Energy Stocks Surge After Biggest Short Squeeze In A Year

Over the past month we had repeatedly pointed out that at a time when oil and other energy commodities were soaring – and Brent last week surpassed the average price at which Biden drained the SPR so at least the US now has (almost) triple digit oil again but 200 million fewer emergency barrels of oil – energy stocks were rising but at a much slower pace (something which even JPMorgan highlighted on Friday in their wholesale upgrade of the energy sector).

dramatic disconnect between oil and energy stocks pic.twitter.com/VelHdd21K9

— zerohedge (@zerohedge) September 20, 2023

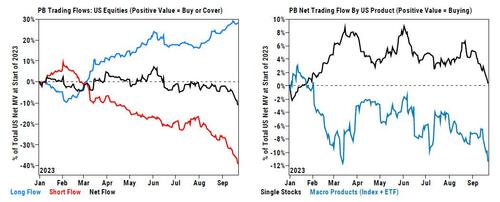

We also pointed out why it was that energy stock prices had remained so depressed even when underlying commodities were once again flying: hedge funds, which were buying up tech and AI names (just before the latest dump) were aggressively shorting energy stocks, pushing cumulative net trading flow to the shortest it has been this year as recently as early August, prompting us to predict an imminent short squeeze:

The next squeeze: HFs piling into energy shorts, praying oil stops rising.

good luck pic.twitter.com/F4qe2Dvnvh

— zerohedge (@zerohedge) August 12, 2023

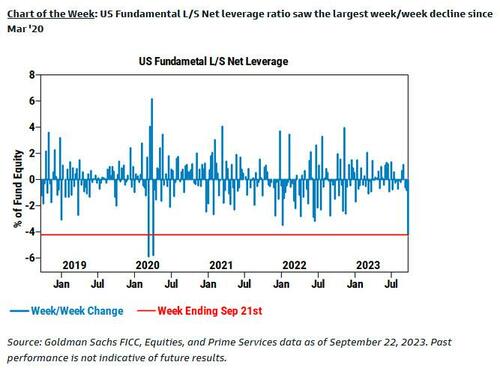

We were right, because not only did the XLE accelerate back to 2023 highs shortly after, but at a time when hedge funds just shorted the broader market at the fastest pace since Jan 2022…

… amid the biggest deleveraging in the hedge fund community since the covid crash (March 2020) as hedge fund net leverage absolutely imploded…

… one sector stuck out.

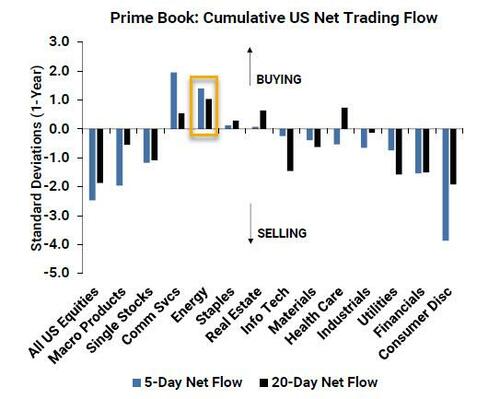

Indeed, as Goldman’s Prime Brokerage reported in its latest weekly analysis (discussed earlier here), “single stocks were net sold for a third straight week driven almost entirely by short sales” with 8 of 11 sectors were net sold on the week, led in notional terms by Consumer Discretionary, Financials, Health Care, and Info Tech.

Consumer Discretionary stocks saw the largest net selling since Dec ’21 (-3.9 SDs), driven by short-and-long sales (~3 to 1). Automobiles, Broadline Retail, and Specialty Retail were the most net sold subsectors.

But not every sector was shorted: “Energy stocks saw the largest net buying in a year (+1.4 SDs), driven by short covers and to a lesser extent long buys (1.8 to 1).”

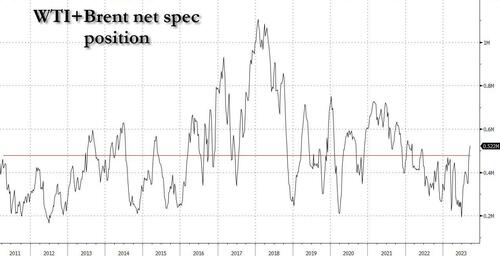

And as all those energy shorts are finally carted out wheel first and are forced to capitulate, we are seeing more of the same in oil, where after hitting a near-record low just a few months ago, WTI+Brent net specs have just barely managed to crawl above the average level for the past 12 years.

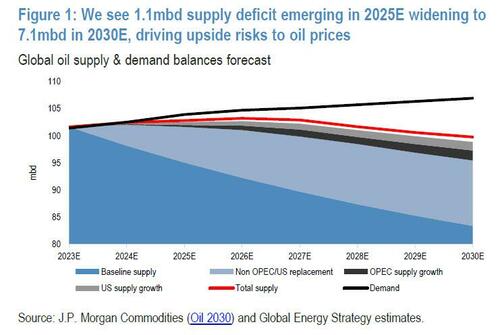

Should the squeeze accelerate, and assuming JPM is correct and the current 3 million barrel/day deficit extends to 7 million by 2030…

… it most certainly will, the net spec contracts in Brent+WTI would have to double before hitting their 2018 high, something that could happen in just a few months if not weeks. It’s also why would would not be very surprised if in 7 years Exxon is as big as Nvidia, or even Apple is today.

And we are not the only ones. As the FT reported late last week, hedge funds are piling into the oil market betting that prices will soon pass $100 a barrel.

Riyadh’s extension until December of a 1mn barrel a day oil cut, in addition to further cuts under its Opec+ target, has compounded Moscow’s move to limit exports and pushed prices for Brent crude, the international oil benchmark, to $95 a barrel this week, a fresh high for the year.

Quoting the same futures and options trader data we use every week, the FT concludes that hedge fund positioning had “exacerbated the near 30 per cent move higher in prices since June, with a surge in buying accelerating in the past two weeks for both Brent and US crude futures.“

Ole Hansen, head of commodity strategy at Saxo Bank, said that hedge fund interest in oil had been reignited by Saudi Arabia’s announcement at the start of this month that it would keep its voluntary production curbs in place longer than previously thought.

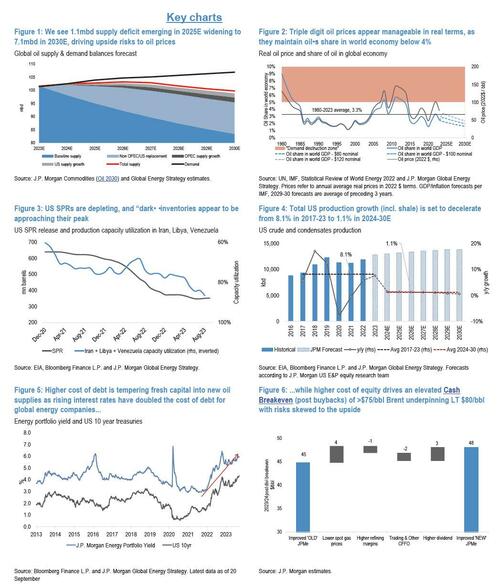

“That was the trigger,” Hansen said. “Suddenly everyone realised the market was set to keep going higher in the short term.” And not so short term, for various reasons explained by JPM including:

- More positive macro outlook (our preference is oil over gas owing to the former’s structurally positive characteristics and lower OPEC-mitigated volatility),

- in-the-money corporate cash breakevens (vs the forward strip), implying ~12% ‘24 FCF yields rising to ~15% at $100/bbl,

- Upside risks to EPS (we are ~10% higher than the street in 2024 (on MTM basis) having been ~10% below in January),

- Attractive valuations relative to the market underpinned by cash return yields >30%,

- In the event that global inventories continue to fall and a rising oil price environment, OPEC is likely to add in the next 12 months. Historically, this has been supportive for energy equities as it typically indicates improving underlying fundamentals (demand) – we show energy equities tend to outperform and positively decouple to oil on production adds (we note that although oil prices are up 30% since June when Saudi initiated the 1mb/d cut, equities have lagged, only up ~10% i.e. negatively decoupled).

Then again, with most financial professionals using oil and energy equities as their preferred way to hedge against the next recession, the oil bears are still in the majority.

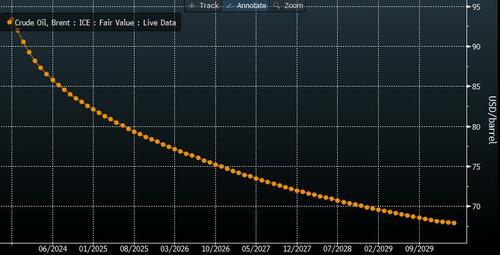

Doug King, chief investment officer at RCMA Asset Management — who runs the $300mn Merchant Commodity Fund — said he was not convinced oil would go that much higher as the strength in the market was being driven by Opec+ supply restraint, rather than particularly strong demand.

“The move higher is not massively structural, I think it’s more contrived,” said King. “We’re approaching the upper end of this move in my view, as if we get above $100 a barrel I suspect we’ll see more barrels leak on to the market.”

Other investors were using the options market to hedge against prices passing $100 a barrel before the end of the year. As of Friday, funds had bought about 37,000 call options in WTI expiring in December at a “strike” price of $115, according to Charlie McElligott, an equity derivatives strategist at Nomura. “Hot moves risk bringing in tourist buyers,” he said.

“The march to $100 [a barrel] seems relentless,” said Ehsan Khoman, head of research for commodities at MUFG Bank. “The question is how long does it stay there.”

Ryan Fitzmaurice, head index trader at broker Marex, said that oil currently looked like a “heavily momentum-driven market”, with spot prices for oil moving significantly above those for delivery later in the year, a market phenomenon known in the industry as backwardation.

While funds tend to concentrate trades in the front month, Fitzmaurice said oil producers were selling contracts for later delivery to lock in higher prices for future production. “That’s resulted in this extreme curve shape,” said Fitzmaurice.

Higher oil prices are already affecting wider stock markets. The Dow Jones US Airlines index has dropped 24% since July 11, with Delta Air Lines and American having slashed their third-quarter earnings forecasts because of rising fuel prices. The S&P 500 Energy index, in contrast, is up 11% over the same period, and is set to rise much more as all those funds who bet – poorly – on a continued meltup in AI and other stupid tech gimmicks, rotate right into the painful squeeze that is crushing energy shorts.

Tyler Durden

Mon, 09/25/2023 – 07:45

via ZeroHedge News https://ift.tt/wxyEUSz Tyler Durden