Bond Yields Blasted To 16 Year Highs; Stocks Sink Ahead Of Fed

Ugly Canadian CPI, surging crude prices (early – on Azerbaijan angst)), mixed housing data, and a trigger happy group of traders anxiously awaiting tomorrow’s Fed-sponsored narrative all sparked some chaotic moves in markets today.

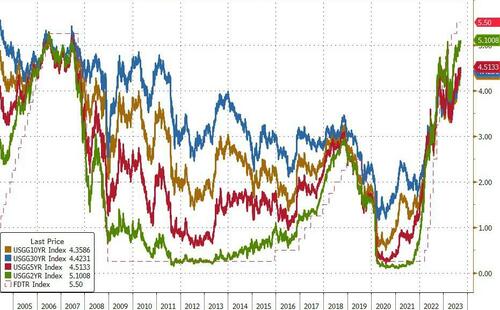

The headline-making market of the day is USTs today with a double-barf sending yields 5-7bps higher on the day…

Source: Bloomberg

Which pushed yields to their highest since 2007…

Source: Bloomberg

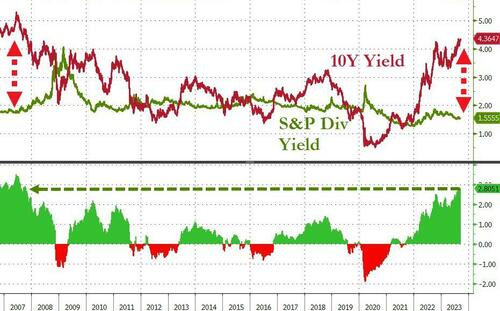

With bonds at their cheapest to stocks since Oct 2007…

Source: Bloomberg

At the very short-end of the curve, the market has really started to embrace the ‘higher for longer’ narrative as this year’s rate-change expectations have drifted (dovishly) lower (less expectations of more rate-hikes) while next year’s rate-change expectations have surged (hawkishly) higher, pricing out expectations of rate-cuts…

Source: Bloomberg

All of which pressured stocks lower – especially longer-duration assets. After Europe closed, the algos tried to lift the major indices back to unch but failed. All the major indices closed red (down 02. to 0.3% on the day)…

CART IPO’d at $30, opened at $42, rallied up to $42.95 before fading the rest of the day…

ARM fell back below its post-IPO opening price…

Regional banks keep falling – now back at SVB tumble lows…

The dollar chopped around but ended back in the very tight range of the last couple of days…

Source: Bloomberg

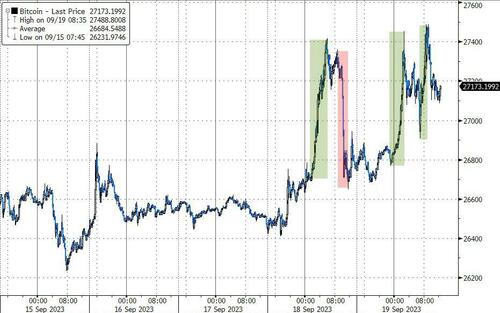

Bitcoin bounced back above $27,000…

Source: Bloomberg

Gold (spot) neared $1940 intraday, but ended unchanged…

Source: Bloomberg

Oil prices pumped (to new cycle highs) and dumped (WTI finding support at $90) to end practically unchanged…

Finally, with real yields hitting fresh highs, one wonders when reality hits for equity valuations?

Source: Bloomberg

Consider what kind of shift (down) in real yields it would take to rationalize this valuation (economic depression?)

Tyler Durden

Tue, 09/19/2023 – 16:00

via ZeroHedge News https://ift.tt/039B2ia Tyler Durden