Eurozone Inflation Tumbles To Two-Year Low

There was good news on the crusade against inflation front on both side of the Atlantic.

As we reported earlier, core PCE – the Fed’s favorite inflation indicator – came in mostly in line and was still “sticky high”, even as sequential prints actually came below expectations, with core PCE up just 0.1% MoM, the lowest sequential increase since Nov 2020. Even the Fed’s mouthpiece, WSJ’s Nikileaks, had nothing but superlatives for today’s US PCE print, and pointing to the 3-month annualized numbers (Core goods: -2.6%; Housing: +5.4%; Core services ex-housing: +3.4%) said that “core services ex-housing rose 0.14% in August from July, the mildest MoM increase in three years.”

3-month annualized core PCE inflation

Core goods: -2.6%

Housing: +5.4%

Core services ex-housing: +3.4%Core services ex-housing rose 0.14% in August from July, the mildest MoM increase in three years pic.twitter.com/zGsddFbKT5

— Nick Timiraos (@NickTimiraos) September 29, 2023

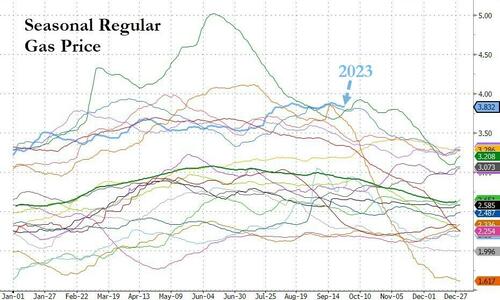

Of course, all that will change very fast, once the soaring oil and gas prices flow through to other industries – for context, gas prices have never been higher at this time of year…

… and headline inflation spikes sharply higher in the coming months. But until them, sentiment has clearly “doved out”, and the latest inflation data out of Europe only helped.

According to Eurostat, Eurozone inflation fell to its lowest level for almost two years, bolstering hopes that the biggest surge in consumer prices for a generation is fading fast and paving the way for the European Central Bank to halt interest rate rises, and even maybe cut rates once Europe’s recession get worse.

Headline CPI in the Euro area rose 4.3% in the year to September, down from 5.2% in August, and below the 4.5% consensus estimate. The last time inflation was lower was in October 2021. Core inflation, which excludes energy and food and is closely watched by the ECB as a gauge of underlying price pressures, also fell more than expected to 4.5%, down sharply from 5.3% in August.

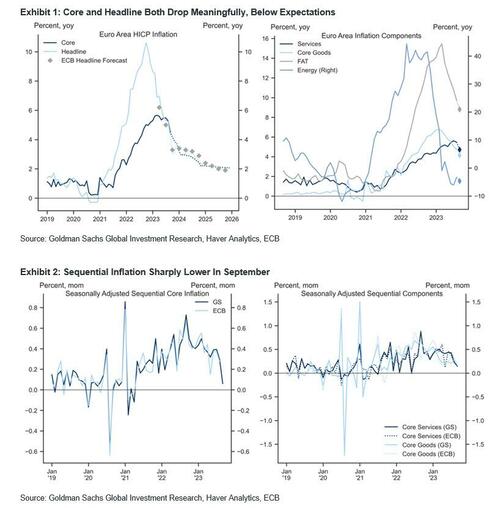

Commenting on the latest inflation data, Goldman wrote that “core HICP inflation fell 74bp to 4.55%yoy, notably below consensus expectations. Euro area headline HICP inflation fell 90bp to 4.34%yoy, also below expectations. We estimate that seasonally adjusted sequential core inflation was 0.15%mom, 13bp below the ECB’s estimate of the August pace. Within core inflation, we estimate that seasonally adjusted sequential core goods inflation was 0.16%mom (vs 0.30%mom in August), while sequential services inflation was 0.14%mom (vs 0.23%mom in August).” The bank updated its inflation forecast and now expects core and headline inflation to be 3.7%yoy (vs 3.9%yoy previously) and 3.8%yoy (vs 4.0%yoy previously) respectively in December 2023.

Some more details:

- 1. Euro area core HICP inflation fell 74bp (on rounding) to 4.55%yoy, notably below consensus expectations, while headline HICP inflation fell 90bp to 4.34%yoy, also below expectations.

- 2. The breakdown by main expenditure categories showed services inflation fell eight-tenths of a percentage point to 4.7%yoy, and non-energy industrial goods’ inflation fell five-tenths of a percentage point to 4.2%yoy. Of the non-core components, energy inflation fell 1.4pp to -4.7%yoy, while food, alcohol and tobacco inflation fell nine-tenths of a percentage point to 8.8%yoy (Exhibit 1).

- 3. Seasonally adjusted sequential core inflation was 0.15%mom on a bottom-up approach (0.06%mom top-down), compared with the ECB’s estimate of the August pace at 0.28%mom. Within core inflation, sequential core goods inflation was 0.16%mom, below the Q1 and Q2 averages of 0.43%mom and 0.23%mom, respectively. Sequential services inflation was 0.14%mom, below both the Q1 and Q2 averages of 0.46%mom and 0.43%mom respectively (Exhibit 2).

Price growth slowed in 15 of the 20 eurozone members and came in below the ECB’s 2 per cent target in two of them. Prices fell in the Netherlands by 0.3% from a year ago. The bloc’s highest inflation rate was 8.9% in Slovakia. The removal of last year’s cheap German public transport tickets and fuel prices from the annual comparison pushed inflation down, while France’s recent cut in its electricity subsidy lifted energy prices.

The sharp slowdown in inflation added to investors’ hopes that the ECB will end its unprecedented string of 10 consecutive interest rate increases when its governing council meets on October 26.

“This reinforces our view that the ECB has finished raising interest rates,” said Jack Allen-Reynolds, an economist at research group Capital Economics, according to the FT. “Nevertheless, we continue to think that the bank won’t start cutting rates until late 2024.”

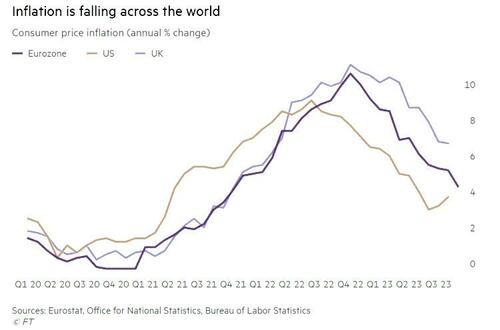

Inflation in the eurozone has fallen from a peak of 10.6% last year. Price pressures in the bloc have receded more slowly than in the US, which reported inflation of 3.7% in August, but faster than in the UK, where inflation was 6.7% last month.

European government bonds rallied after the better than expected figures for eurozone and French inflation were published, while equity markets strengthened.

Following turmoil in European bond markets on Thursday, Italian 10-year government bond yields fell 0.15 percentage points to 4.76 per cent on Friday, down from their highest level in a decade. At the same time, German 10-year bond yields slipped 0.1 percentage points to 2.85 per cent, having also hit a 10-year high during the previous trading session.

The euro strengthened 0.4 per cent against the dollar to $1.0603. In equity markets, Europe’s region-wide Stoxx 600 added 1 per cent and Germany’s Dax rose 0.6 per cent. London’s FTSE 100 rose 0.6 per, while France’s Cac 40 index gained 0.7 per cent.

And while the drop in inflation is good, the question is how bad will the coming stagflation be. The eurozone economy is widely expected to shrink in the third quarter and separate data published on Friday added to these fears after German retail sales fell for the third consecutive month in August, dropping 1.2 per cent from July. French household spending fell 0.5 per cent in the same period.

Despite the recent jump in oil prices, the cost of energy in the eurozone fell 4.7 per cent in the year to September, a faster decline than the previous month. There were also falls in food, alcohol and tobacco inflation to 8.8 per cent and in goods inflation to 4.2 per cent. Services inflation slowed to 4.7 per cent, dragged down by a sharp monthly fall in airfares.

Tyler Durden

Fri, 09/29/2023 – 11:25

via ZeroHedge News https://ift.tt/h0IVNAr Tyler Durden