x5DYrFX Tyler Durden