Massive Short-Squeeze Lifts Stocks; Bitcoin Jumps As Bullion & Black Gold Dumped

Inflation tumbling in Europe (German CPI), the American consumer hitting a wall (PCE), and the US housing market collapsing (pending home sales) were enough to actually – for once – drag Treasury yields lower on the day… and as yields decline so a bearish-sentiment-soaked equity market melted up to start the day.

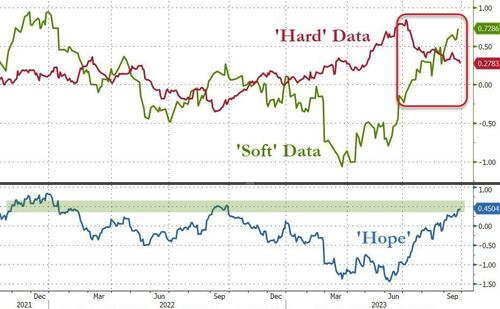

‘Hard’ data keeps sliding (lowest since May) but ‘hope’ remains alive thanks to ‘soft’ survey data…

Source: Bloomberg

An initial spike in yields on the headline GDP revision data quickly reversed (led by the short-end) as ‘humans’ read the report. By the close, 2Y yields were down 7bps and the long-bond down 1bp…

Source: Bloomberg

Which steepened the yield curve (2s30s) to its least inverted since May (steepening for the 5th day in the last 6)…

Source: Bloomberg

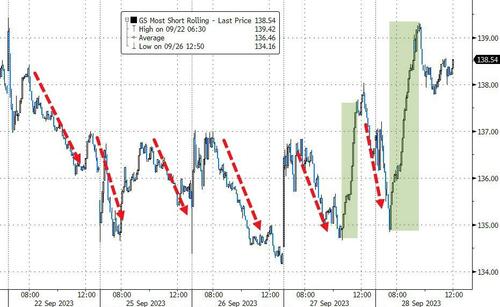

Of course, lower yields supported stocks (especially with such a dramatically bearish sentiment embedded) and ‘most shorted’ stocks were immediately aggressively squeezed and ripped almost 4% higher (remember negative gamma swings both ways)

Source: Bloomberg

And that lifted all the majors higher, led by Small Caps and Nasdaq. The Dow lagged on the day (lowest duration) but ended green on the day…

VIX slipped back further near 17.00…

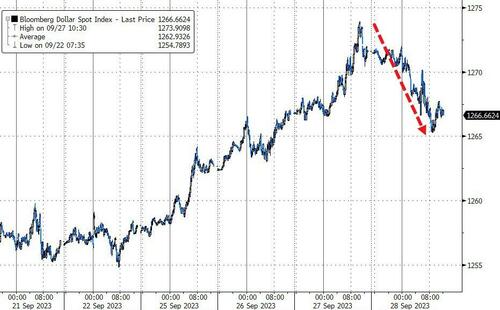

As yields declined, so the dollar slipped lower…

Source: Bloomberg

And as the dollar dropped, bitcoin popped, ramping back above $27,000…

Source: Bloomberg

But Gold legged lower again, back near the pre-SVB spike lows in March…

Source: Bloomberg

And so did crude oil, with WTI back below $92 (after tagging $95 overnight)…

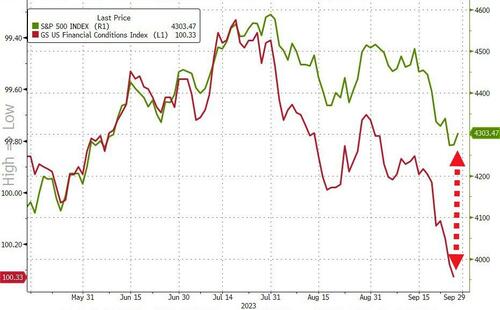

Finally, despite the recent decline4 in stocks, there remains a long-way-down to reconnect equity markets to the significant tightening in financial conditions…

Source: Bloomberg

So how will that reconnect? Equity market re-rating lower or a recession-signal rushing through the long-end of the curve, dragging yields lower (but, wait, that’s not good for stocks either?)

Tyler Durden

Thu, 09/28/2023 – 16:00

via ZeroHedge News https://ift.tt/QBGnwrS Tyler Durden