Futures, Yields Rise Ahead Of Jobs Report

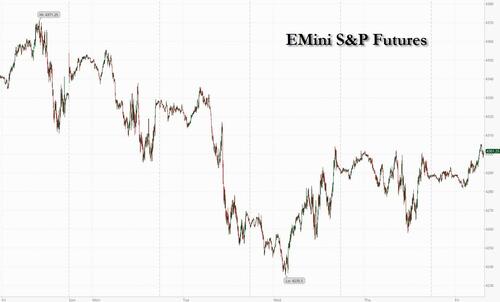

Global stocks and US index futures gained ahead of the September payrolls report (exp. payrolls 170K, unemp 3.7%, full preview here) that could potentially ease pressure on the Federal Reserve to raise interest rates again. At 7:45am ET, S&P futures rose 0.1%, after falling by a similar amount on Thursday while the tech-heavy Nasdaq 100 rose 0.2%, after slipping 0.4% the day before. Shares climbed in Asia and Europe, while mainland Chinese markets remain shut for a weeklong holiday. Treasury yields extended their advance, with the 10-year hovering around 4.74% after reaching 4.88% earlier this week. The Bloomberg dollar index was little changed. Oil was also little changed, halting its decline this week. All eyes on today’s NFP release at 8.30am, which is the near-term focus to set narrative: consensus expects NFP to print 170k and the unemployment rate to print 3.7%.

In premarket trading, shale giant Pioneer Natural rose as much as 10% after WSJ reported that Exxon Mobil is in talks to acquire the company. Exxon Mobil fell as much as 2.1%. Tesla fell as much as 1.6% as the electric-vehicle maker cut prices on its most popular cars in the US. Here are some other notable premarket movers:

- Aehr Test Systems fell as much as 14% after the supplier of semiconductor test and production burn-in equipment reported its first-quarter results.

- AMC Entertainment Holdings Inc. gained 2.8% after it said it sold more than $100 million in advance tickets for the Taylor Swift/The Eras Tour Concert movie.

- Elf Beauty rose as much as 2.5% as Jefferies raised to buy from hold. The broker says it sees a buying opportunity following the recent valuation pullback in the cosmetics company. .

- Shoals Technologies Group rose as much as 4% as Piper Sandler raised to overweight from neutral. The broker said it’s upgrading the solar-energy equipment maker after the recent pullback in its shares. .

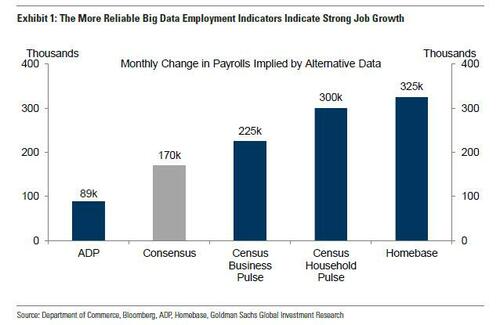

Today’s nonfarm payrolls report is forecast to show employers slowed hiring last month, with 170,000 jobs being added last month, down from 187,000 in August. The crowdsourced whisper number is 190k, while Goldman warns that big data indicators hint at an even larger beat. In any event, this is expected to be the last to show solid hiring before a sharp slowdown.

Job data earlier this week provided a discordant narrative: job-openings overshot estimates, while a measure of private employment from ADP was weaker than forecast. Here is a forecast of payrolls by bank (with our full preview available here).

- 240,000 – Citigroup

- 200,000 – Goldman Sachs

- 200,000 – UBS

- 190,000 – HSBC

- 190,000 – Societe Generale

- 180,000 – Morgan Stanley

- 175,000 – JP Morgan Chase

- 173,000 – Bloomberg Economics

- 150,000 – Deutsche Bank

- 150,000 – Wells Fargo

“Although both numbers haven’t been moving in tandem recently, the lower-than-expected ADP figures have given markets hope that September nonfarm payrolls will surprise to the downside,” said Julien Lafargue, chief market strategist at Barclays Private Bank. “Beyond the number of job creations, investors will pay close attention to wage growth figures and whether they confirm recent disinflationary trends.”

Meanwhile, the global bond selloff is hammering risk assets from stocks to corporate credit on concerns that central banks will keep interest rates elevated longer than expected. While 30Y yields this week touched 5% for the first time since 2007 and subsequently dropped, on Friday Treasury yields once again extended their advance, with the 10-year adding two basis points to 4.74% after reaching 4.88% earlier this week. A gauge of dollar strength was little changed.

The beaten-down bond sector will make a staggering comeback in 2024 when higher interest rates send the economy into a recession, according to BofA’s Michael Hartnett. Once the recession being priced by bond and stock markets “mutates into economic data, bonds rally big and bonds should be the best performing asset class in the first half of 2024,” Hartnett wrote in a note.

“Friday’s payrolls data, and next week’s inflation number, will decide whether the 10-year Treasury yield goes up to 5% or down to 4.5%,” said Kenneth Broux, a strategist at Societe Generale in London. A higher-than-forecast jobs number may trigger “another wave of dollar-buying and bond-selling,” he said.

Traders have record sums riding on the outcome of November’s Fed meeting as investors and policymakers debate the likelihood of a further rate increase this year. San Francisco Fed President Mary Daly, who doesn’t vote on the Fed’s rate-setting committee this year, said the central bank may keep rates on hold if inflation and the jobs market cool.

In Europe, the Stoxx 600 rose as much as 0.8%, extending earlier advance as bond yields remain in Thursday’s range and gains in dollar pause ahead of US job data. FTSE MIB outperforms peers. Insurance +2% and banks +1.6% lead gains; Food and beverages -1.5% and personal care -0.9% are the only sectors in the red. Insurers led gains in Europe’s Stoxx 600 index, after Aviva Plc was cited in a newspaper as a target for potential bidders. Prudential, Legal & General Group and Phoenix also rose. Here are the most notable European movers:

- Shell shares rise as much as 1.5% after it says its earnings from gas trading rebounded in the third quarter from the dip seen in the prior period.

- Aviva shares rise as much as 8.3% to 420.40p after The Times reported market speculation that the insurer may be attracting interest from at least two potential bidders.

- Man Group gains as much as 4.6%, most since Mar. 21, after BNP Paribas Exane raised its recommendation on the UK-listed hedge fund to outperform from neutral.

- Maire shares gain as much as 7.5% as Mediobanca upgrades the technology and engineering group to outperform from neutral, after it won the largest order in the group’s history.

- Nestle shares drop as much as 3.4% to the lowest since March 2021, biggest laggard in Europe’s Stoxx 600 Index by index points. Retail giant Walmart said Wednesday that it’s already seeing an impact on shopping demand from people taking Ozempic, Wegovy and other appetite-suppressing medications.

- Philips shares fall as much as 8.5%, the most in a year, after the company said it agreed with the US FDA recommendations to implement additional testing on certain sleep and respiratory care devices to supplement current test data.

- JD Wetherspoon falls as much as 4.8%, the most in two months, as Morgan Stanley notes the UK pub chain now anticipates a “reasonable outcome” for the 2024 fiscal year, versus the “improved outcome” guidance provided at 4Q results. Wetherspoon said it returned to profit in the 12 months through July.

- CD Projekt shares widen two-day decline to 12% as analysts point to negative surprise concerning the cost of production of the Phantom Liberty paid add-on to its Cyberpunk 2077 game that may limit profits from the new release.

Earlier in the session, Asia stocks also gained, led by a rally in Hong Kong shares, while other markets were more muted with all eyes on the US payroll data for cues on the Federal Reserve’s policy path. The MSCI Asia Pacific Index rose as much as 0.7% Friday, paring its slide for the week to 1.4%. It would be the third consecutive week of declines for Asian stocks. Chinese tech giants Tencent, Alibaba and Meituan were among the biggest contributors to the gauge’s advance. The benchmark tumbled into a technical correction earlier this week amid concern over higher-for-longer US rates. Hong Kong stocks were the biggest gainers in the region, with analysts citing positive Golden Week holiday spending data and positioning ahead of the reopening of mainland markets as drivers. Japan equities were mixed while benchmarks in Australia and South Korea edged higher.

- Hang Seng outperformed amid strength in tech, property and banking stocks, with sentiment also underpinned by hopes of a stabilisation in US-China ties as the White House is reportedly planning a Biden-Xi meeting in California next month although nothing has been confirmed yet.

- Japan’s Nikkei 225 was choppy as better-than-expected Household Spending data was offset by slower wage growth, while former BoJ official Momma said the BoJ will likely discuss whether to tweak forward guidance along with YCC at the end-October meeting.

- Australia’s ASX 200 was led by gains in the top-weighted financial sector after the latest RBA Financial Stability Review which noted increasing global financial stability risks but also stated that Australian banks are well-capitalised and well-positioned to manage any increase in mortgage arrears and absorb loan losses.

- Indian stocks gain for a second day, supported by a pause on interest rates by the central bank and gains in the technology and capital goods companies. The S&P BSE Sensex rose 0.6% to 65,995.63 in Mumbai on Friday, while the NSE Nifty 50 Index advanced by the same measure. The MSCI Asia Pacific Index was up 0.5%.

In FX, the Bloomberg dollar spot index erased an earlier advance. GBP and CAD are the strongest performers in G-10 FX, JPY and AUD underperform.

- The EUR/USD pared a 0.2% drop to trade little changed at 1.0552. The pair is down a 12th week, the longest streak of losses since 1997.

- GBP/USD rose 0.1% to 1.2203, heading for a third daily advance for the first time since August

- The yen led declines among Group-of-10 currency peers. USD/JPY extended gains, rising as much as 0.3% to 148.99 after Japan’s slower-than-expected wage growth suggests the Bank of Japan has to wait more to normalize policy

In rates, treasuries were slightly cheaper across the curve ahead of September jobs report, with futures trading just off Thursday session highs, as stock futures hold small gains. Gilts underperformed in early London session, adding to upside pressure on Treasury yields, while WTI oil futures are little changed after past week’s collapse. US yields 2bp-3bp cheaper with curve spreads little changed on the day; 10-year TSYs were around 4.74%, around the middle of Thursday’s range, with gilts lagging by 1.5bp in the sector. Gilt 10-years slightly underperform comparable bunds and USTs. A survey by BMO Capital Markets on client attitudes toward rates market found the lowest willingness to buy in a year — 37% vs a 49% average — if bond prices fall after the jobs report. The Dollar IG issuance slate empty so far and expected to be muted Friday ahead of Monday’s bank-and-bond-market holiday; three names priced $2.5b Thursday, taking weekly volume to almost $9b, below the $15b projected

In commodities, oil trades slightly higher on the day, but is poised for the biggest weekly drop since March. Spot gold is little changed at $1,820/oz.

Looking at the day ahead, today’s US economic data slate includes September jobs report (8:30am) and August consumer credit (3pm). Scheduled Fed speakers include Waller at 12pm

Market Snapshot

- S&P 500 futures little changed at 4,290.50

- MXAP up 0.4% to 154.81

- MXAPJ up 0.8% to 486.12

- Nikkei down 0.3% to 30,994.67

- Topix little changed at 2,264.08

- Hang Seng Index up 1.6% to 17,485.98

- Shanghai Composite up 0.1% to 3,110.48

- Sensex up 0.6% to 66,024.33

- Australia S&P/ASX 200 up 0.4% to 6,954.17

- Kospi up 0.2% to 2,408.73

- STOXX Europe 600 up 0.4% to 442.89

- German 10Y yield little changed at 2.90%

- Euro little changed at $1.0543

- Brent Futures up 0.4% to $84.41/bbl

- Gold spot down 0.0% to $1,819.92

- U.S. Dollar Index little changed at 106.42

Top Overnight News

- The White House has begun making plans for a November meeting in San Francisco between President Biden and Chinese leader Xi Jinping — an attempt to stabilize the relationship between the world’s two most powerful countries, according to senior administration officials. WaPo

- India’s RBI keeps rates unchanged, as expected, but suggested it would hold policy tight going forward due to ongoing inflation concerns. WSJ

- Beijing’s tough treatment of foreign companies this year, and its use of exit bans targeting bankers and executives, has intensified concerns about business travel to mainland China. Some companies are canceling or postponing trips. Others are maintaining travel plans but adding new safeguards, including telling staff they can enter the country in groups but not alone. WSJ

- Russia allowed a return to seaborne exports of diesel just weeks after imposing a ban that roiled global markets, taking other steps instead to keep sufficient fuel supplies at home. BBG

- European gas jumped as union members at Chevron LNG facilities in Australia voted to resume industrial action after criticizing the company’s efforts to finalize a deal on pay and conditions. BBG

- The ECB may need to raise interest rates again if wages, profits or new supply snags boost inflation, ECB board member Isabel Schnabel said in an interview published on Friday. RTRS

- Tesla cut prices on its Model 3 and Y cars in the US again, days after its third-quarter deliveries missed. BBG

- The corporate borrowing binge over the past 18 months shows C-suites across the US have been largely undeterred by the Fed’s relentless hikes. Not only have they displayed little desire to pay down debt, but many have heaped more of it on their books. The recent yield spike may have cooled the market, but the overall pace of borrowing has been blistering. BBG

- Exxon is in talks to acquire Pioneer Natural Resources, a person familiar said. An agreement worth as much as $60 billion may completed within days, the WSJ reported, making it the world’s largest deal this year and Exxon’s biggest acquisition in over two decades. WSJ

- We estimate nonfarm payrolls rose by 200k in September (mom sa), above consensus of +170k. We estimate that the unemployment rate declined one tenth to 3.7%—in line with consensus—reflecting a rise in household employment and unchanged labor force participation at 62.8% (we do not expect the August rise in the foreign-born labor force to reverse). We estimate a 0.30% increase in average hourly earnings (mom sa) that edges the year-on-year rate lower by 1bp to 4.28%, reflecting waning wage pressures but positive calendar effects (the latter worth +5bps month-over-month, on our estimates). Consensus for average hourly earnings is +0.3% mom and +4.3% yoy. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher albeit with some of the upside capped following the inconclusive performance on Wall St and as participants await the incoming US Non-Farm Payrolls report. ASX 200 was led by gains in the top-weighted financial sector after the latest RBA Financial Stability Review which noted increasing global financial stability risks but also stated that Australian banks are well-capitalised and well-positioned to manage any increase in mortgage arrears and absorb loan losses. Nikkei 225 was choppy as better-than-expected Household Spending data was offset by slower wage growth, while former BoJ official Momma said the BoJ will likely discuss whether to tweak forward guidance along with YCC at the end-October meeting. Hang Seng outperformed amid strength in tech, property and banking stocks, with sentiment also underpinned by hopes of a stabilisation in US-China ties as the White House is reportedly planning a Biden-Xi meeting in California next month although nothing has been confirmed yet.

Top Asian News

- TSMC (2330 TT/TSM) September sales: (TWD) 180.43bln (prev. 188.69bln in Aug; -13% Y/Y), according to Reuters.

- A 6.1 magnitude earthquake has struck southeast of Honshu, Japan, according to GFZ.

European bourses trade on the front foot as indices attempt to recoup lost ground with the Stoxx 600 on track to close the week out with losses of over 1.5%. Sectors in Europe are mostly firmer with the current outperformers being Insurance, Banks, and Tech, while Food Beverages and Tobacco, Optimised Personal Care Drugs and Grocery, and Utilities reside as the laggards. US futures are trading marginally firmer, with overall sentiment tentative ahead of the big NFP report, expected to be released at 13:30 BST / 08:30 ET.

Top European News

- German Government expects GDP to decline by 0.4% in 2023 in draft Autumn projections, according to Reuters citing sources. German government foresees GDP growth of 1.3% in 2024 and 1.5% in 2025 and expects inflation of 6.1% in 2023 and 2.6% in 2024. Reasons for the expected mild GDP contraction in 2023 are high energy prices, high inflation and weakness in international trade, via Reuters citing German Government Source

FX

- DXY is caged to a tight 106.34-55 with FX markets generally steady in the run-up to the US jobs report.

- Pound perked up enough in early trade to probe 1.2200 and decent expiry interest at the round number.

- EUR/USD secured a firmer grasp of the 1.0500 handle having closed bullishly above the 10 DMA yesterday.

- Kiwi and Aussie are underpinned by a pick-up in broad risk appetite rather than specifics.

Fixed Income

- Bond futures have plateaued and pushed the bounds of recovery far enough ahead of the US jobs data – which has the potential to move the dial or even alter the overall trend.

- Bunds are close to 128.00 within their 128.17-127.79 intraday range having peaked on Monday at 128.50 and troughed at 126.62 on Wednesday.

- Gilts are midway between 92.86-53 stalls flanked by 93.71-91.50 w-t-d extremes.

- T-note is sitting tight inside 107-10/02 confines compared to a high of 107-29+ and 106-03+ low.

- Orders for Italy’s new 5-yr BTP Valore retail bond touched EUR 16bln since the beginning of the offer, according to Reuters.

Commodities

- Crude futures are choppy with two-way price action seen this morning as the complex consolidates after essentially wiping out its September gains at the start of this month.

- Dutch TTF futures are firmer intraday as the Offshore Alliance members at Chevron voted to recommence protected industrial action.

- Spot gold is flat within recent ranges while base metals rebounded off worst levels at the start of European trading but gains are capped ahead of the tier 1 US data in the afternoon.

- Offshore Alliance members at Chevron (CVX) vote to recommence protected industrial action, according to the union.

- Russia lifts diesel export ban via pipelines, according to Ifax.

Central banks

- ECB’s Schnabel said if risks materialise then further rate hikes may be necessary at some point, according to Reuters.

- ECB’s Herodotou said monetary policy transmission is taking place to tame inflation, but energy prices and bank liquidity needs monitoring, according to Reuters.

- Former BoJ official Momma commented that the BoJ will likely discuss whether to tweak forward guidance along with YCC at the October 30th-31st meeting,

- RBA Financial Stability Review stated global financial stability risks are elevated and growing, while the risks include China’s property sector, a disorderly fall in global asset prices and exposure to commercial real estate. The FSR also noted that tightening global financial conditions could slow growth and lift unemployment, while a fall in global asset prices could raise funding costs in Australia and limit the supply of credit. Nonetheless, it stated the Australian financial system is sound but there are some pockets of stress among household borrowers and Australian banks are well-capitalised with low exposure to commercial property, as well as well-positioned to manage any increase in mortgage arrears and absorb loan losses.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected, while it maintained the stance of remaining focused on the withdrawal of accommodation in which 5 out of 6 members voted in favour of the policy stance. RBI Governor Das said they have identified inflation as a major risk to macroeconomic stability and remain focused on aligning inflation to the 4% target with the MPC highly alert and will take timely measures as necessary. However, Das commented that headline inflation is to see further easing in September and the silver lining is the declining core inflation, as well as noted that the transmission of past rate hikes is thus far incomplete.

- RBI Governor Das said OMO sales are not for yield curve management but for liquidity management. Das added the RBI does not have a specific level in mind for the exchange rate; intervention is to prevent volatility in the FX market, according to Reuters.

- CNB Minutes: A large part of the debate was devoted to starting the process of lowering monetary policy rates and pace; the weakening of the FX rate over the past month had delivered a monetary policy easing of roughly 25-50bps, according to Reuters.

US Event Calendar

- 08:30: Sept. Change in Nonfarm Payrolls, est. 170,000, prior 187,000

- Change in Private Payrolls, est. 160,000, prior 179,000

- Change in Manufact. Payrolls, est. 5,000, prior 16,000

- Unemployment Rate, est. 3.7%, prior 3.8%

- Underemployment Rate, prior 7.1%

- Labor Force Participation Rate, est. 62.8%, prior 62.8%

- Average Weekly Hours All Emplo, est. 34.4, prior 34.4

- Average Hourly Earnings YoY, est. 4.3%, prior 4.3%

- Average Hourly Earnings MoM, est. 0.3%, prior 0.2%

- 15:00: Aug. Consumer Credit, est. $11.7b, prior $10.4b

DB’s Jim Reid concludes the overnight wrap

Risk assets were under pressure again over the last 24 hours, with investors remaining cautious before today’s US jobs report. For instance, oil prices remained on track for their worst weekly performance since the banking turmoil in March, having now shed more than -11% this week. Credit spreads widened as well, with US HY spreads at their widest in more than 3 months. And whilst it’s true that sovereign bonds did recover some ground for the most part, we did see some new milestones for yields, and the US 30yr real yield (+6.8bps) closed at a post-2008 high of 2.50%. Furthermore, the spread between Italian and German 10yr yields closed above 200bps for the first time since early February. US equities also lost further ground, with the S&P 500 down -0.13% in spite of a late recovery, and there’s been little respite this morning with futures for the index down -0.05%.

With that backdrop in mind, the main highlight today is likely to be the US jobs report for September, which is the last before the Fed’s next decision on November 1. And since pricing for another rate hike this year has kept oscillating above and below 50% (currently 38% this morning), today’s reading will be important in determining if another hike remains on the table. The reading also follows a progressive slowing in job growth over recent months, and in the last report we saw the 3m average for payrolls growth fall to a post-pandemic low of +150k. Then on Wednesday this week, the ADP’s report of private payrolls showed the weakest monthly gain (+89k) since January 2021, which prompted investors to dial back the chances of another rate hike. But on the other hand, the weekly jobless claims yesterday were at 207k (vs. 210k expected) over the week ending September 30, which pushed the 4-week average down to its lowest since early February, at 208.75k. So there are signals pointing in both directions. For today, our US economists are expecting nonfarm payrolls to grow by +165k, which would see the unemployment rate tick down a tenth to 3.7%.

With all that to look forward to, sentiment remained pretty negative in markets and there was a clear risk-off tone for much of the day yesterday. That was very clear in commodity markets, where oil prices continued to slump and Brent Crude fell another -2.03% to $84.07/bbl. Bear in mind that it was at $95/bbl at the start of the week, so with a -11.75% decline over four days, Brent is on track to almost match its worst week of the year back in March (-11.85%). If it’s sustained, this downward pressure could actually be very supportive for central banks as they seek to get inflation back to target. However, the reason it’s slumped is very much based on fears that growth is weakening, which in turn would reduce oil demand. It was a similar story for other cyclical commodities, and copper prices (often taken to be an industrial bellwether) were down -1.03% to a 4-month low. Meanwhile, the rise in real rates meant that gold (-0.06%) remained under pressure, with a 9th consecutive daily fall for the first time since 2016.

When it came to equities, the risk-off mood dominated in the first half of the US session, with the S&P 500 down -0.89% at the lows of the day. But it recovered to end the day with a modest decline of -0.13%. Other US indices, including the NASDAQ (-0.12%), the FANG+ index (-0.14%) and the Russell 2000 (+0.14%), posted similar moves. Over in Europe, the STOXX 600 (+0.28%) ticked up from its 6-month low the previous day, but there still wasn’t much strength across the major indices, and the DAX (-0.20%) closed at a 6-month low.

For sovereign bonds however, the risk-off tone meant they put in a much better performance, not least because investors moved to lower the chances of further monetary tightening. In the US, that meant yields on 10yr Treasuries were down -1.4bps to 4.72%, whilst in Europe there were also declines for yields on 10yr bunds (-4.0bps), OATs (-2.4bps) and gilts (-3.8bps). However, it wasn’t all good news, and longer-dated US Treasuries continued to struggle, with new records set among some real yields. For instance, the 20yr real yield (+6.4bps) hit a post-2009 high of 2.58%, and the 30yr real yield (+6.7bps) hit a post-2008 high of 2.49%. Italian BTPs also lost further ground, and the spread between 10yr BTP yields over bunds closed above 200bps for the first time since early February.

That rates moves came amidst slightly less hawkish comments from Fed and ECB speakers. San Francisco Fed President Daly noted that the rise in yields in September “is equivalent to about a rate hike” and that the Fed can hold rates steady if the cooling of the labour market and inflation continues. Meanwhile, Richmond Fed President Barkin said that “we have time to see if we’ve done enough or whether there’s more work to do”. Over in Europe, Banque de France Governor Villeroy said that as of today he saw “no justification for an additional increase in the ECB rates”. Speaking of central banks, my colleague Peter Sidorov has published a report overnight on global central bank QT. We’ve seen DM central banks’ rundown of bond holdings accelerate in recent months and he observes that this QT pace is yet to peak. See the report here for more on QT trends and their implications.

Overnight in Asia, there’ve been more positive signs in markets, with gains across the major equity indices. The Hang Seng (+1.81%) is leading the way, but there’s also been advances for the KOSPI (+0.26%) and the Nikkei (+0.08%), whilst markets in mainland China remain closed for a holiday. The 10yr Treasury has also seen modest gains overnight, with yields down -0.6bps to 4.71%.

To the day ahead now, and the main highlight will be the US jobs report for September. Other data includes German factory orders and Italian retail sales for August, along with the Canadian employment report for September. From central banks, we’ll hear from the Fed’s Waller, and the ECB’s Knot, Vasle, Vujcic and Kazimir.

Tyler Durden

Fri, 10/06/2023 – 07:54

via ZeroHedge News https://ift.tt/xA45aZV Tyler Durden