Exploding Mortgage Rates, Approaching 8%, Send Mortgage Demand To Lowest Since 1996

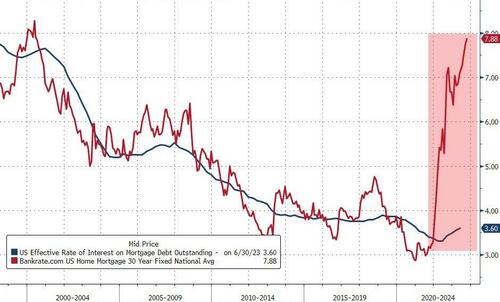

As we previewed yesterday, the BankRate average 30Y US mortgage this morning has spiked 8 basis points to the highest level in 23 years – one not seen August 25, 2000 – a mindblowing 7.88%, which is insane when one considers that three years ago the same mortgage was less than 3%.

One thing is certain: nobody, and we mean nobody, who can’t afford 100% cash down, can afford to purchase a home today.

For context, the chasm between the effective rate of around 3.6% that current homeowners have on average and the shocking 7.9% current mortgage rate is impassible…

Indeed, the latest data from the Mortgage Bankers Association confirms this: according to the MBS, total mortgage demand fell 6% compared with the previous week.

“Mortgage rates continued to move higher last week as markets digested the recent upswing in Treasury yields,” said Joel Kan, MBA’s vice president and deputy chief economist. “As a result, mortgage applications ground to a halt, dropping to the lowest level since 1996.”

Applications for a mortgage to purchase a home fell 6% for the week and were 22% lower than the same week one year ago. And as purchases continued to sink, applications to refinance a home loan have absolutely imploded – for obvious reasons: there is nobody in the market that hasn’t managed to refinance at a lower rate in the past 23 years – and dropped another 7% for the week and were 11% lower than the same week one year ago. Refinances now make up less than one-third of all mortgage applications. According to CNBC, just two years ago, when rates were setting multiple record lows, refinance demand made up roughly three-quarters of all mortgage applications.

“The purchase market slowed to the lowest level of activity since 1995, as the rapid rise in rates pushed an increasing number of potential homebuyers out of the market,” said Kan, who also noted that adjustable-rate mortgage (ARM) applications increased.

The ARMs made up 8% of purchase applications, up from 6.7% about a month ago, when interest rates were slightly lower. ARM’s offer lower rates but are fixed for a shorter term, usually five or 10 years.

Tyler Durden

Wed, 10/04/2023 – 11:05

via ZeroHedge News https://ift.tt/VK5MQ2P Tyler Durden