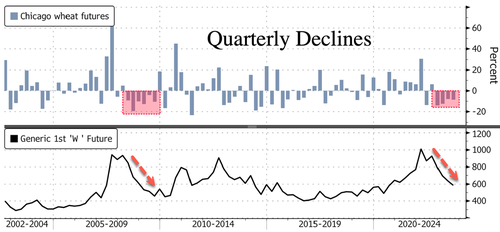

Wheat Prices Record Most Consecutive Quarterly Declines Since GFC Meltdown

Russia’s second consecutive bumper wheat harvest has cemented it as the top producer of the grain, with the surplus leading to a three-year low in prices, overshadowing any concerns about tensions in the Black Sea between Ukraine and Russia. As the quarter ends on Friday, wheat prices are on track to record the longest quarterly slump in 14 years. While this development is favorable for consumers, traders must closely watch prices.

Bloomberg reports wheat futures in Chicago have tumbled about 11% in the past three months and are set for the fourth quarterly decline. Even though Russia terminated a safe-passage deal in July that allowed bulk carriers to export Ukraine’s grain via the Black Sea to the rest of the world, prices have remained under pressure – mainly because Russia has had a record bumper harvest.

“What the events around the start of the Ukraine conflict showed is that in this day and age, the world, by and large, has a way of getting grain to the people who need it,” said Michael Whitehead, the head of agribusiness insights at ANZ Group Holdings Ltd. He continued, “This may be the new, low price level for wheat.”

Bloomberg recently noted last year’s invasion of Ukraine, which “hobbled Ukraine’s food exports, helping cement Russia’s domination of the global wheat market. That’s reflected in record Russian shipments, as the nation’s traders overcome the financing and logistical challenges some faced in the aftermath of the invasion.”

“We have seen wheat prices substantially decline basically as a result of Russia,” said Michael Magdovitz, senior commodity analyst at Rabobank.

However, the Financial Times pointed out some “analysts warn that prices could rapidly rise if the war spills out across the Black Sea. Russia’s Black Sea ports handle about 70 percent of its wheat exports, making it a crucial artery for the global supply of grain.” These low prices could be a potential entry point for traders looking for an area of value.

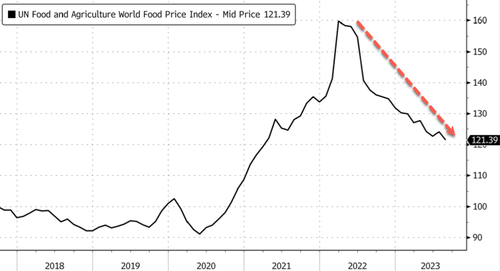

The slide in wheat prices coincides with the UN’s global food price index, hitting lows not seen since the early days of the invasion.

This is a welcoming sign not just for inflation trends but also for consumers worldwide.

However, there are risks, as Morgan Stanley warned clients: El Nino could spark another “inflation shock.”

Tyler Durden

Sat, 09/30/2023 – 15:35

via ZeroHedge News https://ift.tt/4VPnK5t Tyler Durden